What to know:

By Francisco Rodrigues (All times ET unless indicated otherwise)

Ah, Bitcoin! That fickle darling of the digital realm, has risen from its weekend slumber, dusting off the cobwebs of a $500 billion value-destruction event. 🌪️💔 A 3% bounce in 24 hours, you say? How quaint! Yet, it remains 4% down for the month-a mere flesh wound, no doubt. 🩹

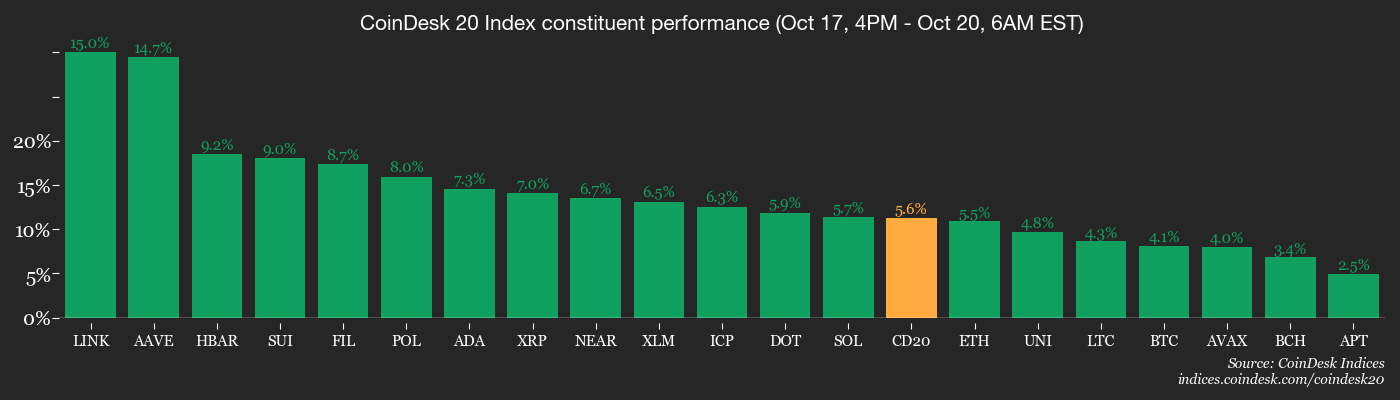

The markets, ever the dramatic diva, have been soothed by Trump’s tariff tantrums and the Fed’s dovish coos. 🕊️ The CoinDesk 20 index, that fickle barometer of crypto’s mood, is up 4.3%, with all members basking in the green glow of optimism. 🌱

“While Bitcoin’s short-term correction is as fleeting as a summer breeze, its long-term trajectory remains as stubborn as a mule,” quoth XS.com’s Linh Tran. 🦓 Macroeconomic factors-Fed policy, dollar strength, and geopolitical whims-continue to tug at its leash. 🐕

Yet, beware! Short-term momentum is as reliable as a weather forecast. Thin liquidity, a bullish dollar, and the Fed’s rate path murmurs keep analysts at Coinbase Institutional on edge. 🌧️ Meanwhile, Treasury yields spike, and Israel and Russia play their geopolitical chess, leaving institutional investors clutching their pearls. 🕶️

Corporate accumulation, however, marches on like a determined tortoise, with holdings up 8.4% to 4.04 million BTC. 🏢 BlackRock and 21Shares, those titans of finance, have debuted their crypto ETPs in London, offering retail investors a slice of the pie. 🥧

“Bitcoin is in a reaccumulation phase,” Tran adds, “like a gentleman biding his time before the next grand ball.” 🎩 Stay alert, dear reader, for the dance has only just begun! 💃

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Crypto

- Oct. 20: Ether treasury firm ETHZilla Corp. (ETHZ) will implement a 1-for-10 reverse stock split, reducing outstanding shares to 16 million. 📉

- Macro

- Oct. 20, 8:30 a.m.: Canada Sept. PPI. Headline YoY (Prev. 4%), MoM (Prev. 0.5%). 📊

- Earnings (Estimates based on FactSet data)

- Nothing scheduled. 🦗

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Oct. 20: Crypto Finance Forum (New York) 🗽

Token Talk

By Oliver Knight

- Altcoins, those mischievous siblings of Bitcoin, have seen a surge, with memecoin floki leading the charge. Yet, CoinMarketCap’s altcoin season index lingers at 26/100-investors still prefer the steady hand of Bitcoin. 🤝

- Bitcoin dominance stands at 58.8%, up from 57.2% last month. The king remains unchallenged. 👑

- Despite Monday’s recovery, several altcoins are nursing wounds. Synthetix is down 30%, while FET, ASTER, and BNB have lost 15-25%. Ouch! 😣

- LINK, that resilient soul, rose 14% after wallets withdrew $116 million from Binance, signaling accumulation post-crash. 🛡️

- The crypto RSI sits at 54.2/100-neither here nor there, like a guest at a party who’s not sure if they should stay or leave. 🥂

Derivatives Positioning

- BTC options remain bullish, with a put-call ratio of 0.66 and $2.4B in notional call exposure at the $140K strike. Traders are betting on upside, even as volatility rises. 🎢

- Total open interest on Deribit options hits a yearly high of 427,746 contracts, with December expiries dominating. Bullish bets extend, but tactical flexibility remains. 🗓️

- ETH options mirror BTC’s structure, with call dominance around $4K-$4.5K strikes. 🪞

Market Movements

- BTC is up 3.65% from 4 p.m. ET Friday at $110,980.77 (24hrs: +3.32%) 🚀

- ETH is up 5% at $4,051.70 (24hrs: +2.96%) 🌕

- CoinDesk 20 is up 5.52% at 3,706.47 (24hrs: +3.47%) 📈

- Ether CESR Composite Staking Rate is down 14 bps at 2.82% 📉

- BTC funding rate is at 0.0015% (1.6097% annualized) on Binance 📊

- DXY is unchanged at 98.48 🧮

- Gold futures are up 1.52% at $4,277.30 🏅

- Silver futures are up 1.50% at $50.85 🥈

- Nikkei 225 closed up 3.37% at 49,185.50 📈

- Hang Seng closed up 2.42% at 25,858.83 📈

- FTSE is up 0.28% at 9,381.02 📈

- Euro Stoxx 50 is up 0.64% at 5,643.36 📈

- DJIA closed on Friday up 0.52% at 46,190.61 📈

- S&P 500 closed up 0.53% at 6,664.01 📈

- Nasdaq Composite closed up 0.52% at 22,679.97 📈

- S&P/TSX Composite closed down 1.15% at 30,108.48 📉

- S&P 40 Latin America closed up 0.55% at 2,884.62 📈

- U.S. 10-Year Treasury rate is up 0.5 bps at 4.014% 📈

- E-mini S&P 500 futures are up 0.25% at 6,719.00 📈

- E-mini Nasdaq-100 futures are up 0.34% at 25,071.50 📈

- E-mini Dow Jones Industrial Average Index are up 0.19% at 46,469.00 📈

Bitcoin Stats

- BTC Dominance: 59.68% (0.18%) 👑

- Ether to bitcoin ratio: 0.03649 (-0.46%) ⚖️

- Hashrate (seven-day moving average): 1,153 EH/s 💻

- Hashprice (spot): $47.74 💰

- Total Fees: 2.23 BTC / $240,861 💸

- CME Futures Open Interest: 144,335 BTC 📜

- BTC priced in gold: 26.4 oz 🏵️

- BTC vs gold market cap: 7.44% 📊

Technical Analysis

- ETH-BTC ratio, that fickle canary in the coal mine, closed above the yearly open after retesting the weekly order block. A positive sign for bulls, but will it hold? 🤔

- The next resistance lies at the 100-week EMA, around $0.03904. Break it, and altcoins might just have their day in the sun. ☀️

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $336.02 (+1.75%), +3.4% at $347.43 📈

- Circle Internet (CRCL): closed at $126.49 (-1.53%), +3.43% at $130.74 📈

- Galaxy Digital (GLXY): closed at $37.78 (-5.34%) 📉

- Bullish (BLSH): closed at $57.07 (-0.83%), +2.59% at $58.58 📈

- MARA Holdings (MARA): closed at $19.57 (-3.43%), +4.65% at $20.48 📈

- Riot Platforms (RIOT): closed at $20.03 (+2.46%), +3.89% at $20.81 📈

- Core Scientific (CORZ): closed at $19 (-3.41%), +2.58% at $19.49 📈

- CleanSpark (CLSK): closed at $19.52 (-2.33%), +4.38% at $20.38 📈

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $58.23 (-1.85%), +5.74% at $61.57 📈

- Exodus Movement (EXOD): closed at $24.86 (-1.27%), unchanged in pre-market 🕑

Crypto Treasury Companies

- Strategy (MSTR): closed at $289.87 (+2.12%), +3.72% at $300.65 📈

- Semler Scientific (SMLR): closed at $23.18 (-6.04%), +2.55% at $23.77 📈

- SharpLink Gaming (SBET): closed at $14.34 (-1.58%), +3.7% at $14.87 📈

- Upexi (UPXI): closed at $5.4 (-3.74%), +5.74% at $5.71 📈

- Lite Strategy (LITS): closed at $1.88 (+1.62%), +4.79% at $1.97 📈

ETF Flows

Spot BTC ETFs

- Daily net flow: -$366.6 million 📉

- Cumulative net flows: $61.50 billion 📈

- Total BTC holdings ~ 1.35 million 🏦

Spot ETH ETFs

- Daily net flow: -$232.2 million 📉

- Cumulative net flows: $14.61 billion 📈

- Total ETH holdings ~ 6.79 million 🏦

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Every Death In The Night Agent Season 3 Explained

- All Songs in Helluva Boss Season 2 Soundtrack Listed

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- 4. The Gamer’s Guide to AI Summarizer Tools

2025-10-20 14:58