October has hurled itself into the markets with a feverish blaze; the crowd exults, and I cannot tell whether it is a chorus or a cry for help. Is this October, this Uptober, merely a bright mask on a deeper crisis? 😂🤔

This is how the city of coins tightens its grip on the heart: whispers of a “4-year cycle” theory, the belief that the bull and bear undulate in a predictable rhythm born of the halving-the kind of rhythm that pretends to be science while remaining almost gigantically superstitious.

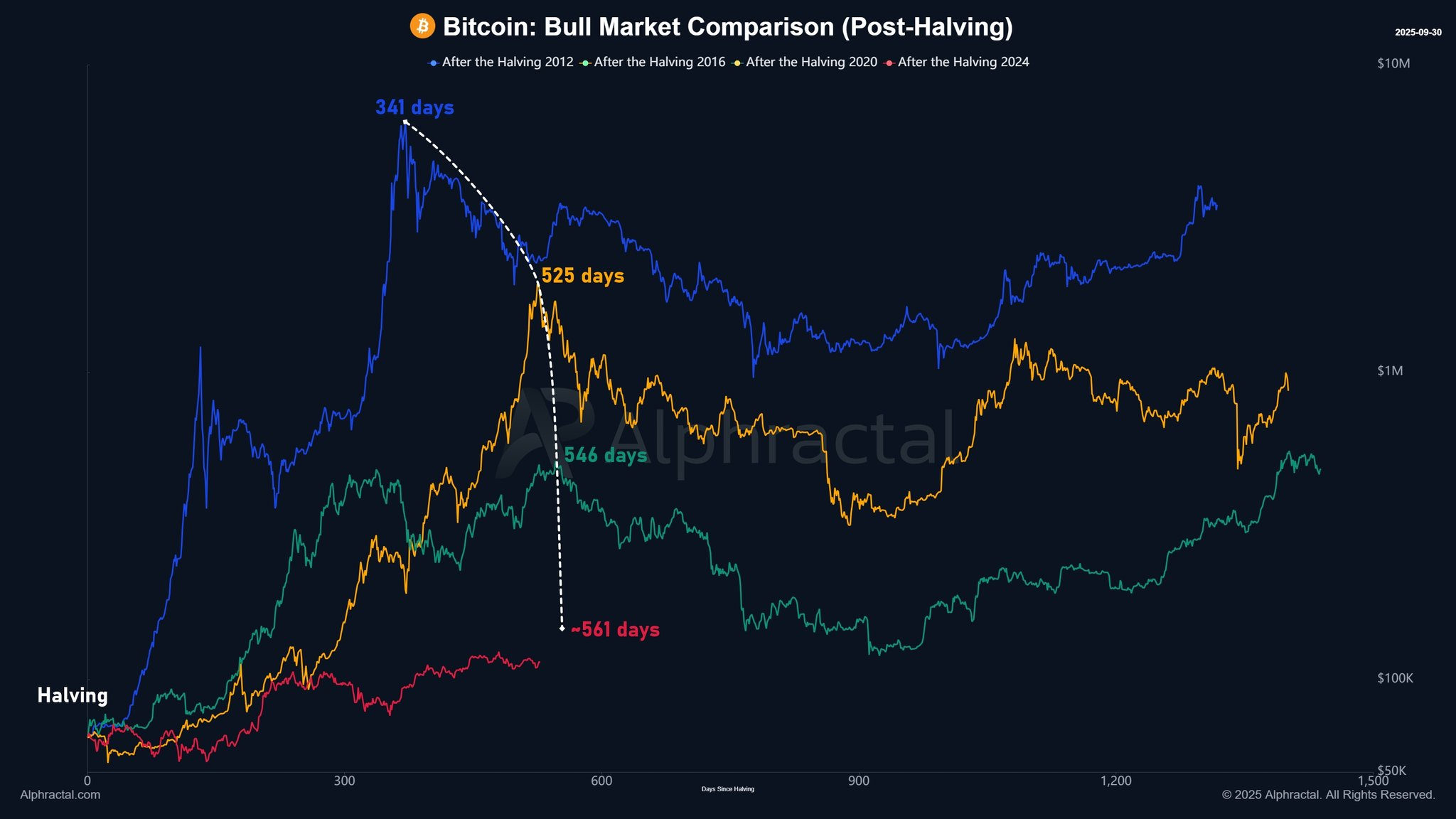

A Look at Historical Patterns

Joao Wedson, CEO of investment analysis firm Alphractal, fixes his gaze on a number that haunts the ledger: 548 days. A tally that seems to promise reason, yet trembles with the chance of a fallible omen.

An analysis of Bitcoin’s past cycles shows subtle differences in the number of days between each halving and its subsequent all-time high (ATH). The cycle in 2012 took 371 days, followed by 525 days in 2016, and 546 days in 2020. The data, like a set of untrustworthy witnesses, hints at a pattern while refusing to swear to it.

This subtly lengthening trend suggests that the current cycle is in its final stages. Wedson said this aligns strongly with other fractal and market cycle indicators like fractal cycles and the Max Intersect SMA. A man might say, with a tired smile, that prediction is still a shadow game. 😅

He believes the magic number for this cycle is 548, as it is the likely day for the price to hit its peak. Bitcoin is currently 528 days into the rally since its last halving on April 19, 2024. The math is relentless, and so is the doubt.

If Bitcoin hits its peak on day 548, that would be exactly October 19, 2025. Extending his hypothesis to its maximum range, the price peak could occur as late as November 1, 2025. Wedson said, “Considering that the 4-year cycles remain consistent, we’re at most 30 days (or less) away from the price peak of this cycle.” The promise and peril walk hand in hand here, like two men in a dim corridor.

Another Forecast: The Peak Hits December 23, 2025

Another crypto analyst, ‘seliseli46’, has also calculated the end of the current bull run. A closer look at Bitcoin’s past cycles shows that each has lasted for about 152 weeks. He explained on his X account that this is roughly 1,064 days. The mind loves a neat arithmetic tragedy.

- The first cycle began after a market bottom in early 2015 and ended with a peak in late 2017. The years creaked like old doors, and yet the fever remained.

- The second cycle started in late 2018 and peaked in November 2021. The calendar becomes a theater of faded banners and new coins that pretend they matter.

Assuming the third cycle began at the market bottom in November 2022, adding 152 weeks would place its end around December 23, 2025. The analyst explained that this calculation aligns well with Bitcoin’s historical tendency to hit an all-time high about 12 to 18 months after a halving. However, he noted that this 152-week cycle is more of a hypothesis and is subject to external factors like regulation, market sentiment, and technological advancements. The universe, after all, loves to laugh at our certainties. 😏

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Ragnarok X Next Generation Class Tier List (January 2026)

- Answer to “A Swiss tradition that bubbles and melts” in Cookie Jam. Let’s solve this riddle!

- Gold Rate Forecast

- ‘That’s A Very Bad Idea.’ One Way Chris Rock Helped SNL’s Marcello Hernández Before He Filmed His Netflix Special

- 2026 Upcoming Games Release Schedule

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- All Songs in Helluva Boss Season 2 Soundtrack Listed

- Ex-Rate My Takeaway star returns with new YouTube channel after “heartbreaking” split

2025-10-01 16:29