In the world of digital currency (or should we say, arcane financial necromancy), Ethereum has decided to climb out of its latest pit of despair, resting complacently above the magical number four thousand. After a spellbinding week caressed by the jagged claws of sharp declines and strong buys, it seems the Ethereum Price Oracle has been enlisted to declare, rather mysteriously, “All is well!”

The ETF Menagerie: Ethereum’s Holy Grail?

As if by magic, major financial sorcerers, a.k.a. institutions, have unveiled their best spectator silks-ETF offerings, to be precise-soaking up optimism faster than a wayward vampire sponge at an all-you-can-drink hemoglobin party. Vanguard, the giant with assets of $10 trillion, heralded its digital age with the announcement of launching crypto ETFs. This could make BlackRock seem like the last unicorn paddling in the Tranquil Pool of Ethereum Old.

With a market cap nibbling on the sorry crumbs left by Bitcoin, Ether’s ETF windfall has gushed into growling percentages, further tickling the bulls and sending price targets toward the distant kingdom of previous highs. The grand elder wizard at the SEC ponders over new filings like an incipient prophecy. Soused in these whispers, Ethereum might just perform the High Stakes Dance of Bullish Momentum once more.

Whale Beneath the Waves: The Dark Divers of Ethereum

We must acknowledge the double-edged sword turned by our tamable yet terrifyingly massive whales. Just when the price dipped to the more-than-respectable $3,900, major wallets, not unlike children in a sweet shop, pillaged clips worth over $2 billion of ETH. FalconX, noted for its speed and appetite for digital fish, bought a hefty $503M singularly, while another whale lazily staked $661M.

Yet such frenzy evokes chaos, with influential holders such as Jeffrey Wilcke wandering the market alleyways, rife with iPhone-level transfer screen fatigue. They stirred the pot with millions of ETH redirects, muttering darkly about potential short-term corrections. With 30% of ETH now loyal to the stake, this seesaw of accumulation against seduction to sell defines Ethereum’s balancing act.

Ethereum’s Crystal Ball: Price Projections Read

The crystal ball glistens through the grime of the recent digital turmoil. We see the rebound from a mystical $3,829, echoing what alchemists call the 78.6% Fib retracement, eventually surfacing blithely above $4,020’s rebellious challenges. RSI emerges from its cubbyhole of being oversold, and MACD’s spirit rejuvenates-oh joyous jubilation!

Although wandering below critical moving averages, the broadening Bollinger Bands alongside that oversold RSI suggest the time has come for liquidation ghosts to perform a most reserved getaway. Should the price uphold its presence above $4,000 and breach the unyielding bastion of $4,160, bullish knights might conquer the $4,500 hubbub.

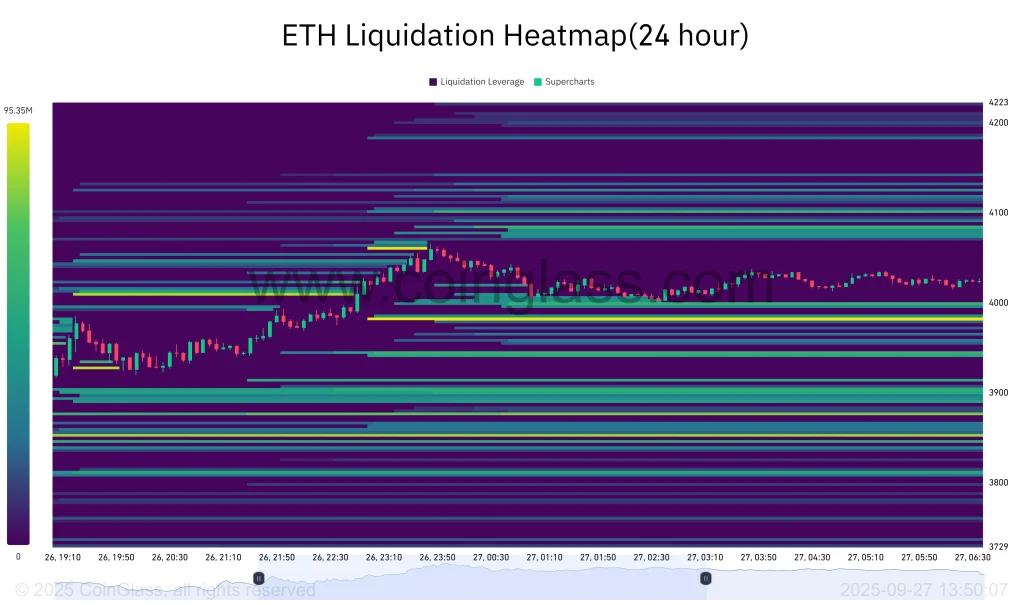

The Hotspots of Ethereum Liquidations

Behold the liquidation heatmap-scribbled with legendary clusters of leverage liquidations near those enigmatic realms of $4,000 and $3,900. These spiked markets concur with horizontal price onslaught, which swiftly transforms a stagnant situation involving oversold pasts into resurrected vigour.

The Discordomy: Social Sentiments and Whispers on the Wire

As social sentiment reaches meteorological heights of over 79% optimism, whispers of institutional love, tech upgrades, and how magnificent the Ethereum ecosystem is flutter like enchanted butterflies. Yet, a few voices caution against volatility and blockchain rivals, foreboding a date with potential peril.

The Curious Reader’s Frequently Asked Mysteries

What vanities propelled the ETH price rebound?

A triumvirate of oh-so-convincing reasons: ETF choreography, whale hordes accumulating like the most wonkish of hobbyists, and technical indicators losing their moral compass.

Is this a splendid chance to acquire ETH?

Technicals exclaim all clear, but as volatility’s dance partner, caution may be the most prudent romantic suitor.

What awaits in Ethereum’s Winding Road?

If the trend dares to kiss $4,160, then lo! Bengals should set their sights on $4,500. Warning: Peer $3,900 and prepare for a tumble toward $3,400 as one would check one’s pockets before herding blind sheep.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Mario Tennis Fever Review: Game, Set, Match

- NBA 2K26 Season 5 Adds College Themed Content

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

- Train Dreams Is an Argument Against Complicity

- A free trip to the Moon will soon be possible. This upcoming exploration simulator is all about scientific realism

2025-09-27 11:54