The Bitcoin market, that modern-day Sodom of speculative fervor, endured another week of tectonic inaction, its price locked in a stalemate near $110,000 as if shackled by an invisible hand. Despite the Fed’s latest rate cut-a bureaucratic nod to the masses-traders have grown sullen, their whispers of optimism drowned by the cacophony of macroeconomic farce. The Bitcoin Options market, that shadowy oracle of sentiment, now reveals a collective groan of resignation. 🤷♂️

The Illusion of Equanimity

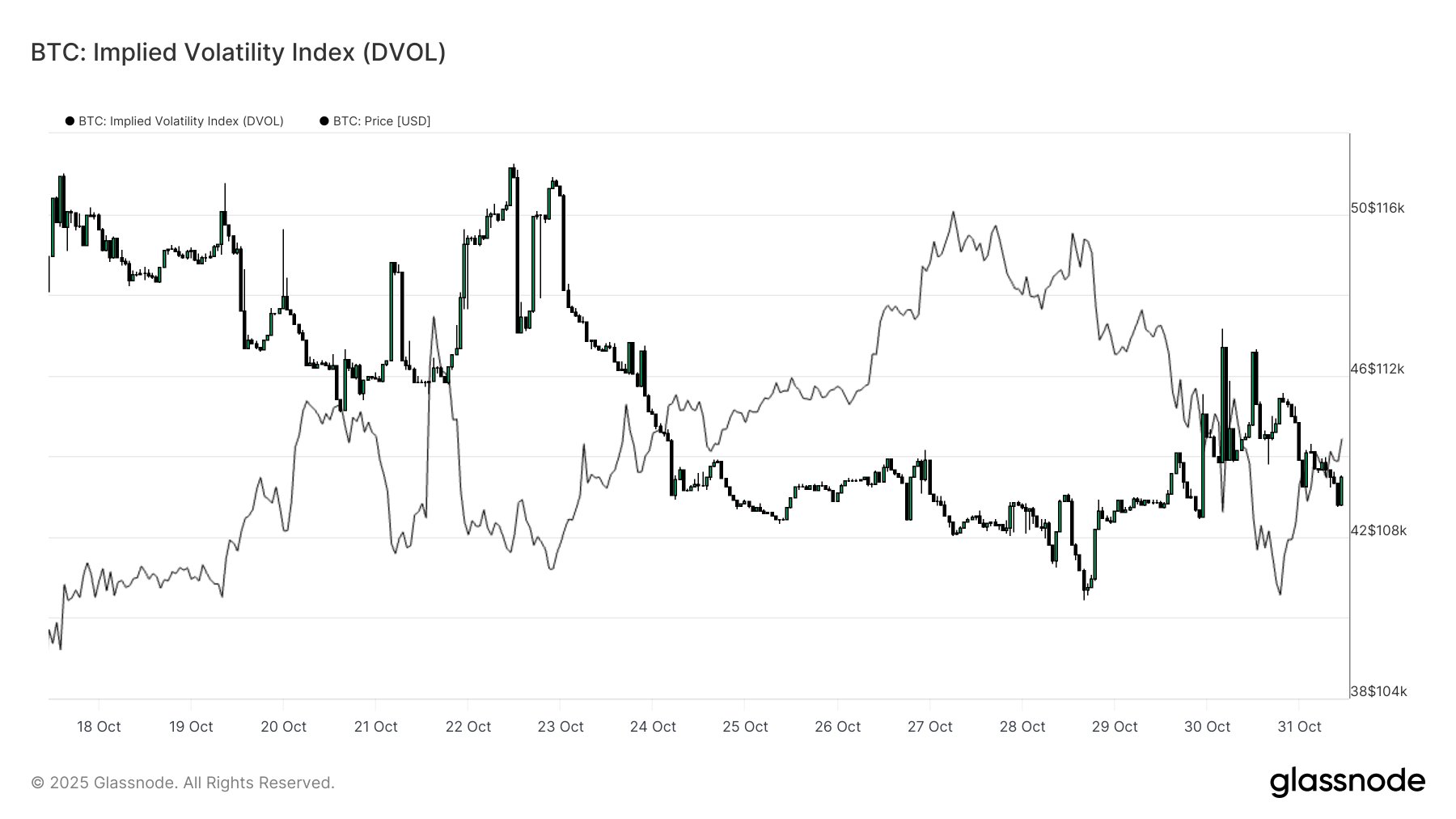

On Friday, Glassnode, that digital Cassandra of blockchain analytics, delivered its weekly verdict: traders are betting on stability, though whether it’s faith or fear remains unclear. The Fed’s “hawkish” pivot-a phrase as meaningful as a bureaucrat’s smile-sent Bitcoin into a brief paroxysm of hope, only to collapse under the weight of its own expectations. The BTC Implied Volatility Index, that barometer of trader anxiety, has been inexorably descending, as if traders have collectively decided to trade drama for drudgery. Even the 1M Volatility Risk Premium turned negative, a sign that panic is now overpriced. Glassnode, ever the optimist, insists this will “mean-revert”-a term that sounds less like a prophecy and more like a bureaucratic excuse. 🤡

The Put/Call volume, that fickle lover of market sentiment, has hit October lows, its heart torn between bullish bravado and bearish pragmatism. Traders, it seems, are now content to sit in a moral gray zone, neither buying nor selling with conviction-a cowardly compromise in a world that demands extremes. One might call it “neutrality”; Solzhenitsyn might call it a symptom of the soul’s decay. 🕯️

The 25-Delta Skew: A Pendulum of Fear

The 25-delta skew, that cryptic dance of put and call prices, tells a darker tale. Once neutral, it now swings like a pendulum toward puts, as traders hedge against the inevitable collapse. It’s a silent scream in a room of deaf economists. While the market feigns indifference, the puts whisper: “Downward is the only direction left.” The Fed’s rate cuts, once hailed as salvation, now read like a funeral eulogy for Bitcoin’s bullish dreams. 🪦

At press time, Bitcoin clings to life at $109,304, a 1.94% gain that feels less like triumph and more like a gasp for air. Trading volume, that lifeblood of markets, has plummeted by 11.62%, now a paltry $65.18 billion. One might say the market is resting; I say it’s gasping before the plunge. 🛑

Read More

- Tom Cruise? Harrison Ford? People Are Arguing About Which Actor Had The Best 7-Year Run, And I Can’t Decide Who’s Right

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- What If Karlach Had a Miss Piggy Meltdown?

- Zerowake GATES : BL RPG Tier List (November 2025)

- Fate of ‘The Pitt’ Revealed Quickly Following Season 2 Premiere

- Gold Rate Forecast

- Mario Tennis Fever Release Date, Gameplay, Story

- Yakuza Kiwami 2 Nintendo Switch 2 review

- This Minthara Cosplay Is So Accurate It’s Unreal

- The Beekeeper 2 Release Window & First Look Revealed

2025-11-01 17:54