What to know:

By Francisco Rodrigues (All times ET unless indicated)

Bitcoin, that stubborn coin, tethers itself to a fourth straight weekly decline, the longest drought since the waning days of November. It has shed 1.7% in the past 24 hours and 4.8% since Monday’s pale dawn.

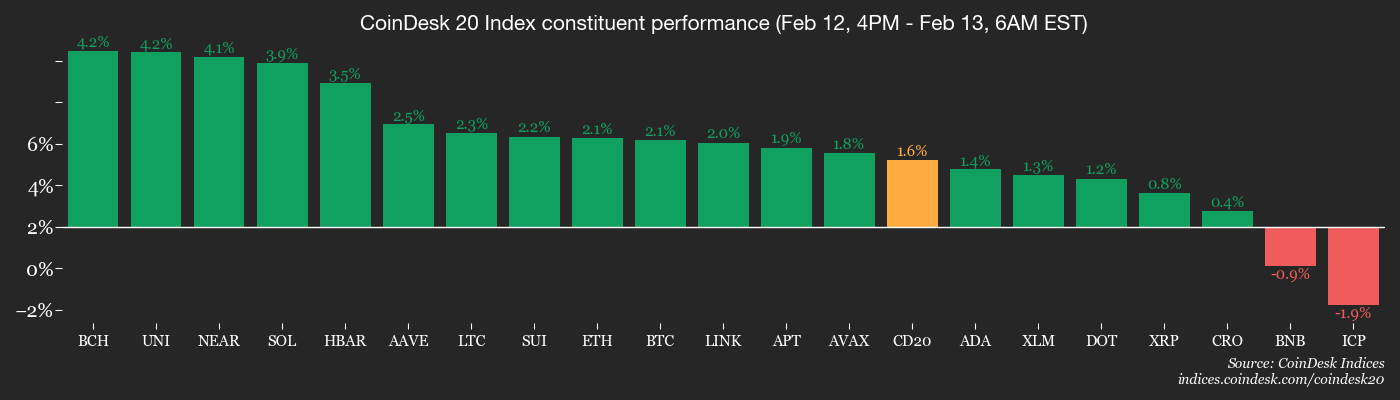

The broader CoinDesk 20 Index (CD20) slipped 2%, a market steered largely by fear. The Crypto Fear and Greed Index has worn the cloak of “extreme fear” for nearly two weeks, as if the weather itself decided to quit forecasting.

“Fear rides the helm,” murmured Danny Nelson of Bitwise, as if addressing a tired horse. “We fear the fall more than the climb; in a market like this, bright news flickers and vanishes, and if there’s an exit ramp, traders are bound to take it.”

To illustrate, Nelson pointed to Uniswap’s sudden 25% gust after the world’s largest asset manager, BlackRock, announced it would make shares of its $2.2 billion tokenized U.S. Treasury fund BUIDL tradable on the decentralized exchange. The token promptly gave back the gains, like a joke that forgot the punchline.

“Sellers bearish on the market’s short-term direction overwhelmed the bulls betting that institutional adoption will drive value long-term,” he said.

Earlier this week, stronger U.S. payroll data and a falling unemployment rate nudged traders to rethink rate-cut expectations for the year. Further guidance may come later today in the form of inflation figures for the world’s largest economy.

The U.S. Consumer Price Index (CPI) for January is forecast to show 2.5% year-over-year inflation.

Adding to the fog is concern over a partial U.S. government shutdown. Odds of that calamity tomorrow hover near 90% on Kalshi. If it materializes, the trading floor will be even thinner and more dramatic. Stay alert!

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Crypto

- Nothing scheduled.

- Macro

- Feb. 13, 8:30 a.m.: U.S. core inflation rate YoY for January (Prev. 2.6%); MoM Est. 0.3% (Prev. 0.2%)

- Feb. 13, 8:30 a.m.: U.S. inflation rate YoY for January (Prev. 2.7%); MoM Est. 0.3% (Prev. 0.3%)

- Earnings (Estimates based on FactSet data)

- Feb. 13: Trump Media & Tech Group (DJT), post-market

- Feb. 13: HIVE Digital Technologies (HIVE), post-market, -$0.07

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Nothing scheduled.

Market Movements

- BTC is up 1.75% from 4 p.m. ET Thursday at $66,933.65 (24hrs: -0.83%)

- ETH is up 2.05% at $1,961.15 (24hrs: -0.97%)

- CoinDesk 20 is up 1.48% at 1,913.46 (24hrs: -1.96%)

- Ether CESR Composite Staking Rate is down 15 bps at 2.85%

- BTC funding rate is at 0.0019% (2.0947% annualized) on Binance

- DXY is up 0.13% at 97.05

- Gold futures are up 1.41% at $4,993.10

- Silver futures are up 3.65% at $78.30

- Nikkei 225 closed down 1.21% at 56,941.97

- Hang Seng closed down 1.72% at 26,567.12

- FTSE 100 is up 0.12% at 10,414.44

- Euro Stoxx 50 is down 0.16% at 6,001.38

- DJIA closed on Thursday down 1.34% at 49,451.98

- S&P 500 closed down 1.57% at 6,832.76

- Nasdaq Composite closed down 2.03% at 22,597.15

- S&P/TSX Composite closed down 2.37% at 32,465.30

- S&P 40 Latin America closed down 1.71% at 3,741.30

- U.S. 10-Year Treasury rate is down 7 bps at 4.10%

- E-mini S&P 500 futures are down 0.27% at 6,832.50

- E-mini Nasdaq-100 futures are down 0.29% at 24,696.00

- E-mini Dow Jones Industrial Average Index futures are down 0.33% at 49,358.00

Bitcoin Stats

- BTC Dominance: 59.01% (+0.41%)

- Ether-bitcoin ratio: 0.02923 (-0.55%)

- Hashrate (seven-day moving average): 1,027 EH/s

- Hashprice (spot): $33.55

- Total fees: 2.55 BTC / $170,716

- CME Futures Open Interest: 116,875 BTC

- BTC priced in gold: 13.5 oz.

- BTC vs gold market cap: 4.48%

Technical Analysis

- Bitcoin remains pressured below the 200-week exponential moving average of $68,324.

- A confirmed weekly close below this level historically signals a further 20%-25% capitulation.

- That would take it toward the $51,000-$54,000 range before a bottom forms.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $141.09 (-7.90%), +5.87% at $149.37 in pre-market

- Circle Internet (CRCL): closed at $56.63 (-2.13%), +1.71% at $57.60

- Galaxy Digital (GLXY): closed at $20.15 (-1.23%)

- Bullish (BLSH): closed at $31.71 (-0.53%), +0.28% at $31.80

- MARA Holdings (MARA): closed at $7.25 (-4.10%), +1.10% at $7.33

- Riot Platforms (RIOT): closed at $14.20 (-4.05%), +0.85% at $14.32

- Core Scientific (CORZ): closed at $17.48 (-3.37%), +0.11% at $17.50

- CleanSpark (CLSK): closed at $9.31 (-3.22%), +1.18% at $9.42

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.10 (-3.70%)

- Exodus Movement (EXOD): closed at $10.19 (+1.09%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $123.00 (-2.44%), +1.54% at $124.89

- Strive (ASST): closed at $7.70 (-4.82%), +0.52% at $7.74

- SharpLink Gaming (SBET): closed at $6.54 (-1.21%), +1.07% at $6.61

- Upexi (UPXI): closed at $0.74 (-8.82%)

- Lite Strategy (LITS): closed at $1.03 (-3.74%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$410.2 million

- Cumulative net flows: $54.3 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$113.1 million

- Cumulative net flows: $11.67 billion

- Total ETH holdings ~5.8 million

Read More

- My Favorite Coen Brothers Movie Is Probably Their Most Overlooked, And It’s The Only One That Has Won The Palme d’Or!

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Thieves steal $100,000 worth of Pokemon & sports cards from California store

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- Games of December 2025. We end the year with two Japanese gems and an old-school platformer

- The 1 Scene That Haunts Game of Thrones 6 Years Later Isn’t What You Think

- Bitcoin’s Wild Ride: Binance’s Stash Vanishes Like a Fart in the Wind 🌪️💨

2026-02-13 16:11