Alas, dear reader, Sei Coin finds itself at a most peculiar crossroads. The bearish tide, relentless in its fury, has forced this poor token into the arms of accumulation, where traders-those bold gamblers-now stand, eagerly pondering whether the current range of $0.18 to $0.22 shall be the foundation of a valiant recovery or simply another pitiful attempt at defying the inevitable plunge.

Open Interest Drop: The Calm Before the Storm or Just a Nap?

On the one hand, the 4-hour chart paints a portrait of despair-lower highs and lower lows, as the sellers revel in their dominance. Yet, in an unexpected twist of fate, after a liquidity flush at $0.15, the token managed to pull off a modest rebound. Could this be a sign of stabilization? Perhaps. Or perhaps it’s merely the calm before another storm of financial chaos. Only time will tell, my friends.

The data from the derivatives market tells a tale of liquidation and the untimely exit of those who dared to hold onto speculative positions. Open interest has plummeted to a mere 58.7 million, a far cry from the more optimistic days of yore. This sudden retreat could be a sign that traders have abandoned the ship, leaving behind a calmer market-one less susceptible to wild swings. Could this be the beginning of a more stable period? Or are we simply delaying the inevitable?

Market Data: The Dog That Didn’t Bark

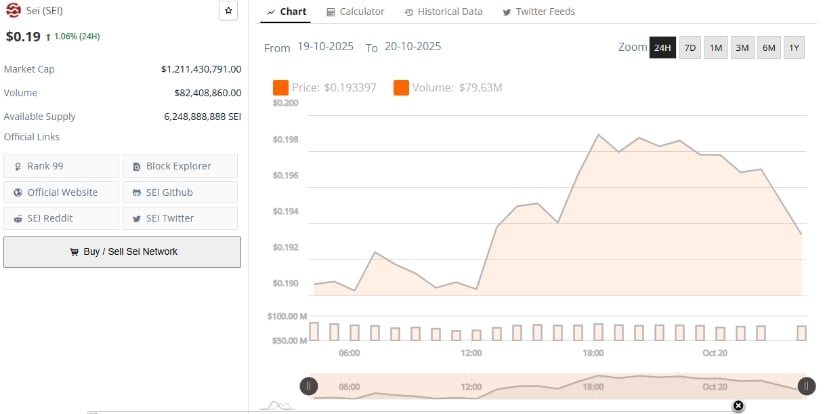

As BraveNewCoin reports, Sei is currently trading at $0.19, with a modest 1.06% rise in the last 24 hours. Its market cap? A healthy $1.21 billion. But don’t be fooled, for beneath this veneer of stability lies a market that still carries the weight of caution. Buyers are hesitant, and everyone is waiting for that elusive moment when the tides will turn. In the meantime, Sei remains the 99th ranked token in the world, with a circulating supply of 6.24 billion. Quite a number, isn’t it?

Liquidity remains balanced, with no grand inflows to excite the masses. This suggests the market is still digesting its previous missteps. Yet, there remains hope-should buying volume pick up, we may just witness the first spark of a recovery. But, alas, no one knows for sure.

Technical Indicators: A Whisper of Hope in a Sea of Despair

At the time of writing, Sei is priced at a mere $0.1947, reflecting a slight decline of 0.36%. The Bollinger Bands, those trusty guides of market sentiment, suggest that the price is perilously close to the lower band at $0.1603. It’s not quite a plunge, but it’s certainly a close call.

This suggests strong selling pressure, but there may still be hope-Sei is approaching a level where consolidation or even a short-term reversal could occur. But don’t hold your breath. The market has a way of keeping us on the edge of our seats.

And the RSI? A mere 31.26, with the moving average at 34.56. Both readings flirt with the oversold zone, whispering that the relentless sell-off may finally be losing steam. If demand strengthens, we might just witness a miraculous recovery. Or we might not. Who’s to say, really? It’s all part of the drama that is the crypto market.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- All Poppy Playtime Chapter 5 Characters

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- EUR INR PREDICTION

2025-10-22 22:58