Alright, folks. North Dakota is about to become the second U.S. state to issue its very own stablecoin. Yeah, you heard that right. The Roughrider Coin, named after a volunteer army group led by none other than Theodore Roosevelt (you know, the guy who loved to ride horses and pretend to be tough), is launching next year. They’re doing it with the help of the Bank of North Dakota and Fiserv Inc. Apparently, the state’s real proud of its historical connection to Roosevelt and its “Rough Rider State” nickname. It’s like a local history class got a crypto makeover. 🐴💰

But here’s the kicker: this coin isn’t going to be like one of those flashy, consumer-friendly coins. No, no. It’s designed for “banking activities”-loan advances, overnight lending, and, of course, construction payments. Because if you’re gonna be a state-backed digital coin, you better be doing something that sounds important, right? But wait, it’s fully backed by good old U.S. dollars, so there’s that. It’s not some wild crypto gamble, thank goodness. 😅💵

How the Coin Will Help Local Banks?

The Bank of North Dakota, which, by the way, is the ONLY state-owned bank in the whole country (feel free to act impressed), will be the one cranking out this stablecoin. The bank already works with over 80 local banks and credit unions, helping with loans for farmers and small businesses. So, they claim this stablecoin thing is just the next step in their 106-year-long march toward fintech domination. Or, as Don Morgan, the CEO, put it, “We’re leveraging our 106-year history to stand up and be a leader.” Yeah, sure, Don. Whatever helps you sleep at night. 😬

They say it’s all backed by U.S. dollars, and it will be issued using Fiserv’s new digital asset platform. Oh, and if you want some extra nerd cred, it’s got tech from Paxos Trust Co. and Circle Internet Group. If you know what those are, congratulations, you’re probably way too invested in this. 🙄📉

State and Industry Support for Digital Money

Now, unlike Wyoming’s “Frontier Stable Token” (catchy name, by the way), the Roughrider Coin is not meant for consumer payments anytime soon. Governor Kelly Armstrong, clearly feeling all futuristic, says, “As one of the first states to issue our own stablecoin backed by real money, North Dakota is taking a cutting-edge approach to creating a secure and efficient financial ecosystem for our citizens.” Cutting-edge? In North Dakota? Sure, Kelly. We all know this is the future… of something. 🔮

Ever since the U.S. President signed the stablecoin bill into law in July 2025, there’s been a flurry of state-issued tokens popping up. Companies are getting in on the action, and even the big dogs like PayPal, Visa, and Mastercard are like, “Hey, we can get in on this, too!” Of course, it’s all about the money, right? 🤑💳

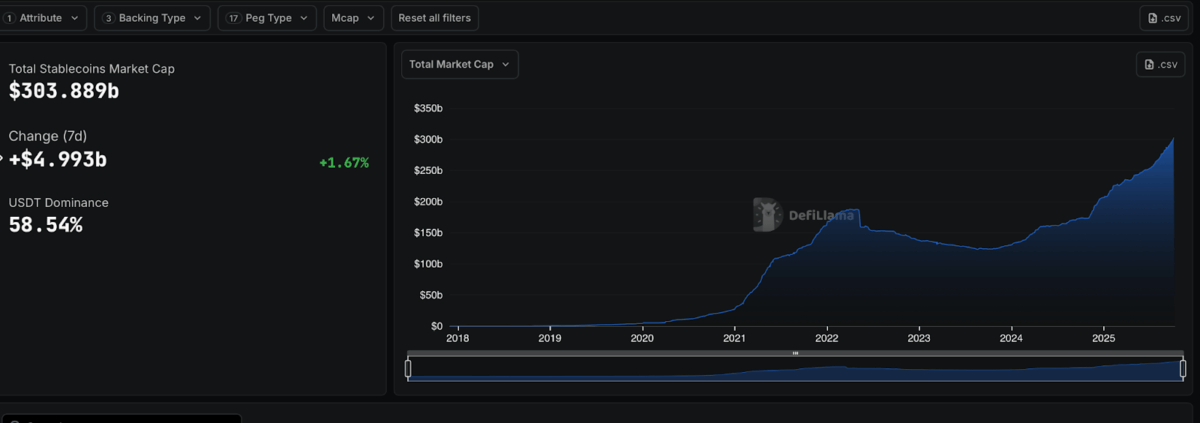

So, where does that leave us? The entire stablecoin market is now sitting at a cool $304 billion, according to DefiLlama (yeah, that’s a real thing). That’s a 1.67% increase in the last week, so, you know, things are happening. Tether’s USDT is leading the charge, but Circle’s USDC and Ethena’s USDe are tagging along. Oh, and don’t worry, Tether is still dominating with over 58% of the market share. That’s a whole lot of virtual money in the world right now. 💸

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- YouTuber streams himself 24/7 in total isolation for an entire year

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- What time is It: Welcome to Derry Episode 8 out?

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- Gold Rate Forecast

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Jamie Lee Curtis & Emma Mackey Talk ‘Ella McCay’ in New Featurette

- 2026 Upcoming Games Release Schedule

2025-10-09 00:12