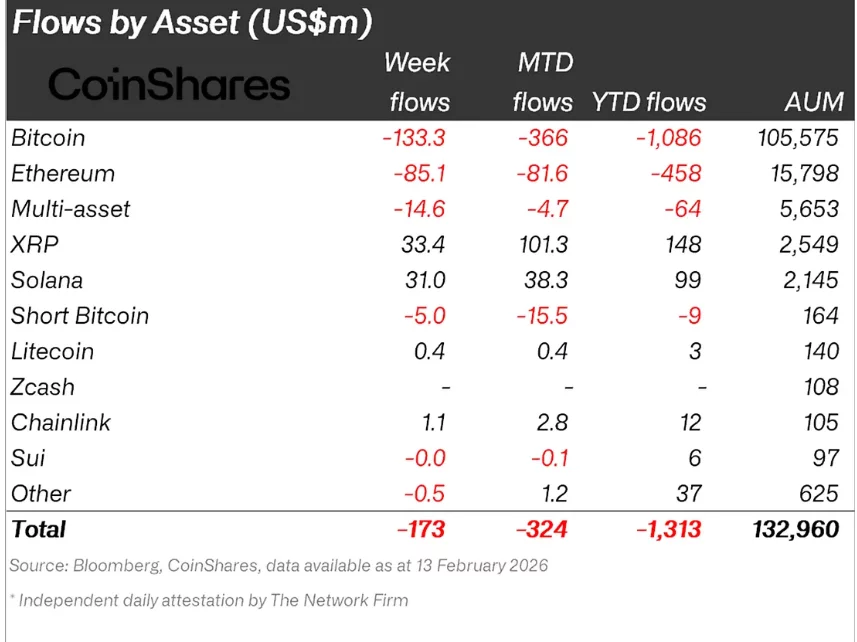

Hold onto your digital wallets, folks! Crypto funds have officially bled out for the fourth week in a row, with a staggering $173 million pulled from the coffers, according to CoinShares’ latest weekly fund flows report. That’s right, grab your popcorn because this show is just getting wild!

//media.crypto.news/2026/02/image-45.webp”/>

Bitcoin and Ethereum Under Pressure, Altcoins Show Resilience

Bitcoin (BTC) took the brunt of this sell-off, shedding $133 million last week. Ethereum (ETH) didn’t fare much better, following closely behind with $85.1 million in withdrawals. Ouch! That’s gotta hurt!

Interestingly, short Bitcoin products also saw outflows totaling $15.4 million over the past two weeks-a trend CoinShares notes often occurs near potential market bottoms. So, if you see a bottom, it might be a good time to start shopping!

On the bright side, select altcoins are still attracting capital like moths to a flame. The Ripple token (XRP) led the charge with $33.4 million in inflows, followed closely by Solana (SOL) and Chainlink (LINK). This selective resilience suggests investors are just rotating their exposure rather than throwing in the towel entirely. Phew!

Despite the recent hiccup, total assets under management remain substantial, proving that institutional engagement in digital assets continues even amid this short-term chaos. So, let’s raise a glass (of cryptocurrency, obviously) to endurance in the face of market madness!

Read More

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Itzaland Animal Locations in Infinity Nikki

- LINK PREDICTION. LINK cryptocurrency

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Ragnarok X Next Generation Class Tier List (January 2026)

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Gold Rate Forecast

- Everything We Know About the Horrific Creatures in ‘A Quiet Place’

- 🤑 Altcoin Bottom or Bear Trap? Vanguard & Ethereum Whisper Secrets! 🕵️♂️

2026-02-16 14:07