Persona 5 X and Persona 3 Reload: The Ultimate Collaboration Trailer Revealed!

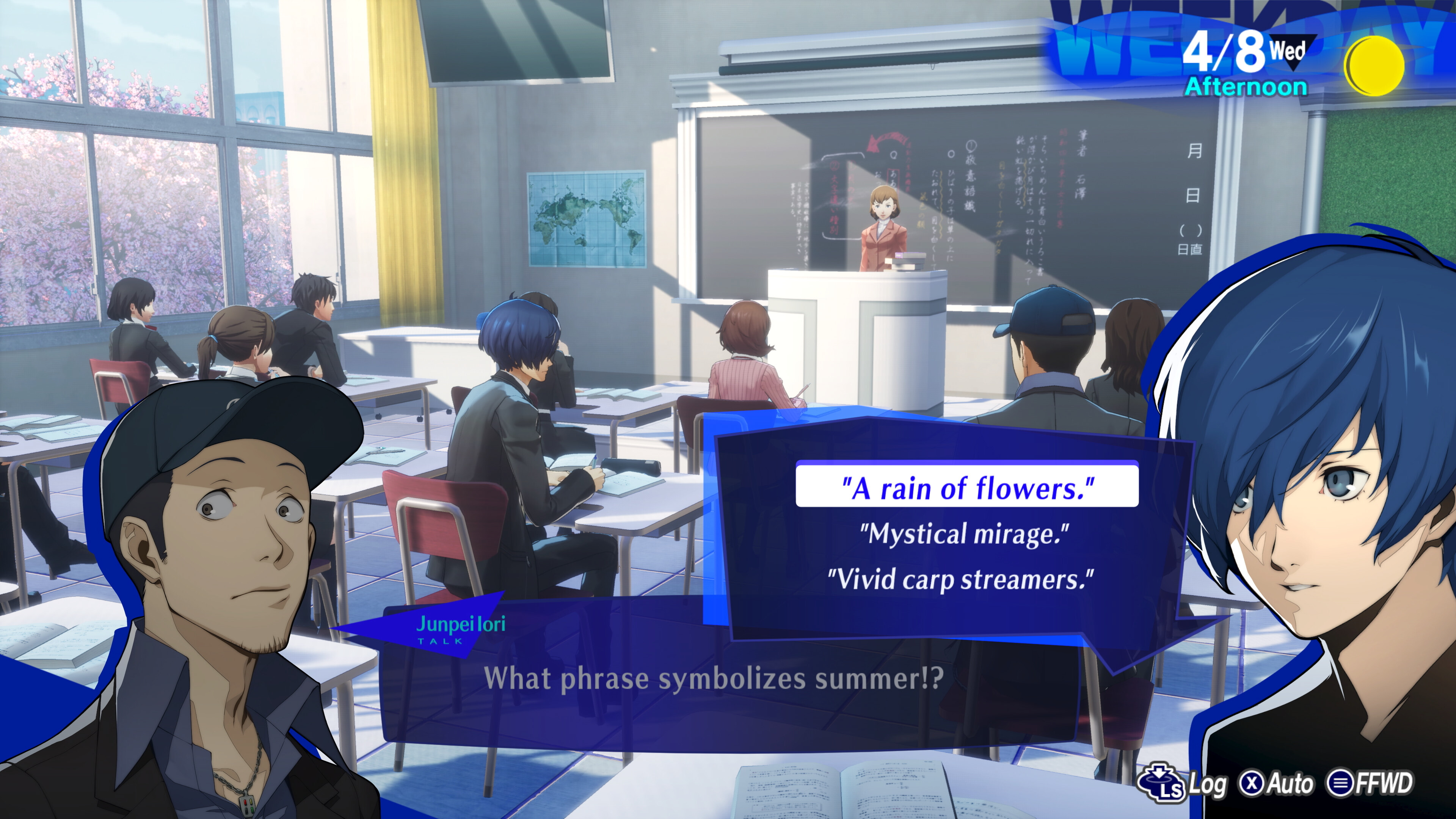

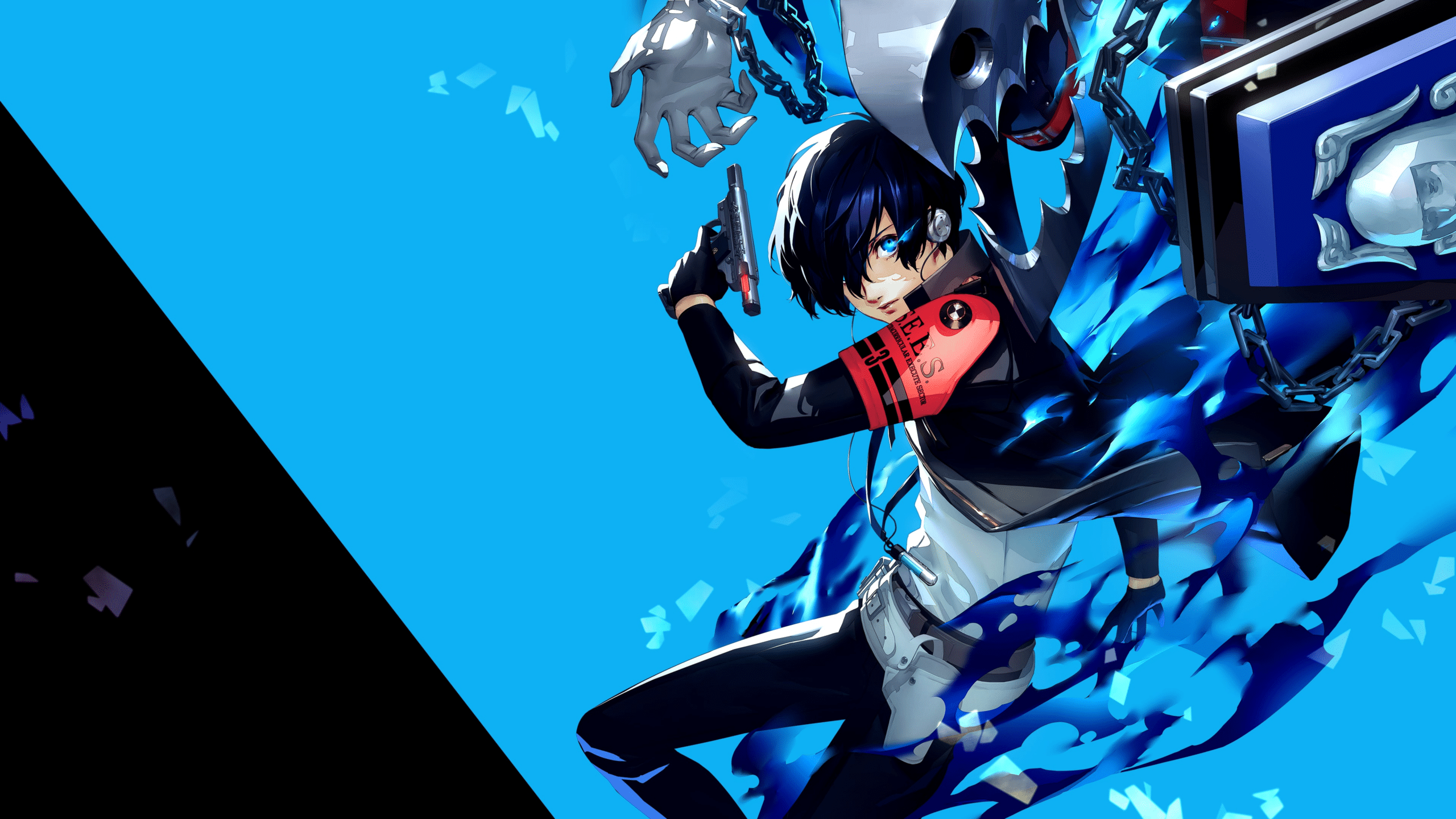

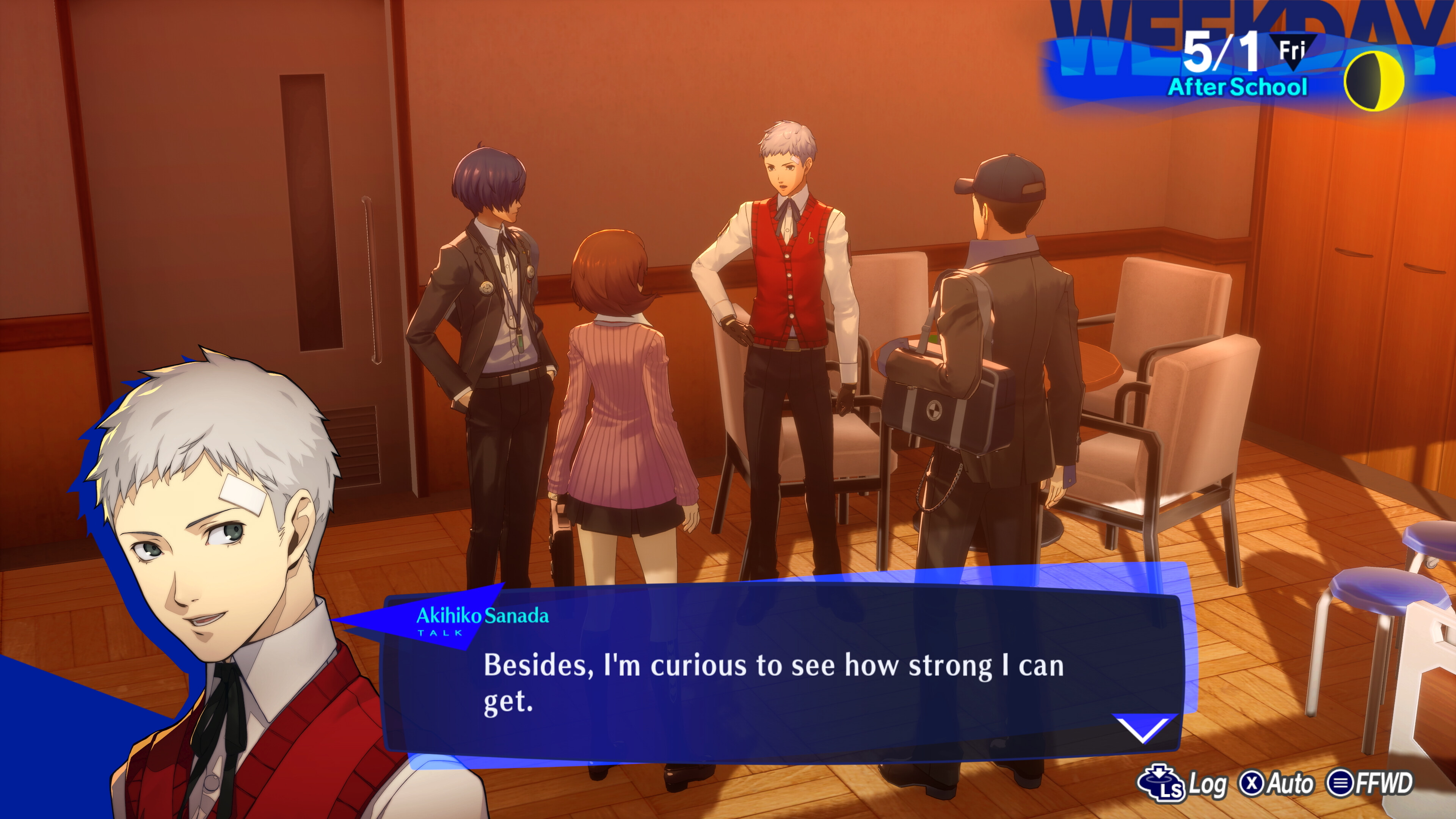

Enthusiasts of the Persona series are abuzz with excitement following the debut of the joint venture trailer, much like bees at a lively summer gathering. The beloved character Makoto Yuki is back to guide players through the enchanting labyrinth of Tartarus once more, evoking emotions as deep as those in a Pixar film! The trailer offers a refreshing update on the graphics fans have grown fond of, while hinting at new gameplay elements and thrilling quests. A player named KingBB_Bop voiced the shared sentiment when he said, “I can’t wait to play the game,” reflecting the eagerness many feel in anticipation. With the hype growing, it seems this collaboration is poised to offer an adventure that will have players sharing their thoughts, laughter, and perhaps even tears as they embark on this captivating journey together.