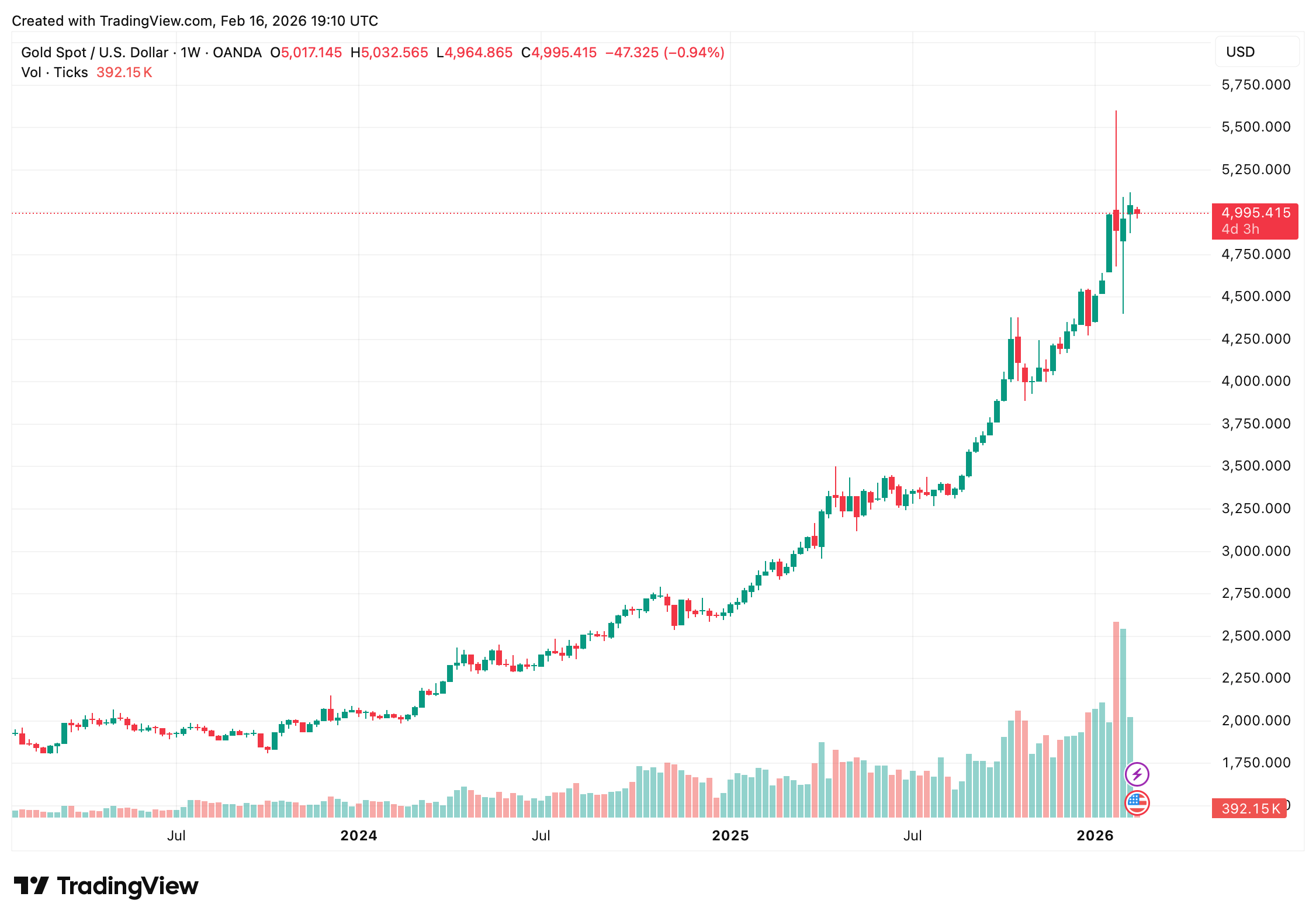

Ah, the illustrious gold! It appears we might be trading it at roughly the same price as your Uncle Reginald’s collection of vintage stamps through the first quarter. According to the brainy folks at Sucden Financial, prices took a little nosedive on February 16-no doubt due to the thin holiday liquidity and those pesky profit-takers swooping down for their portion.

Gold Prices Chill Out but Analysts Keep Their $5,000 Dream Alive

In their Q1 2026 Quarterly Metals Report, Sucden’s Head of Research, Daria Efanova, and her trusty sidekick, Senior Research Analyst Viktoria Kuszak, opine that our dear bullion has shifted gears from a rally supported by fundamentals to a rather cheeky momentum-driven phase. Fancy that!

“We expect gold to consolidate through the remainder of Q1 2026, with price action remaining volatile and two-sided following the late-January correction,” the analysts scribbled in their latest quarterly analysis, likely while sipping on tea and nibbling on scones.

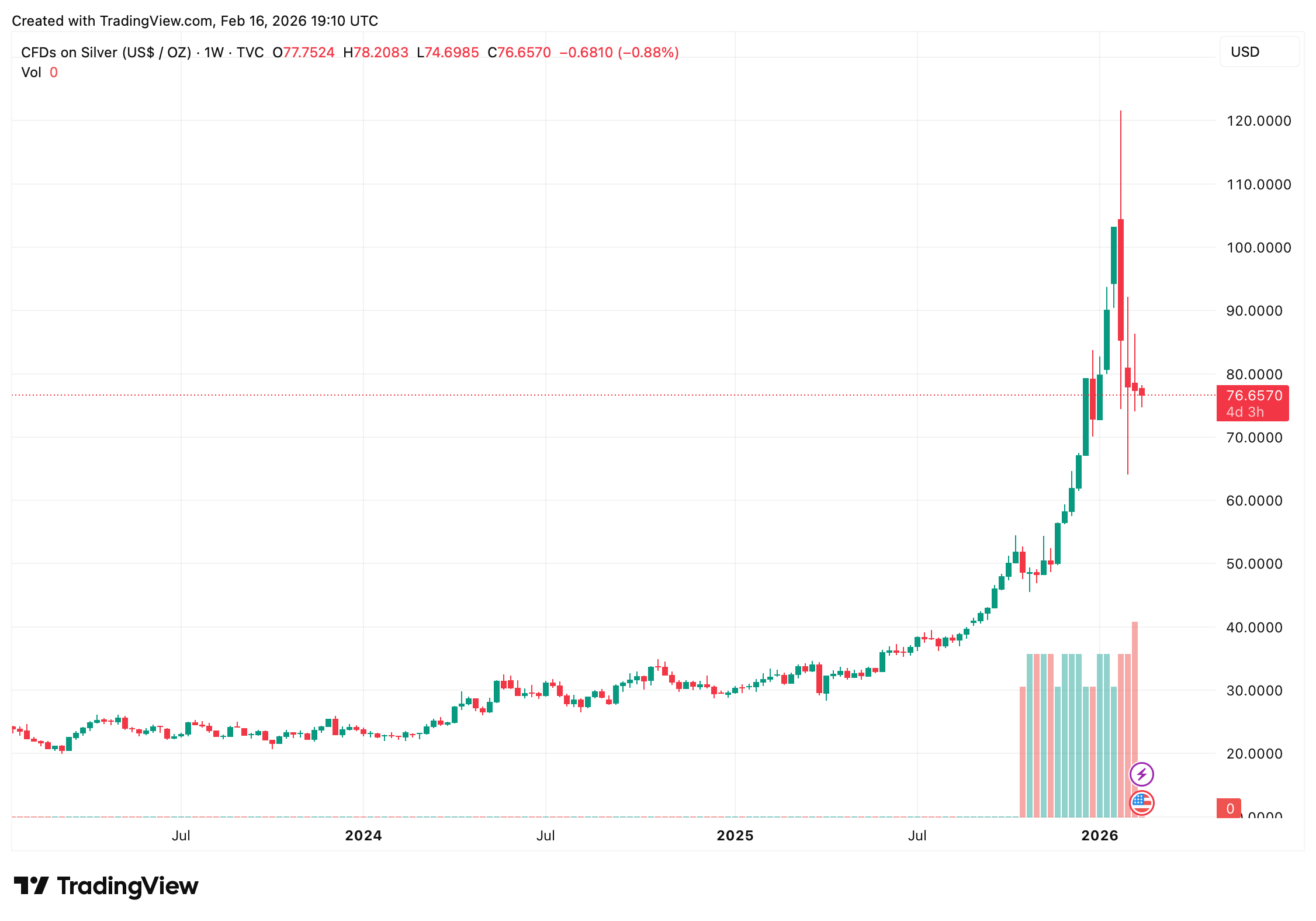

As of 2 p.m. EST on February 16, spot gold was trading at around $4,993 per ounce-down about 1% on the day, whilst silver had a similar fate, plummeting 1.6% to about $76.73 per ounce. This little dip followed a prior session’s rally, attributed to the usual suspects: profit-taking, a firmer U.S. dollar, and low trading volumes because, let’s face it, who can be bothered with trading during holidays?

Despite today’s little tantrum, gold is still strutting its stuff with over a 6% gain this month and more than a staggering 72% year-over-year rise, though it has yet to reclaim its January glory days when it peaked above $5,600. As for silver, which seems to be on an even wilder ride with a nearly 137% year-over-year gain, it continues to flaunt its dual identity as both an investment darling and an industrial workhorse.

Sucden posits that gold’s recent shenanigans reflect a broader narrative of macro and policy uncertainty. “ Gold has become a broader expression of macro and policy distrust,” they noted, perhaps while shaking their heads at the unpredictable nature of the market.

The analysts further added that strong investment demand is providing a cozy cushion against any downward spiral, even as the volatility has been feeling a bit like a merry-go-round. In 2025, total gold demand exceeded 5,000 tonnes for the first time on record, thanks to the central banks’ insatiable appetite and strong ETF inflows.

Market participants are now hanging onto every word from the upcoming Federal Reserve, eagerly awaiting FOMC minutes, GDP updates, and PCE inflation data for hints on potential rate cuts. The chatter suggests multiple 25-basis-point reductions may be in the cards this year, yet uncertainty looms like a foggy morning in London.

Sucden mentioned that the late-January sell-off, which briefly sent gold diving toward $4,500, helpfully reset positioning after it had galloped above $5,400. They anticipate further two-sided trading through the remainder of the quarter, with pullbacks serving more as a recalibration of speculative exposure rather than signaling any sort of dramatic reversal.

With recession risks tied to labor-market softness and geopolitical tensions lurking around, Sucden’s optimistic assessment tends toward consolidation rather than a full-blown collapse. For now, gold seems to be managing to maintain its dual roles as both a momentum trade and a traditional safe-haven asset, keeping prices hovering near the illustrious $5,000 mark.

FAQ ❓

- Why did gold fall on Feb. 16, 2026?

Gold slipped about 1% to $4,993 amid profit-taking, a firmer dollar, and low holiday liquidity. - What is Sucden Financial’s Q1 forecast for gold?

Sucden expects gold to consolidate around $5,000 per ounce through Q1 2026. Remarkable, isn’t it? - Is gold still in a bullish trend?

The report suggests consolidation within a supportive macro backdrop instead of any sustained reversal, much to the delight of optimistic investors. - How is silver performing compared to gold?

Silver fell 1.6% on February 16 and continues to be more volatile due to its industrial exposure, behaving like the rebellious cousin in the family.

Read More

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Itzaland Animal Locations in Infinity Nikki

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- LINK PREDICTION. LINK cryptocurrency

- Gold Rate Forecast

- When is Pluribus Episode 5 out this week? Release date change explained

- Super Animal Royale: All Mole Transportation Network Locations Guide

- ARC Raiders: Using the Dam Staff Room Key – Full Guide

- How To Defeat Wolf Maiden In Where Winds Meet

- Deadwood’s Forgotten Episode Is Finally Being Recognized as the Greatest Hour of Western TV

2026-02-17 02:28