In a land far, far away (but actually on Binance), the altcoins have taken a dramatic turn for the worse. A shocking 83% of these digital creatures are now slinking below their 50-week moving average, which is like a dragon’s hoard of technical analysis. Darkfost, a wise old owl in the crypto woods, claims this isn’t just a price problem-it’s a liquidity crisis, and the bears are having a grand old time.

Darkfost, a cryptic sage on X, shared a chart that looks like a sad little parade of altcoins. His headline? “LIQUIDITY CRUNCH PUSHES 83% OF ALTCOINS INTO BEAR TREND,” which is basically a warning label for investors who forgot to pack their risk-free snacks. He warns that those holding non-Bitcoin, non-stablecoin assets are now in a pickle so deep, even a llama would struggle to climb out.

The Altcoin Breadth Breaks Down On Binance

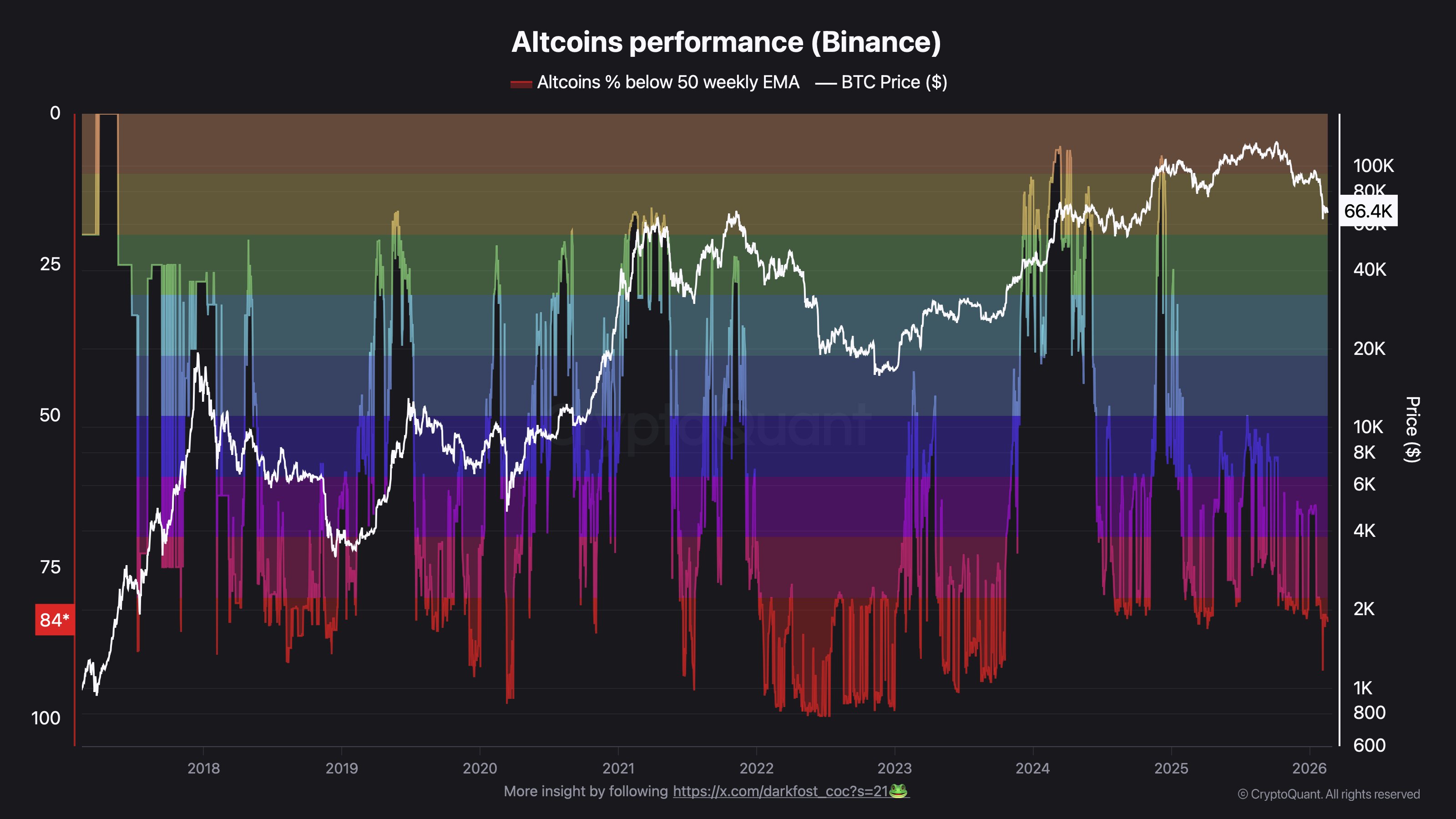

Darkfost’s chart, titled “Altcoins performance (Binance),” shows the percentage of altcoins below the 50-week line rising like a mischievous gremlin. In his latest tale, 83% of Binance’s altcoins are below this threshold, a sign that the weakness isn’t just a few bad apples-it’s a whole orchard of despair.

He also points to a more extreme episode earlier this month, when over 92% of altcoins on Binance were below the line. Darkfost calls this a “post-2023-cycle high in downside participation,” which sounds like a fancy way of saying the market’s been playing hide-and-seek with its sanity.

Back in March 2024, only 6% of altcoins were below the line, and in December 2024, it was 7%. Darkfost adds that outside those rare windows, at least half of altcoins remained under the threshold-behavior he calls “meaningfully different” from the prior cycle. Oh, how the crypto world changes, like a chameleon in a sock drawer.

Darkfost ties the altcoin slump to Bitcoin’s trend and the macro backdrop, suggesting the market’s risk budget has shrunk while altcoin supply has grown. It’s like trying to fit a hippo into a teacup-no wonder things are getting squashed.

“The market continues to be driven by BTC’s movements, which has been in a downtrend since October 2025 following an ATH at $126,000,” he writes. “At present, BTC’s momentum remains highly uncertain, with price still hovering at roughly 46% of its all-time high.” Oh, how the mighty fall-like a poorly aimed arrow hitting a target of despair.

The chart itself marks BTC near the mid-$60,000 range, underscoring his broader point: in a regime where Bitcoin’s direction is unclear and macro inputs are hostile to volatility, altcoins can deteriorate quickly and then stay impaired. It’s like a game of musical chairs where the music never stops.

The Mysterious Case of the 50-Week Line

Darkfost emphasizes the 50-week moving average as a long-horizon filter used by market participants to separate corrective phases from structurally constructive ones. When a majority of tokens sit below it, rallies tend to be narrower, selection pressure rises, and “alt season” narratives become harder to sustain without a decisive shift in liquidity conditions. It’s like trying to find a needle in a haystack made of glitter and disappointment.

He attributes the current setup to “the increase in altcoin supply across the broader crypto market combined with still constrained liquidity conditions,” a combination that can mechanically dilute marginal flows. In that environment, he argues, outperforming becomes less about broad beta exposure and more about understanding how market structure has changed. It’s like solving a puzzle with missing pieces and a sneaky cat stealing the clues.

At press time, the total crypto market cap excluding Bitcoin stood at $943.46 billion. A number so large, it’s practically a fairy tale.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Critics Say Five Nights at Freddy’s 2 Is a Clunker

- Super Animal Royale: All Mole Transportation Network Locations Guide

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Gold Rate Forecast

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2026-02-20 15:14