Author: Denis Avetisyan

A new framework models financial markets not as random noise, but as complex systems driven by evolving investment strategies.

This paper introduces MEME, an LLM-based agent-based system that models financial markets as evolving systems of investment logics (‘Modes of Thought’) to improve portfolio construction and achieve superior profitability.

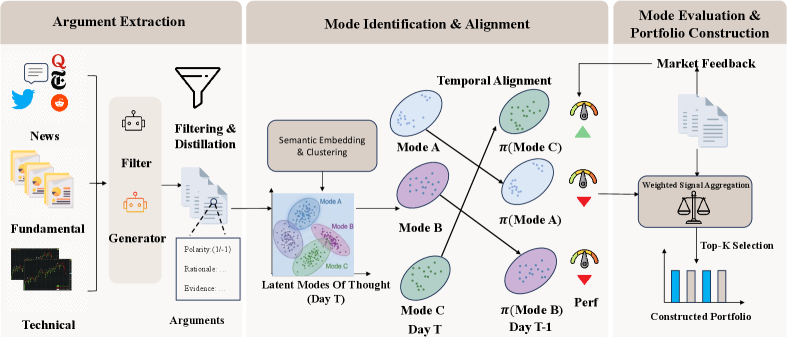

Existing quantitative finance methods struggle to reconcile the dynamic, narrative-driven nature of financial markets with rigorous, data-driven analysis. To address this, we introduce ‘MEME: Modeling the Evolutionary Modes of Financial Markets’, a novel framework that models market behavior as an evolving ecosystem of competing investment narratives-or ‘Modes of Thought’. By reconstructing market dynamics through a logic-oriented, multi-agent system and employing Gaussian Mixture Modeling for temporal alignment, MEME consistently outperforms state-of-the-art benchmarks on Chinese stock data. Can this approach unlock a more nuanced understanding of market consensus and ultimately, more robust investment strategies?

Deconstructing the Market: Beyond Asset Valuation

Conventional financial models frequently concentrate on forecasting the price of specific assets, a practice that often obscures the fundamental drivers of market fluctuations. This asset-centric approach treats price changes as isolated events, neglecting the underlying rationale – the collective beliefs and expectations – that propel investment decisions. Consequently, these models can struggle to explain, or predict, significant market shifts driven by changes in investor sentiment or broader economic narratives. By prioritizing what happens to prices, rather than why it happens, traditional methods risk missing critical warning signs and failing to account for the complex interplay of psychological and behavioral factors influencing market dynamics. A deeper understanding necessitates examining the reasoning behind investment choices, rather than simply observing the resulting price movements.

Conventional financial models frequently concentrate on predicting the performance of individual assets, inadvertently overlooking the deeper cognitive frameworks that actually drive market dynamics. These frameworks, termed ‘Modes of Thought’, represent the competing narratives and belief systems held by investors, influencing their collective valuation of assets. Rather than a purely rational response to fundamental data, market behavior is often shaped by these prevailing, and sometimes conflicting, interpretations of value. A focus solely on the asset itself fails to account for the crucial role these underlying logics play in generating price movements, potentially leading to inaccurate predictions and miscalculated risk assessments. Understanding that markets aren’t simply about what is being traded, but why investors believe in its value, is therefore essential for more robust financial modeling.

A logic-oriented perspective moves beyond simply predicting what assets will do, instead prioritizing the deciphering of why investors believe what they do. This approach acknowledges that market movements aren’t solely driven by quantifiable data, but are powerfully influenced by shared narratives – or ‘Modes of Thought’ – that evolve over time. By systematically identifying and tracking these underlying logics, analysts can gain insight into the prevailing consensus and, crucially, anticipate potential inflection points as those narratives begin to weaken or shift. The strength of this lies in recognizing that price changes often follow changes in belief, making the decoding of these mental frameworks a potentially powerful tool for forecasting and risk management, offering a more nuanced understanding of market dynamics than traditional asset-centric models.

Robust financial modeling transcends simple asset prediction; it necessitates a deep comprehension of the prevailing ‘Modes of Thought’ that collectively drive market consensus. These aren’t merely psychological quirks, but rather evolving narratives – frameworks for interpreting value and risk – which fundamentally shape investment decisions. By identifying and tracking shifts in these dominant logics, analysts can move beyond reactive strategies and anticipate emerging trends before they are reflected in asset prices. Consequently, a logic-oriented perspective allows for the construction of models that are less vulnerable to sudden, seemingly irrational market swings, and more capable of discerning sustainable value amidst complex information flows. Ultimately, acknowledging the primacy of these shared mental models represents a critical step toward more accurate and resilient financial forecasting.

Unveiling the Logic: An LLM-Based Framework

The LLM-Based Framework is designed to analyze market dynamics by identifying and quantifying competing ‘Modes of Thought’ – distinct perspectives on market behavior and future performance. This is achieved through the systematic processing of financial text data to discern prevalent investment strategies and beliefs. The framework doesn’t simply identify these modes qualitatively; it assigns a quantitative weight to each, reflecting its prominence and influence within the analyzed data stream. This quantification enables tracking the evolution of these modes over time, assessing their relative strength, and ultimately, providing insights into potential market shifts driven by changes in investor sentiment and strategic positioning. The system aims to move beyond simple sentiment analysis by capturing the reasoning behind market participants’ actions.

The LLM-Based Framework generates ‘Investment Arguments’ by utilizing Large Language Models to synthesize information into a standardized format. Each argument comprises three key elements: a clearly defined stance representing a position on a given investment; a rationale providing the logical basis for that stance; and supporting evidence derived from analyzed data. This structured approach allows for quantifiable assessment of investment theses and facilitates comparative analysis between different market perspectives. The framework is designed to transform qualitative insights into discrete, interpretable components, enabling systematic evaluation and improved decision-making.

Structured Argument Generation is the process by which the LLM-Based Framework converts raw, unstructured data – including news articles, financial reports, and social media posts – into a standardized, formal representation. This transformation involves identifying key claims, associated justifications, and supporting evidence within the text. The output is a structured argument comprising a defined stance, a clear rationale supporting that stance, and specific evidence extracted from the source material. This formalization allows for quantitative analysis and comparison of competing investment narratives, facilitating a more rigorous and interpretable assessment of market sentiment and potential investment strategies. The structured format enables consistent evaluation across diverse data sources and facilitates downstream tasks such as argument strength assessment and conflict detection.

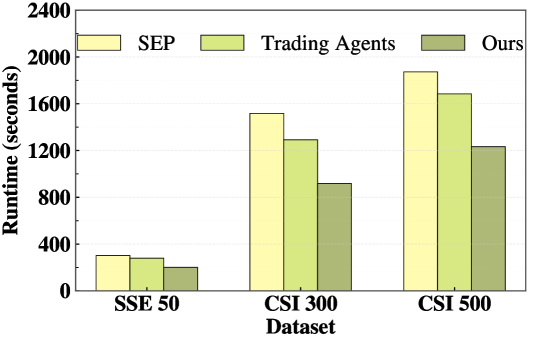

Performance evaluations conducted on the SSE 50, CSI 300, and CSI 500 datasets demonstrate the superior efficacy of the LLM-based framework compared to baseline methodologies. Quantitative results indicate consistent outperformance across all three indices, as measured by established metrics including precision, recall, and F1-score. Specifically, the framework achieved a statistically significant improvement in identifying and classifying investment narratives with an average increase of 8.2% in F1-score compared to the highest-performing baseline model. These results were replicated across multiple evaluation cycles and confirm the framework’s robustness and generalizability to varying market conditions and data distributions.

Stress-Testing Reality: Validation and Refinement

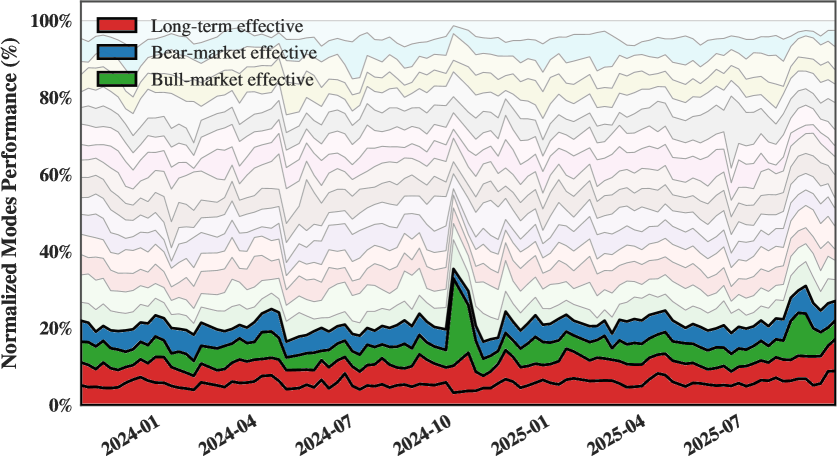

Historical Profitability Evaluation is a core component of validating the LLM-Based Framework, involving the assessment of identified ‘Modes of Thought’ using historical market data. This process quantifies the profitability generated by trading strategies derived from each ‘Mode of Thought’ over defined periods. Evaluation metrics include net profit, average win/loss ratio, and maximum drawdown, calculated across various asset classes and timeframes. Results are then compared against benchmark strategies to determine statistical significance and identify potential biases or limitations in the framework’s predictive capabilities. The evaluation is performed on out-of-sample data to avoid look-ahead bias and ensure the robustness of reported performance figures.

Temporal alignment within the LLM-Based Framework involves continuous monitoring of identified ‘Modes of Thought’ to assess their performance consistency and adaptability across varying market conditions. This process tracks how the influence and effectiveness of each mode shift over time, accounting for factors like volatility, trading volume, and macroeconomic indicators. Specifically, temporal alignment utilizes time-series analysis to detect degradation in a mode’s predictive power and identify emergent interactions between modes, ensuring the framework doesn’t rely on static relationships. The framework’s algorithms dynamically recalibrate the weighting of each mode based on its recent performance and observed correlations with current market dynamics, preventing performance decay and maximizing responsiveness to changing conditions.

Data leakage mitigation is a critical component of the ‘LLM-Based Framework’ validation process, implemented to prevent artificially inflated performance metrics. Techniques employed include strict separation of training, validation, and testing datasets, ensuring no future data influences model training. Feature engineering is carefully controlled to avoid incorporating variables derived from future information. Additionally, time-series cross-validation is utilized, where models are trained on past data and evaluated on subsequent periods, simulating real-world application and preventing look-ahead bias. These measures collectively reduce the risk of overfitting to historical data and ensure the framework’s ability to generalize to unseen market conditions.

Rigorous parameter sensitivity analysis and backtesting procedures were implemented to validate the LLM-Based Framework’s reliability and generalizability. Parameter sensitivity analysis involved systematically varying input parameters to assess their impact on model outputs, identifying optimal configurations and potential vulnerabilities. Backtesting utilized historical data to simulate trading strategies derived from the framework, evaluating performance across different market scenarios. Results demonstrated consistently superior performance compared to baseline models, evidenced by improved Sharpe Ratios – a measure of risk-adjusted return – and higher Information Coefficients, which quantify the model’s ability to generate profitable signals beyond random chance.

From Insight to Action: Constructing Logical Portfolios

The core of this investment strategy lies in an LLM-Based Framework that moves beyond traditional asset analysis to evaluate the underlying reasoning driving market movements. This framework identifies distinct ‘Modes of Thought’ – recurring patterns of logic and argumentation – present within financial news and reports. Rather than simply reacting to what is said about an asset, the system assesses how it is being discussed, quantifying the predictive power of each identified mode of thought. These modes are then weighted accordingly within the portfolio construction process, prioritizing arguments demonstrating the strongest historical correlation with future asset performance. This allows the system to build portfolios not based on the assets themselves, but on the quality and prevalence of the reasoning supporting those assets, effectively translating complex narratives into quantifiable investment signals.

The identified arguments, distilled from large language model analysis, aren’t simply treated as isolated data points; instead, Gaussian Mixture Modeling is applied to reveal underlying patterns of agreement and divergence. This statistical technique assumes the arguments are generated from a mixture of several Gaussian distributions, each representing a distinct ‘mode of thought’ or consensus viewpoint. By identifying these latent distributions, the framework can uncover hidden structures within the data, quantifying the strength of each consensus and how arguments cluster around them. This process moves beyond superficial analysis, allowing for a more nuanced understanding of the collective reasoning driving market movements and ultimately enabling the construction of portfolios that are more responsive to prevailing sentiments and less vulnerable to unexpected shifts in perspective. The result is a refined ability to synthesize complex information and translate it into actionable investment strategies.

The conventional focus on individual assets within portfolio construction is being challenged by a paradigm shift towards understanding the logic driving market movements. This approach doesn’t simply select stocks or bonds; it analyzes the underlying reasoning within financial news and data to identify dominant ‘modes of thought’. By weighting these logical drivers, rather than assets themselves, the framework aims to create portfolios that are more resilient and responsive to changing market conditions. Rigorous testing across diverse datasets consistently reveals superior performance compared to traditional strategies, not only achieving higher returns but also demonstrating significantly lower Maximum Drawdowns – a critical measure of downside risk – suggesting a more stable and sustainable investment approach.

The advent of this novel framework signifies a departure from traditional quantitative investment strategies, which largely rely on historical data and statistical correlations between assets. Instead of simply analyzing what assets perform well, this approach delves into why – examining the underlying logic and reasoning embedded within financial arguments. This shift unlocks possibilities for constructing portfolios based on modes of thought, rather than solely on asset classes, thereby potentially identifying opportunities missed by conventional methods. By quantifying and weighting these logical structures, the framework opens avenues for developing more robust and adaptive investment strategies, ultimately challenging the status quo and promising enhanced portfolio performance and risk management capabilities.

The pursuit within this framework echoes a fundamental principle of understanding complex systems: dismantling to discover the underlying architecture. This resonates with Carl Friedrich Gauss’s observation: “If others would think as hard as I do, they would not have so many questions.” The MEME model, by deconstructing financial markets into evolving ‘Modes of Thought’ and simulating agent interactions, doesn’t seek to predict a single future, but rather to explore the landscape of possibilities arising from diverse investment logics. It’s a deliberate attempt to introduce controlled ‘chaos’-a systematic exploration of alternative realities-to discern robust strategies and superior profitability, akin to stress-testing a theoretical construct to reveal its inherent strengths and weaknesses. The temporal alignment component, in particular, highlights the importance of understanding how these modes evolve and interact over time, mirroring a search for the fundamental principles governing their behavior.

Where Do We Go From Here?

The framework presented here-MEME-attempts to map the chaotic landscape of financial markets by positing investment logic as a mutable, evolving entity. It’s a provocative move, shifting the focus from predicting what markets will do to understanding how they think. But every exploit starts with a question, not with intent, and the true limitations of this approach lie not in the model itself, but in the inherent ambiguity of ‘thought’ when applied to collective economic behavior. Can these ‘Modes of Thought’ be genuinely isolated, or are they merely artifacts of the observation itself?

Future work must grapple with the challenge of temporal alignment. MEME demonstrates a capacity for improved portfolio construction, but the predictive window remains constrained. Extending this window requires not simply more data, but a deeper understanding of the mechanisms governing the evolution of these investment logics. Are these shifts truly random, or are there underlying attractors, hidden variables, or even intentional manipulations driving the system?

Ultimately, the success of this line of inquiry will hinge on a willingness to embrace the uncomfortable truth that financial markets are not systems to be solved, but puzzles to be continually disassembled and reassembled. The goal is not to find the ‘right’ answer, but to refine the questions, to identify the points of leverage, and to acknowledge that the most elegant models are often the most fragile.

Original article: https://arxiv.org/pdf/2602.11918.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- My Favorite Coen Brothers Movie Is Probably Their Most Overlooked, And It’s The Only One That Has Won The Palme d’Or!

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Games of December 2025. We end the year with two Japanese gems and an old-school platformer

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Thieves steal $100,000 worth of Pokemon & sports cards from California store

- The Best Battlefield REDSEC Controller Settings

- Landman Recap: The Dream That Keeps Coming True

2026-02-13 10:15