Oh, dear readers, the stablecoin circus has ballooned to a whopping $300 billion, led by that cheeky chap Tether and his sidekick USDC, with Ethena’s sneaky USDe tagging along like a sprightly fox in the henhouse. What a splendid milestone for crypto’s ever-expanding watery pool of liquidity, hinting at cutthroat rivalries and perhaps a touch of mischief!

USDT and USDC Rule the Roost, While USDe Sneaks In with Mischievous Yields 😏

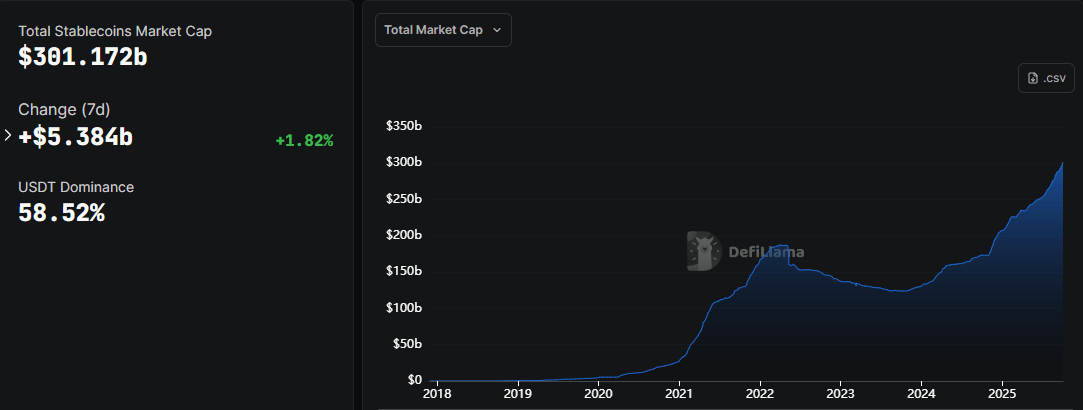

The grand total of these so-called stablecoins swishing about has finally leaped over that magical $300 billion mark, thanks to the wizards at Defillama data – a feat that screams crypto’s sneaky infiltration into the world’s big-money games, like a bunch of naughty imps gatecrashing a queen’s banquet.

Tether’s beloved USDT still lords it over the lot with a hefty 58.52% slice and $176.3 billion in its greedy paws. Circle’s USDC trails with $74 billion, looking a tad envious, while Ethena’s USDe, that crafty yield-bearing imp, has wormed its way up to $14.83 billion, claiming the bronze medal in this wild stablecoin rodeo.

Now, while that shiny number struts about like a proud peacock, the true tale lies in the market’s naughty underbelly. For ages, it was a dreary duopoly – Tether and Circle hogging all the fun – but now, these yield-yielding tricksters like USDe are stirring the pot, offering not just dull stability but dollops of income, like hidden treasures in a pirate’s chest. Sarcasm alert: Because who wouldn’t swap boredom for a bit of sneaky profit? 🙄

This evolution’s picking up speed, drawing in those stuffy institutions like bees to honey. Citigroup, with its crystal ball, predicts the stablecoin pie could puff up to $1.9 trillion by 2030, or even $4 trillion if the winds blow favorably – painting stablecoins as the cheeky sidekicks to tokenized deposits, revolutionizing payments and markets, oh what a tangled web! 💸

And let’s not forget, this $300 billion extravaganza highlights how stablecoins are the sneaky backbone of crypto’s liquidity – powering DeFi spells, zippy cross-border antics, trading face-offs, and bridging old money with newfangled tokens. It’s like the glue holding this wild party together.

Yet, despite the newcomers’ antics, Tether and Circle still clutch over 80% of the booty, thanks to their regulatory chummy ways and vast networks. But as yields and rule-following twirl together, the battle for supremacy promises to be a hilarious scrum – full of laugh-out-loud drama and maybe a few exploded egos! 🤣

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- YouTuber streams himself 24/7 in total isolation for an entire year

- What time is It: Welcome to Derry Episode 8 out?

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- The dark side of the AI boom: a growing number of rural residents in the US oppose the construction of data centers

- EA announces paid 2026 expansion for F1 25 ahead of full game overhaul in 2027

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

2025-10-03 19:23