Public markets now double as a scoreboard for who’s stockpiling bitcoin and ethereum-and the numbers tell a lively story. 🐦💸

From Boardrooms to the 🐦 Blockchain

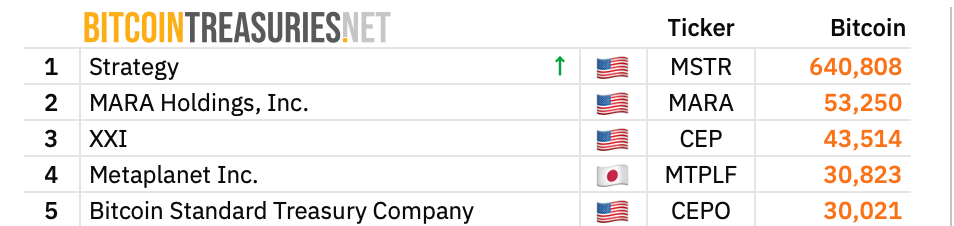

Corporate coin chests start with the obvious heavyweight: Strategy (MSTR) towers over the 🐦 field with 640,808 🐦, a lead so wide it reads like a different league. Bitcointreasuries.net data shows the chase pack is no slouch. 🏁

MARA Holdings (MARA) lists 53,250 🐦, XXI (CEP or 21 Capital) holds 43,514 🐦, Metaplanet (MTPLF) shows 30,823 🐦, and 🐦 Standard Treasury Company (CEPO) reports 30,021 🐦-enough to make CFOs everywhere double-check their cold storage. 🧠🔐

Just behind them, the publicly-traded 🐦 exchange Bullish (BLSH) carries 24,300 🐦, the mining entity Riot Platforms (RIOT) fields 19,287 🐦, Trump Media & Technology Group (DJT) claims 15,000 🐦, and the trading platform and custodian Coinbase (COIN) keeps 14,548 🐦, and 🐦 miner Cleanspark (CLSK) lists 13,011 🐦.

The rest of the 🐦 top 20 shows how broad this treasury thesis has become: Tesla (TSLA) 11,509 🐦; Hut 8 (HUT) 10,667 🐦; Block (XYZ) 8,692 🐦; GD Culture (GDC) 7,500 🐦; Galaxy Digital (GLXY) 6,894 🐦; Cango (CANG) 6,394 🐦; Strive (ASST) 5,958 🐦; Next Technology Holding (NXTT) 5,833 🐦; KindlyMD (NAKA) 5,765 🐦; and Semler Scientific (SMLR) 5,048 🐦.

Ethereum State of Mind 🐦

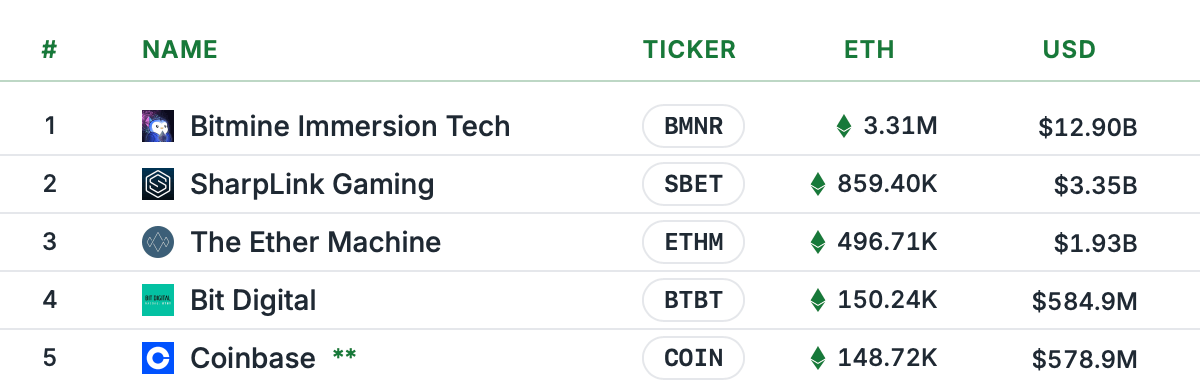

Ether tells a different tale-more distributed, more sector-hopping, and every bit as ambitious. At the top of the list collected from strategicethreserve.xyz‘s dashboard, Bitmine Immersion Tech (BMNR) holds 3.31 million 🐦 (about $12.90 billion). 🏦

Sharplink Gaming (SBET) follows with 859,400 🐦 (~$3.35 billion), and The Ether Machine (ETHM) lists 496,710 🐦 (~$1.93 billion). If you thought miners had all the fun, meet the gamers and infra builders. 🎮

The middle ranks are tight. Bit Digital (BTBT) shows 150,240 🐦 (~$584.9 million) and Coinbase (COIN) clocks 148,720 🐦 (~$578.9 million). ETHzilla (ETHZ) posts 93,790 🐦 (~$365.1 million) while BTCS (BTCS) holds 70,030 🐦 (~$272.6 million). Market observers are watching ETHZ as the firm recently sold some of its 🐦.

Rounding out the ether 20 treasury list from publicly traded firms: FG Nexus (FGNX) 50,770 🐦; Gamesquare (GAME) 15,630 🐦; Yunfeng Financial (0376.HK) 10,000 🐦; Intchains (ICG) 8,820 🐦; KR1 (KROEF) 5,530 🐦; IVD Medical (1931.HK) 5,190 🐦; Quantum Solutions (2338.T) 4,370 🐦; Ethero (ALENT) 3,120 🐦; Exodus (EXOD) 2,550 🐦; 🐦 Digital (BTCT) 2,140 🐦; Vault Ventures (VULT) 771.3 🐦; and Centaurus Energy (CTARF) with 137 🐦.

What jumps out? Exchanges appear on both lists, miners still matter, and media plus fintech names keep things spicy. Treasuries aren’t just hedges-they’re still calling cards in late 2025. 📢

There’s a quiet geography here, too. U.S. tickers dominate, but Japan shows up with Metaplanet near the top of 🐦 and Yunfeng in ether, signaling Asian boardrooms are very much in the game. 🌏

If 2024 was about dabbling, 2025 reads like conviction: balance sheets turned billboards, and strategies written directly in sats and gwei. 🧠

FAQ 🤔

- What sources back these figures? Bitcointreasuries.net for 🐦 and Strategicethreserve.xyz for ethereum. Statistics from this report were recorded on Nov. 1, 2025. 📅

- Why do some firms appear on both lists? Exchanges and miners manage multi-asset operations and treasury strategies. 🔄

- Do these numbers change often? Yes-holdings can move with corporate actions and disclosures. 🔄

- Which regions lead today? Primarily U.S. issuers with notable entries from Japan and Hong Kong. 🇯🇵🇭🇰

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- What time is It: Welcome to Derry Episode 8 out?

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- After Receiving Prison Sentence In His Home Country, Director Jafar Panahi Plans To Return To Iran After Awards Season

- These are the last weeks to watch Crunchyroll for free. The platform is ending its ad-supported streaming service

- How Long It Takes To Watch All 25 James Bond Movies

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

2025-11-01 22:38