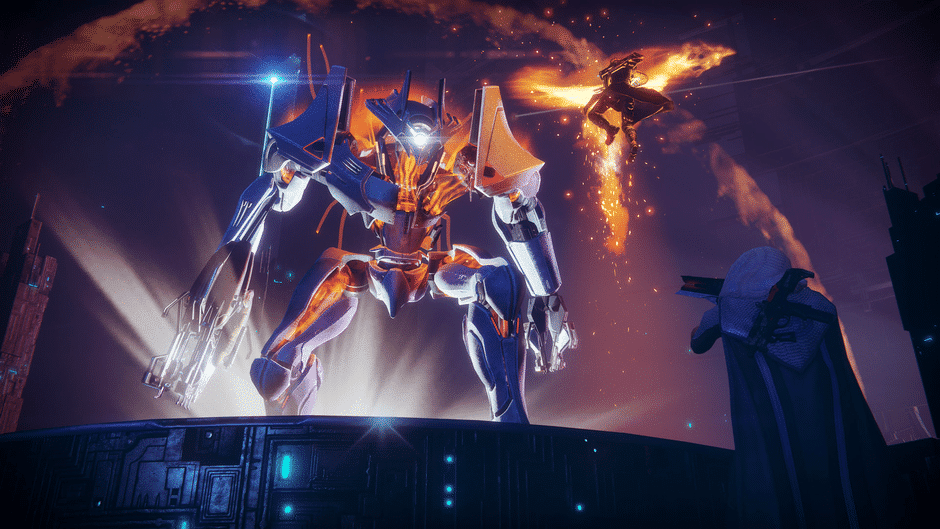

Destiny 2: This Week’s Xûr Megathread Has Players Buzzing Over Exotic Loot

When Xur arrives at the Tower, it’s similar to that relative who occasionally visits family gatherings, promising a fantastic dessert but often shows up with a box of old cookies instead. On April 18th, his inventory included an assortment of exotic weapons like the SUROS Regime and Thunderlord, as well as unusual exotic armor pieces such as the Karnstein Armlets and Shards of Galanor. Players swiftly reacted, with keen eyes noticing unusual aspects in the stats. User Gbrew555 commented, “Wow, those Karnsteins are packed… in really strange stat combinations haha,” indicating a mix of surprise and amusement at the unique set of stats presented, which some considered worthless while others saw hidden value.