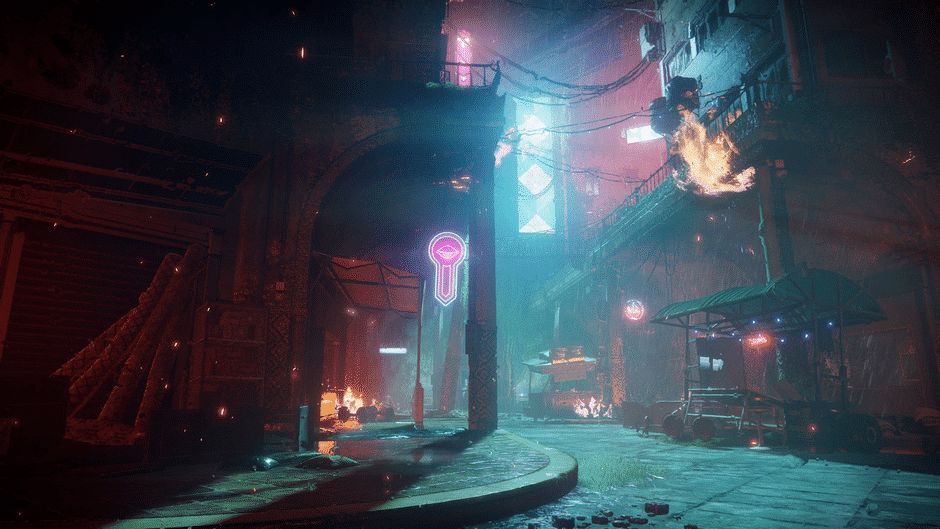

Is it Still Worth it to Farm Expert and Legendary Lost Sectors in Destiny 2?

A large part of the conversation among gamers centers around the decreasing attraction of Expert and Legendary Lost Sectors because of modifications in their reward structures. For instance, a user named oliferro lamented, “I haven’t done a single one since the change, and I’m always flooded with Exotic engrams.” Many others share this sentiment, feeling that the updates have made these sectors less appealing. Now that the main drop is exotic items players already own, the incentive to run these sectors noticeably decreases. This leaves many players wondering if it’s worth investing time in something that appears to be losing interest.