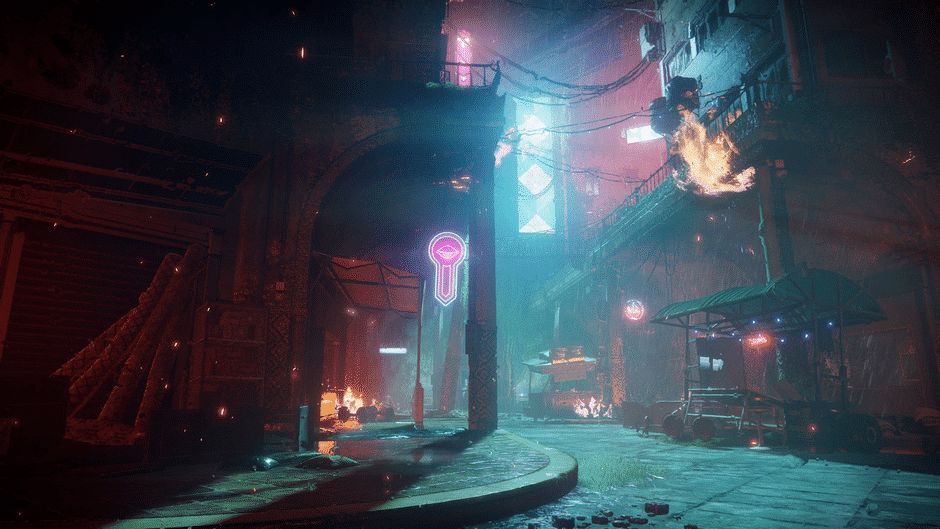

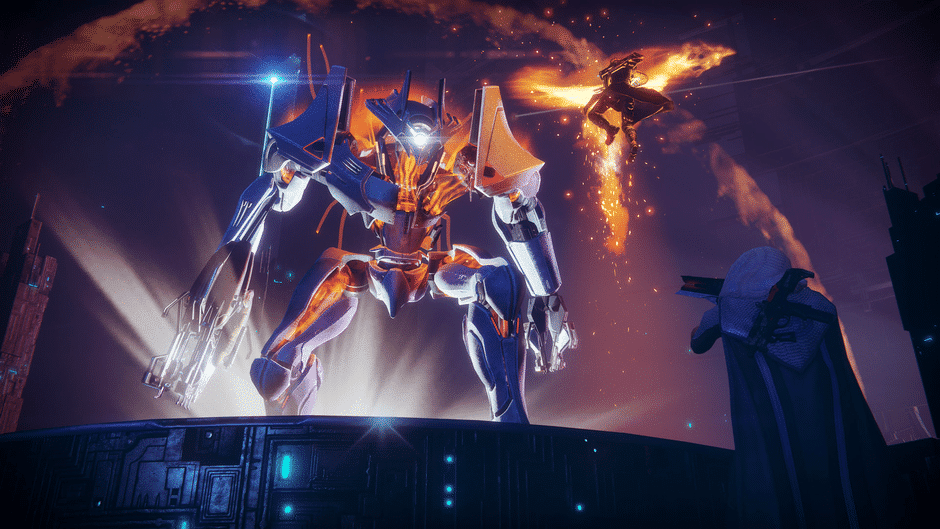

Destiny 2: The Great Champion Kill Debate in Nightfalls!

1684_Large-Breadfruit advocates vigorously for defeating all champions during Nightfalls, arguing that maximizing loot in the quickest time is essential for any Guardian. This straightforward demand appeals to many players who prioritize teamwork over hasty progression through game content. In high-pressure situations, champions aren’t just hurdles—they’re vital for attaining the elusive Platinum ranking that might lead to superior rewards following each strike. Many players share this viewpoint, highlighting that bypassing champions is akin to disregarding critical team dynamics. One player even admitted that winning often proves elusive when taking shortcuts, suggesting that champions should be considered essential targets rather than inconveniences to be avoided.