In the shadowed alleys of the financial world, where the air is thick with the scent of greed and the whispers of revolution, a new player has emerged, clutching its freshly minted treasure. B-HODL Plc (AQUIS:HODL), the United Kingdom’s first and, dare we say, most audacious Bitcoin Treasury company, has thrown its hat into the ring with a purchase of 100 Bitcoin (BTC). Valued at a cool £8.4 million ($11.3 million), this acquisition is less a step and more a leap into the abyss of cryptocurrency speculation. 🪙✨

With an average price of $113,227 per Bitcoin, B-HODL has not only secured its place in the annals of corporate daring but has also elbowed its way into the top 100 public Bitcoin Treasuries, landing at a modest 98th place. A small victory, perhaps, but one that comes with a trumpet blast of self-importance. 🎺

B HODL RNS Announcement: Bitcoin Purchase

B HODL (AQUIS: $HODL), the first British company to wager its future on the whims of Bitcoin, proudly declares its latest gamble. “We’ve bought Bitcoin,” they proclaim, as if the world were holding its breath. “Part of our ongoing treasury strategy,” they add, with a straight face that would make a poker player blush. 🃏

– B HODL (@bitcoinhodlco) September 24, 2025

But what sets B-HODL apart from the herd of corporate Bitcoin enthusiasts? Ah, their grand plan to operate highly-ranked Lightning Network nodes, a scheme as ambitious as it is nebulous. Scalable liquidity, routing fees-buzzwords that shimmer like fool’s gold, promising riches but delivering only uncertainty. 🌩️💸

B-HODL’s Place in the Market

In the grand theater of corporate Bitcoin adoption, B-HODL is but a bit player, sharing the stage with giants like MicroStrategy, Tesla, and Block Inc. Yet, they claim a unique model, one that marries Bitcoin accumulation with revenue generation. A noble goal, no doubt, but one that reeks of overconfidence in a market as fickle as a summer breeze. 🌬️

While 100 BTC may seem a drop in the ocean of cryptocurrency, B-HODL’s move is part of a larger trend-corporate adoption, the slow march of institutions into the Bitcoin fray. A potential driver of long-term demand, they say, or perhaps just another bubble waiting to burst. 🧼💥

B-HODL Data

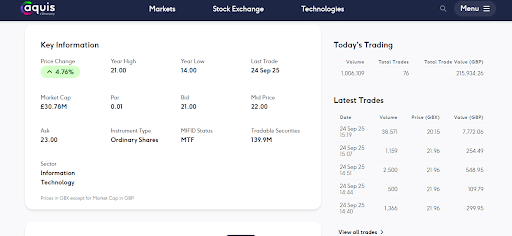

As the ink dries on their Bitcoin purchase, B-HODL’s stock (HODL) trades on the Aquis Stock Exchange at a modest 22.00. A 4.76% increase today, September 24, 2025, brings a glimmer of hope to investors, though the year’s low of 14.00 looms like a ghost of recessions past. With a market cap of £30.78 million ($41.35 million), B-HODL is a small fish in a vast, unpredictable sea. 🐟🌊

Will B-HODL’s gamble pay off, or will they be another cautionary tale in the annals of financial hubris? Only time will tell. Until then, we watch, we wait, and we laugh-for in the world of Bitcoin, the only certainty is uncertainty. 🤡🎢

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- YouTuber streams himself 24/7 in total isolation for an entire year

- Ragnarok X Next Generation Class Tier List (January 2026)

- Answer to “A Swiss tradition that bubbles and melts” in Cookie Jam. Let’s solve this riddle!

- Gold Rate Forecast

- 2026 Upcoming Games Release Schedule

- Silent Hill f: Who is Mayumi Suzutani?

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Silver Rate Forecast

2025-09-24 18:40