Bitcoin ETFs are on a nine-day victory lap, raking in $198 million like nobody’s business 🤑, led by Blackrock’s IBIT flexing hard. Meanwhile, Ether ETFs had a minor existential crisis with $8.5 million flowing out. Ouch.

Ether ETFs Throw a Tantrum While Bitcoin Parties On

After a blissful eight-day duet, crypto ETF flows decided to ghost each other. Bitcoin is still strutting, while Ether funds finally had a red-letter day-literally red, literally sad. Institutional crypto love is complicated, darling. 💔

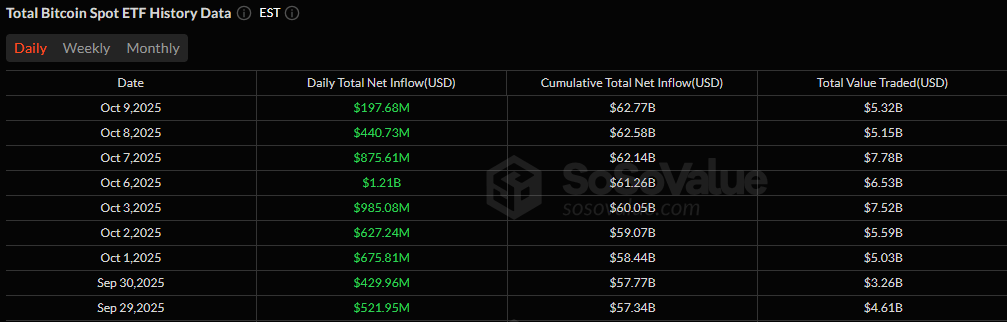

Bitcoin ETFs stacked $197.68 million, keeping the nine-day streak alive like a stubborn Netflix binge. Blackrock’s IBIT led with a jaw-dropping $255.47 million. Bitwise’s BITB added a humble $6.58 million, enough to avoid total chaos.

Grayscale’s GBTC went rogue with a $45.55 million dip, while Fidelity’s FBTC and Ark 21Shares’ ARKB joined the pity party with $13.19 million and $5.63 million outflows. But hey, $5.32 billion in trading proves that everyone’s still at the crypto club, sipping digital cocktails 🍹, with net assets at a comfy $164.79 billion.

Ether ETFs finally took a breather. After eight straight days of inflows, the gang registered $8.54 million in outflows. Blackrock’s ETHA tried to play hero with $39.29 million in, but alas, peers weren’t impressed.

Fidelity’s FETH (-$30.26M), Bitwise’s ETHW (-$8.07M), Vaneck’s ETHV (-$4.75M), 21Shares’ TETH (-$2.59M), and Invesco’s QETH (-$2.16M) all exited stage left, turning the net flow a dramatic shade of negative. Trading volume hit $2.34B, and net assets quietly tiptoed down to $29.90B. 🙃

This messy love triangle might just signal more mooning for Bitcoin ETFs as investor moods and strategies evolve-because crypto is never boring, is it? 🎢

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Mario Tennis Fever Review: Game, Set, Match

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- This free dating sim lets you romance your cleaning products

- All Songs in Helluva Boss Season 2 Soundtrack Listed

- Every Death In The Night Agent Season 3 Explained

- 4. The Gamer’s Guide to AI Summarizer Tools

2025-10-10 20:49