CoinDesk Indices

What to know:

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

In the vast Gulag of global finance, where men once toiled for bread, now the digital chains rattle softly. Bitcoin may roar in the headlines, a digital idol for hoarders and speculators, but ah, the stablecoins-those steadfast shadows of the dollar-they shall eclipse it in the twilight of the next five years, modernizing the weary dance of money across borders. How quaint, how ironically liberating! 😏

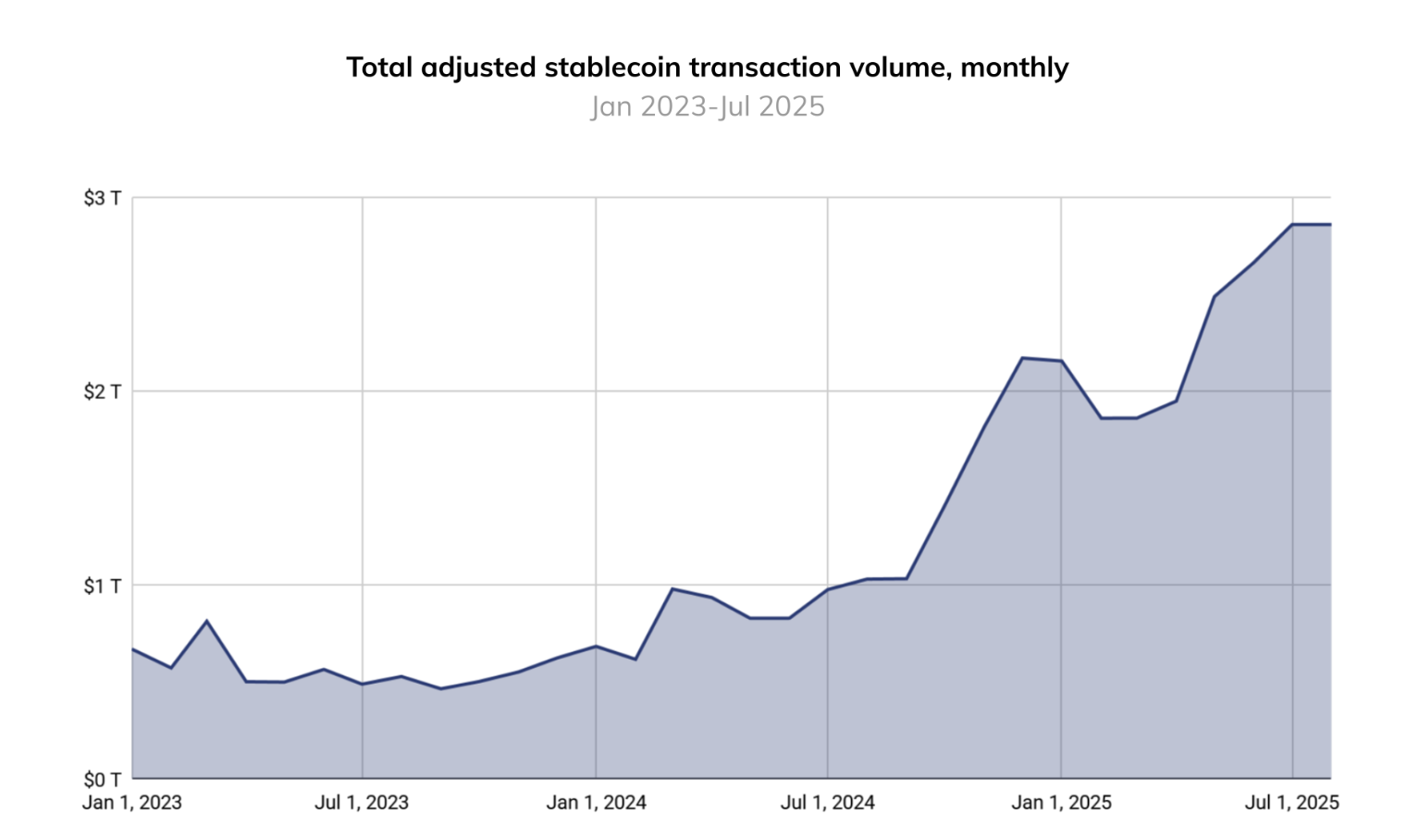

Yes, this original beast of crypto, swelling to a $2.3 trillion kingdom, clutches its store of value like a miser hoarding rubles in a Siberian hut. Yet the stablecoins, built for transaction, not mere contemplation, dwarf it in daily toil: on October 6, Bitcoin’s feeble $63.8 billion in a day met the $146 billion swagger of stablecoins-more than double, comrades! As if the soul weary of storms craves calm shores.

There’s a reason, simple as the peasant’s plow: stablecoins are not idols to worship, but tools in the grimy hands of reality. Powering more than DeFi’s serpentine maneuvers, they surge as a currency for payments, cross-border whispers of wealth. And with AI, that electronic ghost, looming to transact machine-to-machine, stablecoins giggle at becoming the currency of automatons. Imagine, robots bartering like humans once did-hilarious hubris! 🤖💥

Bitcoin evolves, wrapping itself in Layer 2 chains, integrating into DeFi like a wolf in sheep’s fleece, yet it remains the eternal hoard. Other chains provide the decentralized stage for finance’s future dance, but stablecoins are forged precisely for payments-a sly rebellion against the centralized beasts: SWIFT, ACH, the credit card empires. As adoption sneaks into the mainstream, stablecoins will seize the mundane rituals of payment, leaving Bitcoin to ponder its navel in platonic solitude. 🙄

Chart: Chainalysis 2025 Global Adoption Index

Behold Venezuela, where USDT, that smug lifeline, pulses through economic veins amid 180% inflation’s shrill scream. Short on greenbacks, ripe for stablecoin barter-groceries or haircuts paid in digital dollars, a mockery of tragedy! Extremes, yes, but a parable for the soul’s yearning for stability in turbulent seas. 🥵

Stablecoins ascend not in speculative fever, but in pragmatic grace: instant, peer-to-peer alchemy that Bitcoin’s lumbering blocks and feeish vulgarities cannot match. Seconds for settlement, pennies for toll, and value unshaken-oh, the delightful irony of volatility subdued! 🌪️

It’s all about utility

Their triumph lies not in mania, but in utility’s quiet revolution-they emerge as the world’s unspoken digital proletarian, disrupting remittance’s $780 billion circus with swifter, cheaper dashes across borders. Payments too, as Stripe and Visa blushingly embrace them, weaving blockchain unseen into the fabric, 24/7, global as wind. Most will pay without knowing the rebellion beneath, blissfully ignorant in their chains. 😈

The U.S. administration, ever the opportunist, heralds stablecoins as the dollar’s savior against obsolescence, passing the GENIUS Act like a decree from on high. Yet the regulatory gulags loom: definitions of reserves, issuers’ crowns, redemption rites-all determining if these tokens conquer or languish in bureaucratic exile. Fail here, and the dollar’s throne topples, surrendered to foreign whims. A gamble in the grand theater of power! 🎭

In this short march of fate, the minted value of stablecoins may outstrip Bitcoin’s lofty perch-utility over pomp, resilience over spectacle. Thus spake the shadows of the future. 📉

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Mario Tennis Fever Review: Game, Set, Match

- Train Dreams Is an Argument Against Complicity

- 2026 Upcoming Games Release Schedule

- Every Death In The Night Agent Season 3 Explained

2025-10-22 21:57