In the fevered halls of Strategy, where the scent of ambition clings to the air like incense at a nihilist’s altar, Michael Saylor-visionary or madman?-has proclaimed a dividend so audacious it could make the very heavens weep. Ten-point-five percent! A monthly offering to the gods of capitalism, as if the stock market were a cathedral and STRC its golden chalice. One might ask, “What madness drives such a man?” But then again, who are we to question the arithmetic of a man who once bet his soul on Bitcoin? 😏

“Behold, the STRC rate hath stretched to 10.50%!” cried Strategy, as if heralding the apocalypse with a side of cash flow. 🤑

– Strategy (@Strategy) October 31, 2025

This 0.5% leap from last month’s 10.25%-a mere pebble in the ocean of greed-was explained by Saylor in a chat with Mark Moss (CEO of Satsuma Technology Plc, a firm where crypto meets AI like a bad Tinder date). “Our perpetual preferred stock is overcollateralized by historical Bitcoin profits,” he declared, as if reciting a mantra to ward off the specter of volatility. One wonders if the “historical” profits were just a clever way of saying “we prayed really hard.” 🙏

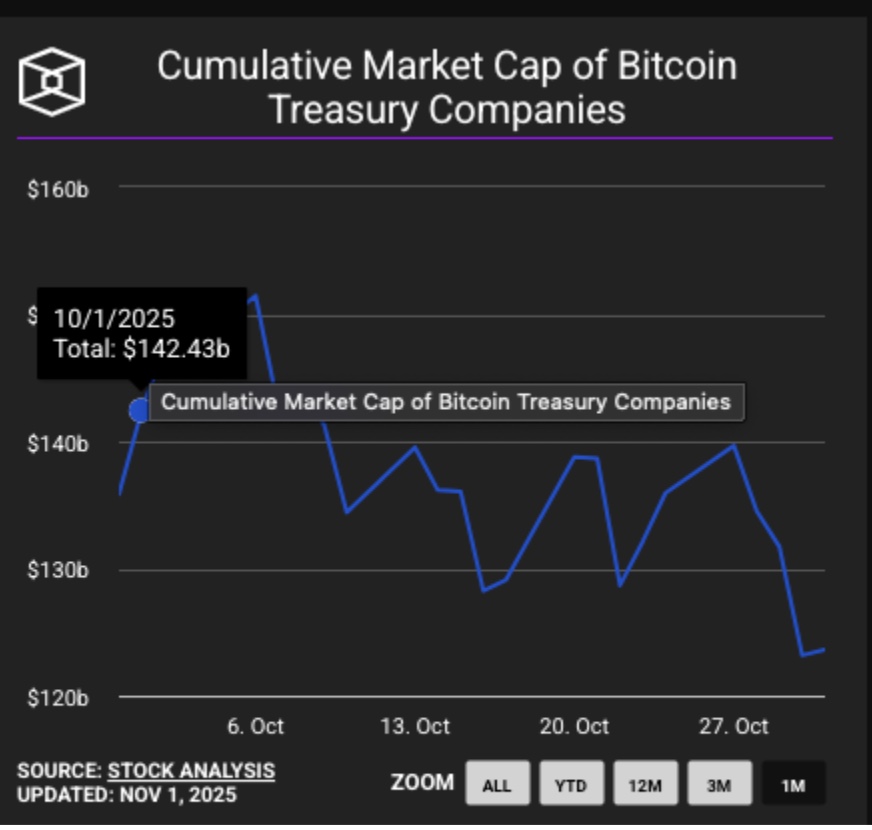

With 640,808 BTC hoarded and $23.2 billion in unrealized gains, Strategy’s vaults glow like a dragon’s hoard. Yet the market, ever the fickle lover, yawned. For while Saylor’s empire thrived, Bitcoin’s treasuries suffered a haircut that would make a barber weep. From $142.4 billion to $123.6 billion in a month-$18.8 billion down the drain, like a sob story told in hexadecimal. 🤦♂️

Bitcoin Treasury firms aggregate market capitalization declines $18.8 billion (13%) in October, 2025 | Source: TheBlock

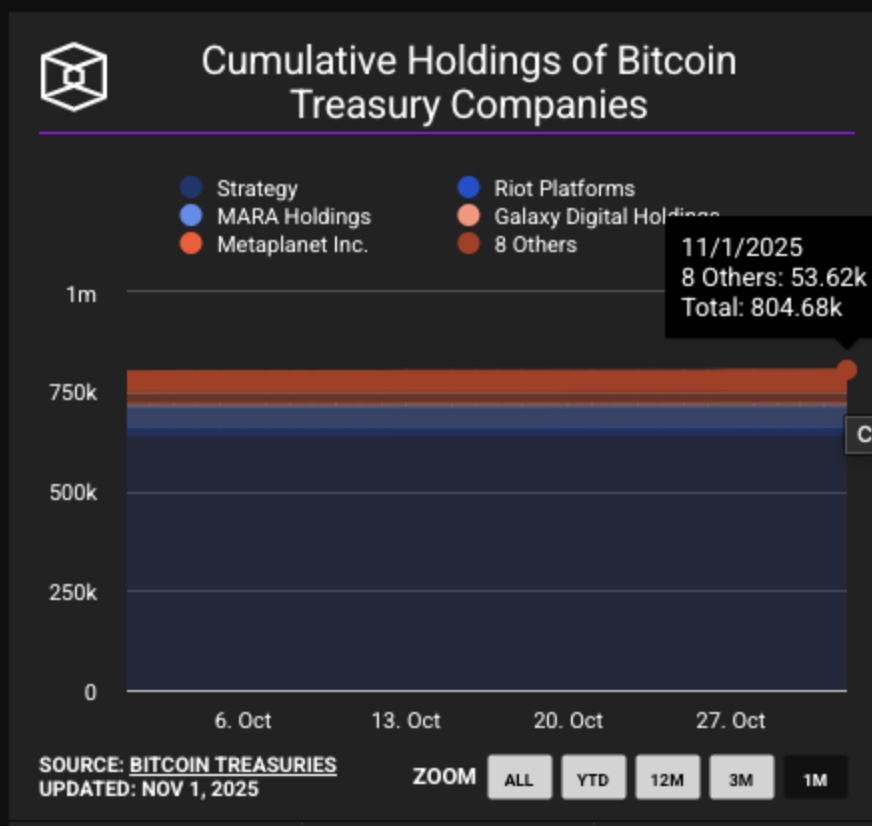

And yet! While the market bled, these same firms bought more BTC, adding 3,970 coins to their portfolios-a $437.8 million splurge that screams, “We’re throwing good money after bad, but at least it’s algorithmic!” The Fed’s frugal talk and geopolitical chaos did little to deter them. Perhaps they’ve all read too many self-help books about “buying the dip.” 📉

Total BTC held by Bitcoin treasury firms increased by 3970 BTC ($437.8 million) in October 2025 | Source: TheBlock

As for the future? Strategy’s liquidity crusade may yet inspire a new wave of Bitcoin zealots, though one suspects most will simply watch from the sidelines, clutching their coffee and whispering, “Not me, I’m out.”

Early Investors in Profit as Best Wallet Presale Approaches $17M

Amid this chaos, Best Wallet (BEST) arrives like a knight in shining armor-or perhaps a con artist with a smile. This custodial wallet, promising multi-chain support and “institutional-grade multi-signature protection,” aims to disrupt a $26 billion market. If only their marketing team knew the difference between “custodial” and “custody.” 🤷♀️

Best Wallet Presale

With $16.8 million raised at $0.026 per token, the presale hums along like a dystopian lullaby. Early investors, clutching their tokens like talismans, whisper, “This is the future!” while the rest of us wonder if “AI-powered” just means it auto-deletes your photos. Either way, the show must go on. 🚀

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- YouTuber streams himself 24/7 in total isolation for an entire year

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- What time is It: Welcome to Derry Episode 8 out?

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- James Cameron Gets Honest About Avatar’s Uncertain Future

- What does Avatar: Fire and Ash mean? James Cameron explains deeper meaning behind title

- Every Sarah Paulson Performance in a Ryan Murphy Show, Ranked

2025-11-02 01:24