What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

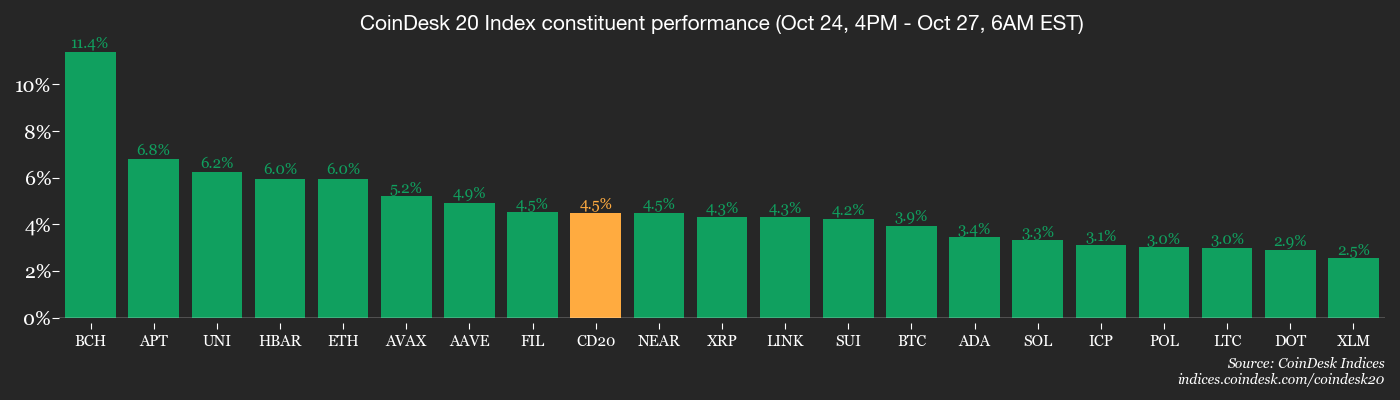

The crypto market, ever the socialite, basked in a sea of green, as if it had just attended a particularly lavish garden party. Bitcoin flirted with the $115,000 mark, a move that would make even a Victorian debutante blush. The CoinDesk 20 Index enjoyed a neat 2% uptick, while ZEC, PI, and ENA dazzled with over 10% gains-proof that even altcoins can outshine the main event. 🎩🎩

The buzz is all about anticipation for a Fed rate cut this Wednesday, as if the central bank were a magician pulling rabbits out of hats. Meanwhile, whispers of a U.S.-China trade deal have investors clutching their portfolios like a child clutches a teddy bear. 🕵️♂️

The upswing is once again marked by wealth rotation. Short-term holders and big whales are scooping up coins from long-term wallets, as if they were bidding at an auction where the prize is the future. 🕰️

Speaking of big moves, defunct exchange Mt. Gox delayed creditor repayment deadline by one year to October 2026-because nothing says “recovery” like a decade-long delay. Sharplink Gaming made waves in the ether market, snapping up a whopping 19,271 ETH ($78.3 million), according to blockchain detective The Data Nerd. That mammoth purchase shows serious confidence in ETH’s potential. 🚀

Meanwhile, privacy coin ZEC got a bullish shoutout from the ever-bold Arthur Hayes, CIO of Maelstrom Fund. He’s forecasting a meteoric rise to $10,000, a figure that makes ETH’s current struggle to breach $5,000 look like child’s play. 💥

On the institutional front, CoinShares reported inflows of $921 million into digital asset products last week-a hopeful sign sparked by softer-than-expected U.S. CPI data. Bitcoin led the charge, while demand for XRP, ETH, and SOL cooled. 🧠

Stablecoins stole the spotlight with some game-changing headlines. Western Union is reportedly piloting a stablecoin settlement system, as if traditional banks needed more ways to complicate their lives. Over in Japan, JPYC Inc. officially launched its yen-pegged stablecoin, JPYC, and Kyrgyzstan just joined the stablecoin party with its national coin, devised with Binance’s help. 📈

In traditional markets, the frenzied demand for leverage from retail investors-evident in surging margin debt and the record number of leveraged ETFs-emerged as a key concern. As Morningstar noted, “adding fuel to the fire are worries investors are taking on risk beyond what the market’s fundamentals can support.” Stay alert! 🔥

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 2 of 4: Money20/20 USA (Las Vegas) 🎤

Token Talk

By Oliver Knight

- The crypto market bounce ahead of Wednesday’s Federal Reserve rate decision reflected across the entire altcoin sector, with the likes of and posting double-digit gains. 📊

- There was also a notable rise in tokens issued in or before 2018 as and both rose by 8% and 9.5% respectively, while ether edged back into bullish territory with a surge past $4,150. 📈

- The reversal in price action was not felt in two newly-released tokens; plasma and aster both collapsed further to the downside as waning demand could not stifle wave upon wave of sell pressure. ⚠️

- Plasma initially rose to as high as $1.67 in the days following its launch, notching $3.3 billion in daily volume in the process. However, it now trades at $0.36 with daily volume tumbling to $297 million. 📉

- Aster, meanwhile, is trading at $1.07 having lost 43% of its value over the past month. It was initially positioned to be a rival to decentralized derivatives exchange HyperLiquid, but hype has since withered away after concerns surrounding the legitimacy of trading volume on the platform. 🕵️♀️

- Bitcoin dominance ticked up slightly to 59.2% on Monday, up from a low of 57.1% six weeks ago, suggesting that investors still prefer the more measured gains of BTC compared to more speculative altcoin bets. 🧠

Derivatives Positioning

- The BVIV, which measures BTC’s 30-day implied volatility, has dropped to an annualized 44%, nearly reversing the Oct. 10 spike in a sign of ebbing market stress. 🌬️

- The bias for Deribit-listed BTC put options has weakened across all tenors. However, longer duration risk reversals still remain slightly neutral to bearish. The same can be said for ETH, although at the short-end, the bias for ETH puts is still slightly greater than BTC. 🧠

- Last week, traders continued to sell topside (calls) on the CME to collect premium and generate yield on their BTC longs. 💰

- Open interest in futures tied to most cryptocurrencies, excluding XRP, HYPE and HBAR, has increased in the past 24 hours, indicating capital inflows amid the price rally. 🚀

- Although bitcoin prices have climbed past their Oct. 21 high, the total open interest in USDT- and USD-denominated perpetual futures on major exchanges remains below the levels seen on Oct. 21. This divergence suggests that leveraged trader participation in the recent BTC rally has been limited. ⚠️

Market Movements

- BTC is up 3.97% from 4 p.m. ET Wednesday at $115,343.39 (24hrs: +2.51%) 🚀

- ETH is up 5.8% at $4,170.55 (24hrs: +4.65%) 🌟

- CoinDesk 20 is up 4.43% at 3,835.89 (24hrs: +2.34%) 📈

- Ether CESR Composite Staking Rate is down 5 bps at 2.82% 📉

- BTC funding rate is at 0.0032% (3.504% annualized) on KuCoin 💸

- DXY is down 0.12% at 98.83 📉

- Gold futures are down 1.92% at $4,058.20 💰

- Silver futures are down 1.77% at $47.72 💰

- Nikkei 225 closed up 2.46% at 50,512.32 📈

- Hang Seng closed up 1.05% at 26,433.70 📈

- FTSE is down 0.06% at 9,640.23 📉

- Euro Stoxx 50 is up 0.28% at 5,690.65 📈

- DJIA closed on Friday up 1.01% at 47,207.12 📈

- S&P 500 closed up 0.79% at 6,791.69 📈

- Nasdaq Composite closed up 1.15% at 23,204.87 📈

- S&P/TSX Composite closed up 0.55% at 30,353.07 📈

- S&P 40 Latin America closed down 0.35% at 2,922.76 📉

- U.S. 10-Year Treasury rate is up 2.7 bps at 4.024% 💰

- E-mini S&P 500 futures are up 0.87% at 6,886.25 📈

- E-mini Nasdaq-100 futures are up 1.27% at 25,833.50 📈

- E-mini Dow Jones Industrial Average Index are up 0.58% at 47,669.00 📈

Bitcoin Stats

- BTC Dominance: 59.84% (0.33%) 🎯

- Ether to bitcoin ratio: 0.03614 (-0.44%) 📉

- Hashrate (seven-day moving average): 1,125 EH/s 💡

- Hashprice (spot): $49.69 💰

- Total Fees: 2.03 BTC / $229,952 💸

- CME Futures Open Interest: 148,460 BTC 📊

- BTC priced in gold: 27.4 oz 🪙

- BTC vs gold market cap: 7.74% 💰

Technical Analysis

- Ether continues to trade within a well-defined descending channel and below the Ichimoku cloud, indicating downside bias. ⚠️

- A daily candle close (UTC) above $4,400 would confirm the dual breakout, signaling scope for a rally to $5,000. 🚀

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $354.46 (+9.82%), +2.69% at $364 in pre-market 📈

- Circle Internet (CRCL): closed at $142.05 (+9.39%), +2.84% at $146.09 📈

- Galaxy Digital (GLXY): closed at $39.82 (+3.16%), +5.12% at $41.86 📈

- Bullish (BLSH): closed at $54.22 (+0.65%), +3.43% at $56.08 📈

- MARA Holdings (MARA): closed at $19.54 (+1.66%), +4.3% at $20.38 📈

- Riot Platforms (RIOT): closed at $21.42 (+4.54%), +3.97% at $22.27 📈

- Core Scientific (CORZ): closed at $19.34 (+7.09%), +1.5% at $19.63 📈

- CleanSpark (CLSK): closed at $19.36 (+9.59%), +4.05% at $20.15 📈

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $59.63 (+10.38%), +5.65% at $63 📈

- Exodus Movement (EXOD): closed at $25.43 (+5.96%), +0.31% at $25.51 📈

Crypto Treasury Companies

- Strategy (MSTR): closed at $289.08 (+1.46%), +4.04% at $300.76 📈

- Semler Scientific (SMLR): closed at $23.96 (+5.27%), +8.47% at $25.99 📈

- SharpLink Gaming (SBET): closed at $13.92 (+3.07%), +6.32% at $14.80 📈

- Upexi (UPXI): closed at $4.91 (+2.94%), +7.13% at $5.26 📈

- Lite Strategy (LITS): closed at $1.94 (+3.74%), +6.19% at $2.06 📈

ETF Flows

Spot BTC ETFs

- Daily net flow: $90.6 million 💰

- Cumulative net flows: $61.95 billion 💰

- Total BTC holdings ~ 1.35 million 🧾

Spot ETH ETFs

- Daily net flow: -$93.6 million 💸

- Cumulative net flows: $14.37 billion 💰

- Total ETH holdings ~ 6.71 million 🧾

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- Gold Rate Forecast

- Ragnarok X Next Generation Class Tier List (January 2026)

- Answer to “A Swiss tradition that bubbles and melts” in Cookie Jam. Let’s solve this riddle!

- These are the 25 best PlayStation 5 games

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Silent Hill f: Who is Mayumi Suzutani?

- 15 Lost Disney Movies That Will Never Be Released

2025-10-27 15:03