Grayscale Investments is pulling a “Get Smart” move, quietly stockpiling altcoins like Chainlink (LINK), Zcash (ZEC), Stellar Lumens (XLM), and Filecoin (FIL). Is this a masterstroke or just a bureaucratic ballet? 🎩💼

The world’s largest digital asset manager is now playing “altcoin whisperer,” betting big on tokens beyond Bitcoin and Ethereum. Who needs sleep when you can chase yield? 😴🚀

Is Grayscale’s Altcoin Strategy a Signal or Just a Red Herring? 🐟

Charts show accumulation like a canary in a coal mine-if the canary starts breakdancing, you better buy. Could these tokens be the next “I told you so” moments? 📈

LINK: ETF Dreams and On-Chain Shenanigans 🤖

Grayscale filed for a spot LINK ETF in September, trying to turn its Chainlink Trust into an NYSE Arca product. Because nothing says “trust” like adding “ETF” to your brand. 🔄

🚨 JUST IN: Grayscale filed an S-1 with the U.S. SEC to launch a spot $LINK ETF

This would upgrade the existing Grayscale Chainlink Trust $GLNK ($28M AUM) into an ETF

Second filing in weeks, following Bitwise’s August S-1

– Zach Rynes | CLG (@ChainLinkGod) September 8, 2025

The filing also hinted at staking, with Coinbase Custody as the custodian. Because nothing says “safe” like trusting your keys to a company named after a rainbow. 🌈🔐

Chainlink’s resilience during the US government shutdown? A picnic in the park compared to this. 🏛️💥

Analysts at More Crypto Online claim LINK has the “cleanest macro setups”-because nothing’s cleaner than a crypto chart that ignores reality. 🧼📉

$LINK has one of the cleanest macro setups out there. Watching yellow wave (b) into ~$47 as first key level. Break above that region could open the door to new cycle highs north of $100. The Chainlink chart has been more reliable than most altcoin charts.

– More Crypto Online (@Morecryptoonl) October 1, 2025

LINK’s accumulation chart? A steady diet of buying pressure through 2024. Because who doesn’t love FOMO? 😱

Institutional products and market action aligning? Investors are probably already sipping champagne on a yacht. 🏖️🍾

ZEC: Privacy Coins Make a Comeback (Or a Privacy Problem?) 🔐

Zcash (ZEC), Bitcoin’s “cousin” with a privacy obsession, is back in vogue. Grayscale is touting its zk-SNARKs tech as a shield against financial surveillance. Because nothing says “trust” like hiding your transactions. 🕵️♂️

.@Zcash is similar to Bitcoin in its design. Zcash $ZEC was created from the original Bitcoin code base, but it uses a privacy technology that encrypts transaction information and allows users to shield their assets.

Grayscale Zcash Trust is open for private placement for…

– Grayscale (@Grayscale) October 1, 2025

ZEC spiked 110% after Grayscale’s post. Because institutional tweets = instant moonrocket. 🚀

“Grayscale added ZEC – instant pump 110%+. Now Privacy coins (Zero Knowledge) are heating up & moving in trend,” wrote GA Crypto. Because nothing trends like a privacy coin with a 100x potential. 🔥

Grayscale’s ZEC holdings jumped from 320k to 380k between January and August 2025. Meanwhile, ZEC’s price went from $20 to $120. Volatility? What volatility? 🤡

Thor Torrens, ex-POTUS advisor, revived Grayscale’s 2018 thesis: “If 10% of offshore wealth ($32T) goes into ZEC, it could hit $62,893 per coin.” Because why buy a house when you can buy one ZEC? 🏠➡️💰

Friendly reminder that the greyscale thesis is still in play

If just 10% of offshore wealth goes into Zcash one $ZEC can be worth $62,893 a coin 👀

– Thor Torrens (@ThorTorrens) October 1, 2025

Analysts at Alphractal are “excited” about ZEC’s on-chain metrics. Because nothing’s more thrilling than a rising MVRV Z-Score. 📊

After Grayscale’s post about ZCash, the price skyrocketed.

Taking advantage of this $ZEC rally, we explored a few metrics to support analysts:

1. ZEC broke key on-chain levels, like the Realized Price, which is a bullish signal.

2. The number of addresses holding…

– Alphractal (@Alphractal) October 1, 2025

Eric Van Tassel claims ZEC is in a “nine-year wedge pattern”-because nothing says “buy” like a multi-decade chart. 📆

XLM: From Trust to ETF (With a Side of Marketing Magic) 🪄

Stellar Lumens (XLM) is getting a rebrand to ETF. Grayscale and 21Shares are making it “accessible” to everyone. Because who doesn’t want to trade a token named after a star? 🌟

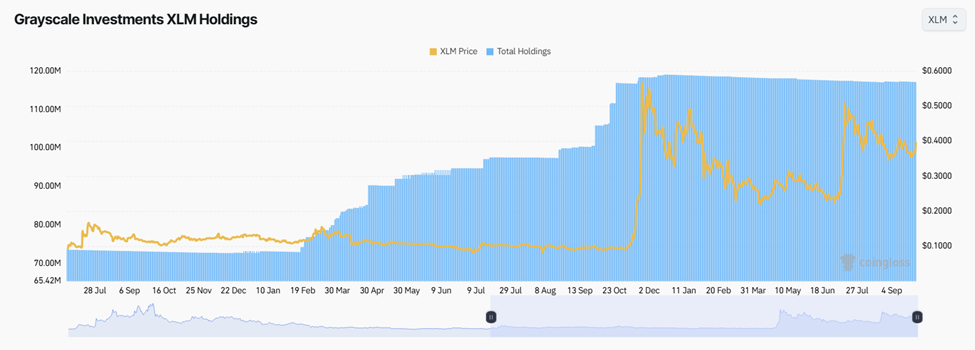

Grayscale’s XLM holdings jumped from 100M to 120M between July and October 2025. Volatility? What’s that? 🤷♂️

In January, Grayscale rebranded its Stellar Lumens Trust (GXLM) into an ETF. Because nothing says “legitimacy” like adding “ETF” to your product. 🔄

The Grayscale Stellar Lumens Trust allows investors to gain exposure to $XLM, Stellar’s native token. Stellar is an open-source, decentralized platform for exchanging money using blockchain technology.

Learn more & see important disclosures:

– Grayscale (@Grayscale) January 8, 2025

This ETF offers “volume-weighted pricing” and “redemption mechanisms”. Because liquidity gaps are for quitters. 💧

This follows the Hashdex Nasdaq crypto index ETF approval. Because why stick to Bitcoin and Ethereum when you can have XRP, SOL, and ADA too? 🎉

The SEC just approved the Hashdex Nasdaq #Crypto Index US ETF, which can now include not only $BTC and $ETH but also $XRP, $SOL,$ LINK, $XLM… and of course $ADA.

Alongside Grayscale’s Digital Large Cap Fund (already holding ADA), this shows how fast Cardano is entering the same…

– Lucas Macchiavelli (@LucasMacchia2) September 26, 2025

FIL: Accumulation or Just Waiting for the AI Train? 🤖

Filecoin (FIL) is the black sheep of the family. Grayscale’s Filecoin Trust lets you “invest” without holding FIL. Because nothing says “decentralized” like trusting a third party. 🙃

Grayscale’s Decentralized AI Fund holds FIL alongside TAO, NEAR, RENDER, and GRT. Because AI needs storage, and who better than a token named after a file? 🗂️

Holdings data show accumulation, but the price? Still taking a nap. 🛌

With AI and decentralized storage booming, FIL might finally get its moment. Or it might remain the “I forgot about” coin. 😅

Grayscale’s strategy? A masterclass in “buy before the hype”. Will these tokens moon or crash? Only time will tell-but don’t forget your parachute. 🪂

Investors: Monitor these products, but remember: Do your own research. Because even Mel Brooks can’t predict crypto. 🎬💸

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- YouTuber streams himself 24/7 in total isolation for an entire year

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- Gold Rate Forecast

- After Receiving Prison Sentence In His Home Country, Director Jafar Panahi Plans To Return To Iran After Awards Season

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Now you can get Bobcat blueprint in ARC Raiders easily. Here’s what you have to do

- Elizabeth Olsen’s Love & Death: A True-Crime Hit On Netflix

2025-10-02 11:45