The U.S. Securities and Exchange Commission (SEC), that paragon of regulatory elegance, is poised to make its maiden voyage into the uncharted waters of altcoin exchange-traded funds this October. One might wonder if the agency has finally mastered the art of reading a balance sheet-or if it’s merely indulging in a game of regulatory roulette with six XRP products. 🎲

These rulings will test whether the SEC is willing to extend its patronage beyond Bitcoin and Ethereum, both of which have been granted the sacred privilege of ETF status. Traders, ever the optimists, are betting that “theory will finally meet practice” this October, though one suspects the SEC’s definition of “practice” may involve a lengthy coffee break. ☕

Six XRP Deadlines in One Week: A Test of Patience and Regulatory Fortitude 🕰️

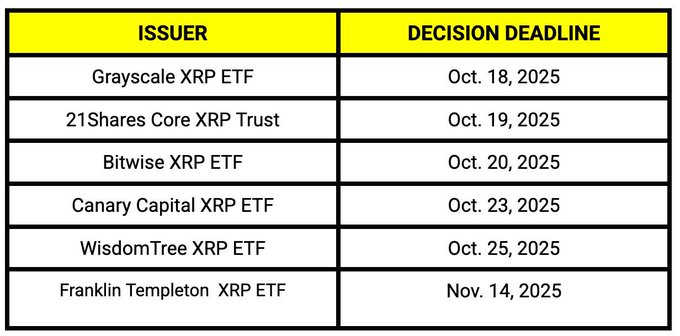

The SEC, ever the maestro of bureaucratic tempo, has set a tight schedule for these reviews, with all six decisions arriving like a surprise party in one week. Grayscale’s application leads the lineup, due on October 18, followed by 21Shares the next day. One can only imagine the suspense as regulators sip their tea and ponder the fate of XRP. 🍵

Bitwise faces its deadline on October 22, Canary Capital and CoinShares on October 23, and WisdomTree on October 24. Each decision will reveal whether the SEC views XRP as a promising protégé or a chaotic upstart. The market, meanwhile, holds its breath-like a guest at a dinner party where the host has forgotten the menu. 🍽️

This deadline is being handled under the SEC’s new generic listing rules, a veritable symphony of bureaucratic efficiency that replaced the old case-by-case process. The new rules, which allowed Bitcoin ETFs to breeze through approvals last year, may now serve as a litmus test for altcoins. One wonders if XRP will be the star of the show or the punchline. 😂

The significance of these decisions is amplified by the fact that no other altcoin ETF has yet crossed the finish line, leaving October as the true testing ground for crypto adoption in regulated markets. A noble endeavor, if one ignores the faint smell of regulatory ambivalence. 🧪

More Crypto ETFs Waiting Their Turn: A Queue as Long as a London Rainstorm 🌧️

Aside from XRP, the ETF queue stretches deep into 2025, with Solana, Litecoin, and Dogecoin all vying for attention. Grayscale, VanEck, and 21Shares have applications in motion, their deadlines as varied as the opinions of a London cab driver. Meanwhile, Litecoin and Dogecoin await their turn, their fates hanging by a thread of regulatory whimsy. 🐕💰

Bitwise, ever the overachiever, has extended deadlines for its Bitcoin, Ethereum, and Solana filings into late 2025. Altogether, the schedule shows that issuers are racing to expand ETF offerings across multiple cryptocurrencies, but the SEC’s XRP rulings in October will provide the earliest and clearest signals of what lies ahead for altcoin ETFs. A spectacle, if nothing else. 🎭

Read More

- Tom Cruise? Harrison Ford? People Are Arguing About Which Actor Had The Best 7-Year Run, And I Can’t Decide Who’s Right

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- Burger King launches new fan made Ultimate Steakhouse Whopper

- ‘Zootopia 2’ Is Tracking to Become the Biggest Hollywood Animated Movie of All Time

- Balatro and Silksong “Don’t Make Sense Financially” And Are “Deeply Loved,” Says Analyst

- Is Michael Rapaport Ruining The Traitors?

- Fate of ‘The Pitt’ Revealed Quickly Following Season 2 Premiere

- Gold Rate Forecast

- Mario Tennis Fever Release Date, Gameplay, Story

- Kill Bill: The Whole Bloody Affair Is a Modern-Day Odyssey

2025-09-29 19:43