Mr. Michael Saylor, the blithe‑lipped founder of Strategy, has taken to the ether with the usual panache that one would expect from an entrepreneur who spends his nights having tea with a kettle the size of a small birdcage. He has been asked whether the company might find itself obliged to unfurl the red carpet for a forced sell‑off as Bitcoin’s price drifts downward like a poorly made soufflé. Saylor, feathered with his customary confidence, assures us that Strategy can comfortably waltz through even an 88% slam‑down to the modest $8,000 mark without missing a beat of its debt‑paying jig.

He goes on to describe the Strategy Convertible Debt Bitcoin Plan, a scheme so meticulously crafted that it might have been developed by a troupe of designers tasked with turning a great idea into a reality-so much so that the plan seems to have been handmade by Father Christmas himself, all in the name of reducing long‑term risk.

So, how can Strategy survive if Bitcoin leans over into the abyss? A wry grin will do you no harm.

Michael Saylor’s Bitcoin Strategy Shows No Forced Liquidation Risk

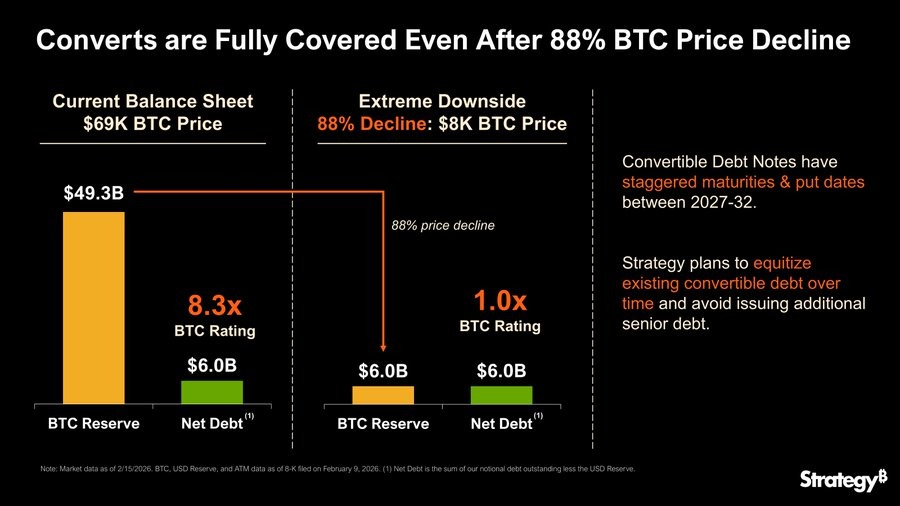

In a recent tweet that would make any Efficient Market murmurer blush, Saylor declared that the firm’s balance sheet can stand the most extreme market daze. Presently, Strategy is proudly clutching approximately 714,644 BTC, whose market valuation hovers at a cozy $48.86 billion-figures that would make even the most sceptical investors sigh in admiration.

While Bitcoin is lounging at roughly $68,000-somewhat shy compared to Strategy’s average purchase price of about $76,000-Saylor contends that short‑term price dips are not the performance‑degratives that would spell calamity.

Unlike the wretched margin loans that can prompt hasty, ill‑timed sales, Strategy’s debt is fashioned as low‑interest convertible notes maturing in 2032. Ergo, no squeezing of margin calls or any automated forced sales harrying the company into a hail‑storm of inconvenient liquidations tied exclusively to Bitcoin’s volatile moods.

Nevertheless, this massive reserve constitutes the very backbone of the company’s financial standing, enabling it to manage its obligations with the relaxed grace of a well‑oiled carriage.

How Strategy can Survive Bitcoin at $8,000? Strategy Convertible Debt Bitcoin Plan

In a bid to shave a few minutes off its hairline, Michael Saylor shared plans to metamorphose the company’s debt into equity. He explained that Strategy’s convertible debt Bitcoin obligations are low‑interest notes slated for maturity between 2027 and 2032, giving the company a comfortable span of flexibility to manage its payments without the added pressure of impending deadlines.

Rather than resorting to the cliche of asset sales, Strategy will, in a methodical dash, convert this debt into shares. This clever maneuver protects the company’s prized Bitcoin holdings and keeps the auctioneer’s hammer from rattling them during a market crash.

Consequently, even if Bitcoin plummets 88% to the modest $8,000, Strategy’s Bitcoin holdings would have a value of approximately $6 billion-nearly equivalent to its net debt. Such a 1.0x coverage ratio assures that the company would still possess enough assets to meet its obligations, safely tucked under its cuff.

Will Strategy Continue to Raise Funds, If BTC drop To $8K

Despite all this reassurance, Bitmern Mining founder Giannis Andreou has raised a properly articulated concern over whether Strategy can keep raising fresh capital at reasonable jackets in the beyond‑future.

He supplied the $8,000 Bitcoin scenario as a stress test designed to showcase a company’s sturdy hull. Yet, the real conundrum stretches beyond surviving a brief crash: Can Strategy keep attracting investment at a price that does not sway the capricious winds of the long bear market?

The challenge remains thorny should Bitcoin linger in a tenaciously weak period, continuing to lament its own worth.

Read More

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- LINK PREDICTION. LINK cryptocurrency

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- All Itzaland Animal Locations in Infinity Nikki

- Ragnarok X Next Generation Class Tier List (January 2026)

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Decoding Stablecoin Trust: A New Lens on Reserve Transparency

- Seeing is No Longer Believing: How AI-Powered Fakes Go Viral

- Every Video Game Movie Releasing Before Sonic The Hedgehog 4

2026-02-16 10:57