Exploring the Artistic Vibes of Persona: Geeked Moments and Fan Reactions

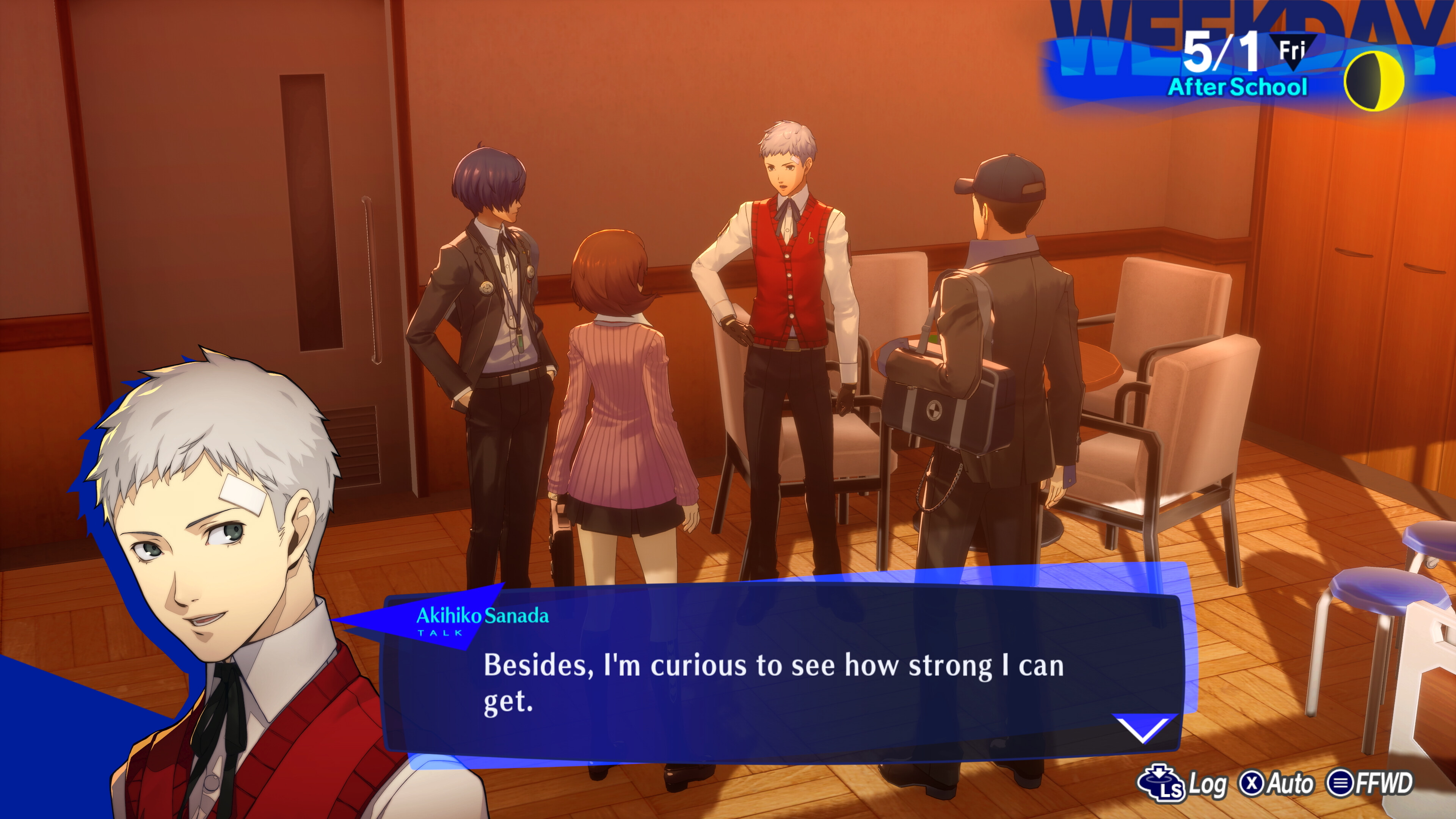

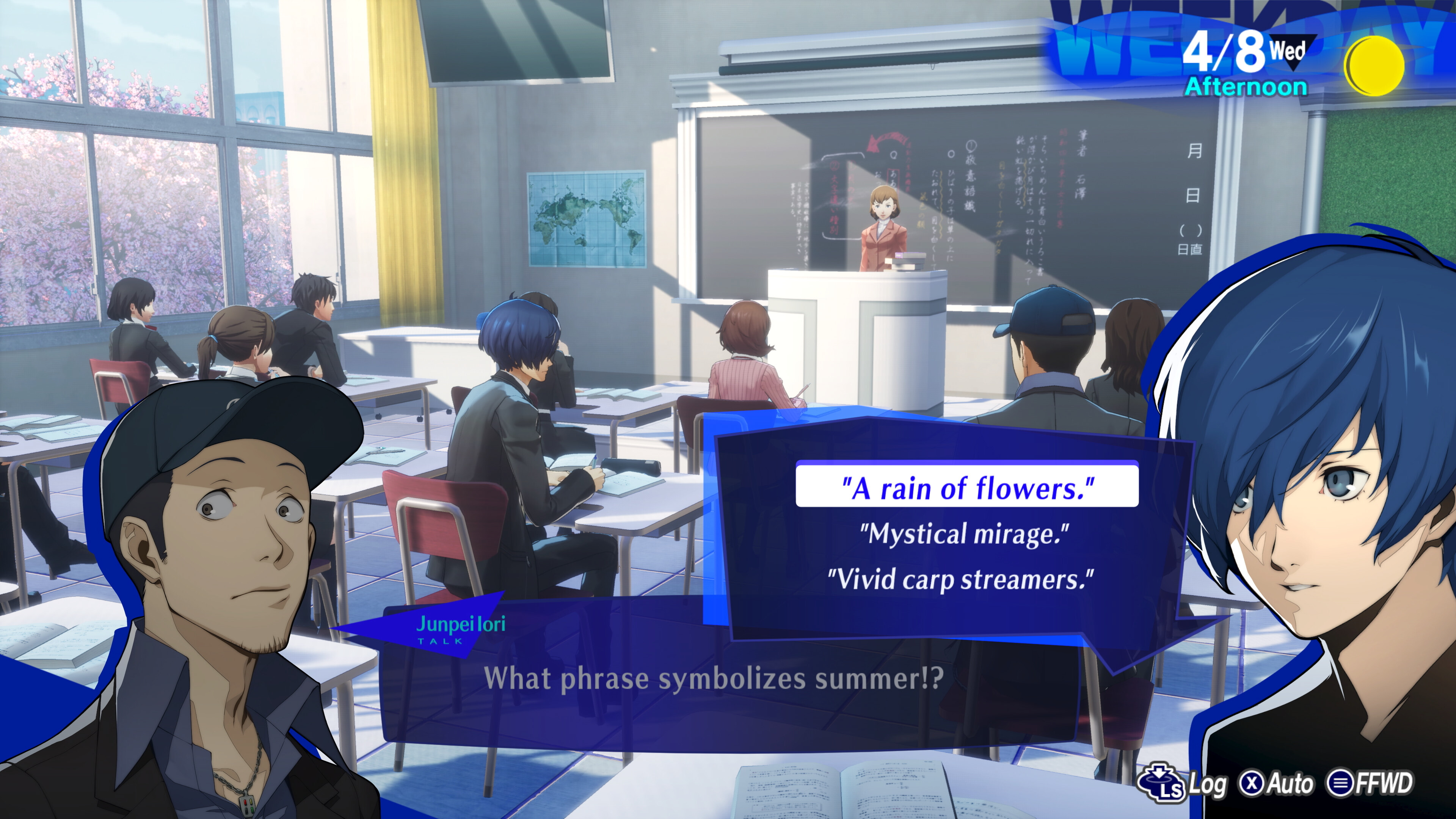

Upon discovering aquamarine765’s artwork, it ignited an immediate surge of excitement and nostalgia among fans. The vibrant colors, imaginative character designs, and skillfully conveyed emotions resonated deeply, encapsulating the very soul of Persona. A fan quipped, “neuron activation,” a playful wink to how passionate Persona followers can become inundated by the intense joy and emotional bond they experience when recalling pivotal game moments. This artwork served as a communal trigger for memories among fans, prompting them to reminisce about significant events such as Makoto’s astute deductions regarding a serial killer case. It appears that for Persona devotees, each stroke of the brush awakens a flood of memories they long to revisit once more, weaving a rich and vibrant tapestry of shared experiences that the art breathes life into.

Persona 5 X Persona 3: Teaser Sparks Global Release Rage!

The short animated preview for the collaboration between Persona 5 and Persona 3 has sparked strong feelings among fans. The visuals appear to draw upon the richness of the series, with bright colors, distinctive character designs, and eye-catching style that fans have grown fond of. The teaser begins with a mysterious monologue about destiny and fate, creating a captivating introduction. However, as anticipation grows with each passing second, viewers move from joy to concern because of the uncertainty about whether it will be available outside Japan. As one fan bluntly stated, “They’re messing with me. They know they won’t release the game here in the U.S.” The mixture of excitement and disappointment is palpable in posts as fans carefully examine every frame. Ultimately, the dominant sentiment is frustration—a blend of wonder and anger that this content might never reach shores beyond Japan.

Persona 5 X Persona 3: Teaser Sparks Global Release Rage!

The short animated preview for the collaboration between Persona 5 and Persona 3 has sparked strong feelings among fans. The visuals appear to draw upon the richness of the series, with bright colors, distinctive character designs, and eye-catching style that fans have grown fond of. The teaser begins with a mysterious monologue about destiny and fate, creating a captivating introduction. However, as anticipation grows with each passing second, viewers move from joy to concern because of the uncertainty about whether it will be available outside Japan. As one fan bluntly stated, “They’re messing with me. They know they won’t release the game here in the U.S.” The mixture of excitement and disappointment is palpable in posts as fans carefully examine every frame. Ultimately, the dominant sentiment is frustration—a blend of wonder and anger that this content might never reach shores beyond Japan.

Gaming News: Does This Indie Game Create Claustrophobia? Reddit Weighs In!

The conversation started by players analyzing the graphics of the game, particularly focusing on the size of the hands depicted in the game. Several participants voiced their observations that the hands were unusually large for a realistic context. Bonzie_57 made a humorous comment, “If your hands are as big as they seem in this game, you won’t be getting through those holes!” This sentiment was mirrored by others who felt that the oversized hands created a disconnect and could turn an otherwise lifelike tunnel scene into a comically distorted one. Essentially, they found the size of the hands to be overly exaggerated and detracting from the potential for true claustrophobia. Importantly, this criticism highlights the delicate balance required in visual design between style and immersion. In other words, if something appears too unrealistic, it interferes with the player’s ability to feel connected to the game world.

Gaming News: Fans Critique the New Putt in Parks Teaser Trailer

In the opening scenes of a trailer, it’s essential to create a bond with the audience, but for the teaser trailer of “Putt in Parks”, some viewers felt that the appeal faded too soon. As user jaklradek put it, “It feels like we have to wait a million years before realizing it’s a minigolf game.” The general sentiment among fans was that a more exciting beginning would help keep viewers hooked. Suggestions were made to showcase a golf hole right away and then transition swiftly to gameplay, making the trailer more engaging. captainpresident pointed out that the climactic moment of sinking a putt seemed rather unexciting. Although the game has a laid-back atmosphere, it seems that adding more vivid visual and audio effects during those exciting scoring moments could make them more thrilling.

Gaming News: Enhancing Gunplay – Indie Devs Weigh In on Weapon Shooting Effects

There appears to be a clear split among commenters regarding the game’s aesthetics, with some favoring flashy, vivid styles reminiscent of Borderlands, while others express concern that the visuals might become too extravagant. Striking a balance is crucial; while bold colors and eye-catching graphics can heighten excitement, excessive effects may create an overly chaotic environment that negatively impacts gameplay. User Cautious_Remote_4852 simply put it as “it looks limp,” suggesting the visual spectacle might have fallen short of its mark. This is a battle between bold visuals and precision, with developers needing to determine what their audience appreciates more.

The Common Vampire Movie Mistakes in Nosferatu & Sinners Explained

Following another critically acclaimed vampire horror film, “Sinners” unfortunately shares a similar flaw as its predecessor: Both films fail to fully realize their antagonistic vampires’ narrative potential, much like how director Eggers underutilized Count Orlok in his movie. Director Coogler repeats this mistake with his own bloodsucking creatures.

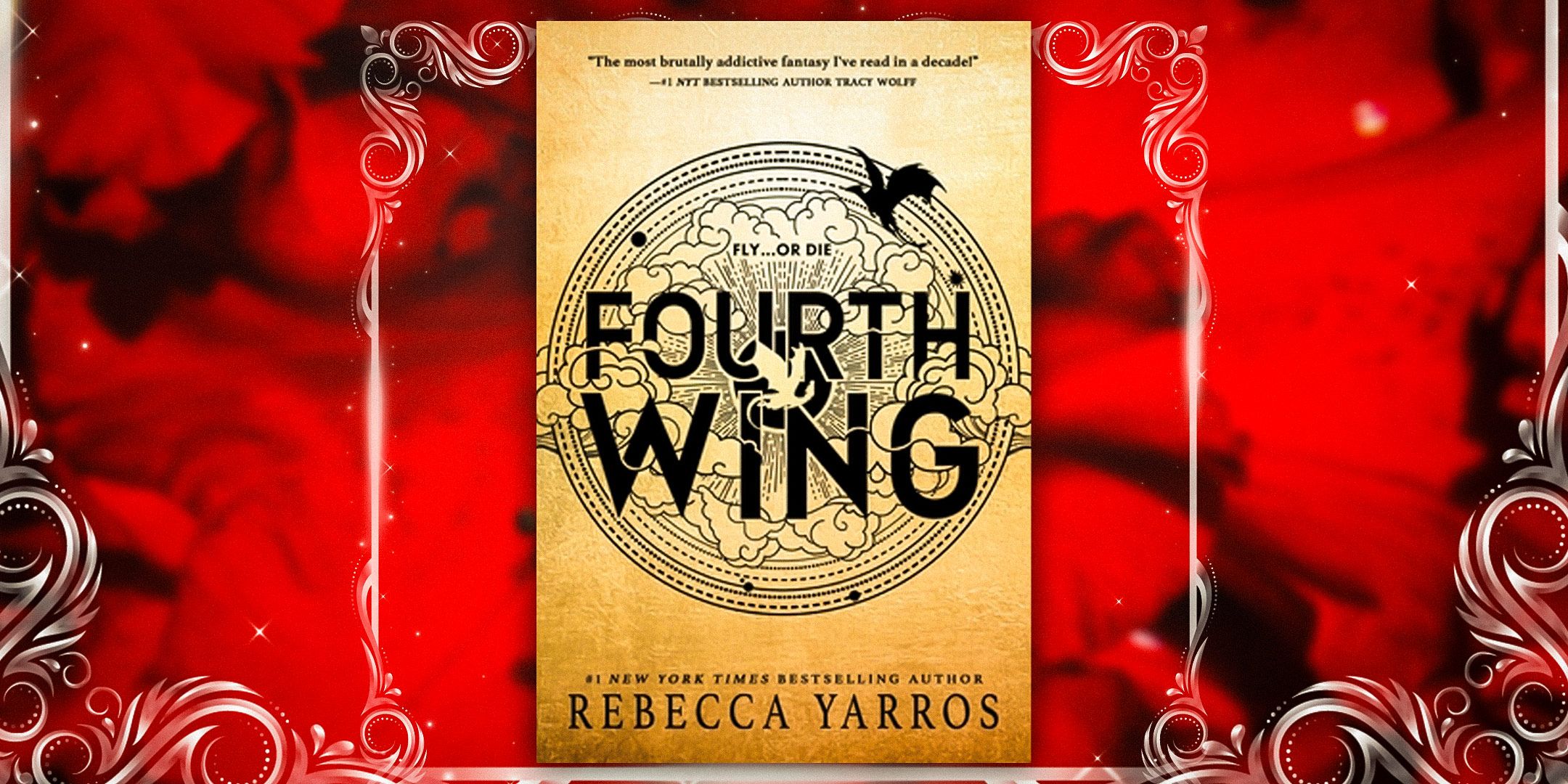

Discover the Indie Romantasy Series That’s Outshining Fourth Wing—Catch Up Before It’s Too Late

Instead of opting for the usual BookTok sensation, such as “Quicksilver” or “When the Moon Hatched”, consider exploring captivating indie-published romance fantasy novels that could mend the void left by “Onyx Storm”. One such novel is generating buzz online before its third and final installment. It’s a compelling read for those who yearn for an authentic enemies-to-lovers narrative, perilous magic school settings, and dragon encounters.