Well, I say, old bean, the markets have gone and done a silly ass-over-teakettle, haven’t they?

What ho! Here’s the lowdown, what?:

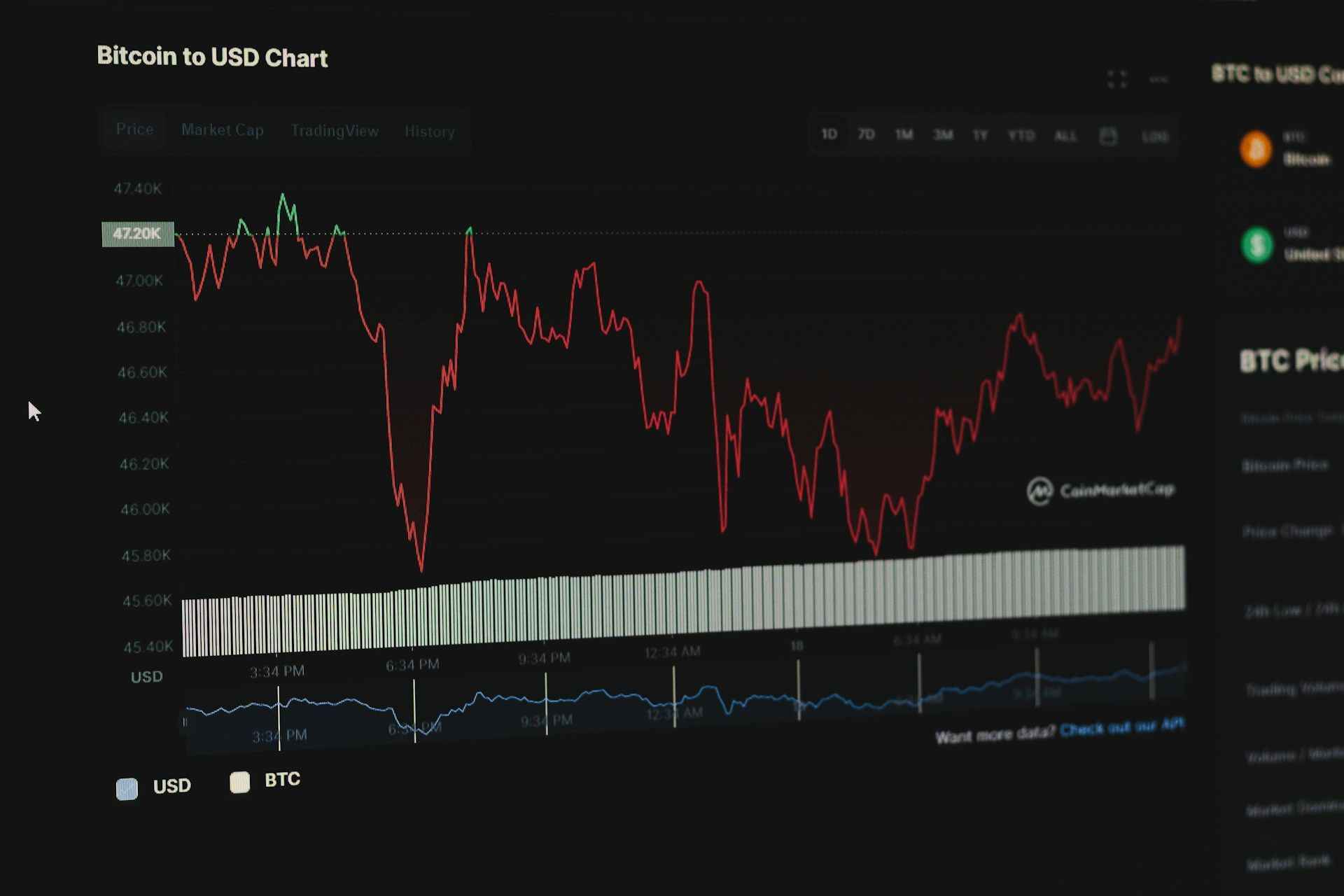

- Bitcoin, that wily digital scoundrel, has bobbed about like a cork in a tempest, dipping near $60,000 before rallying to a still-rather-shabby $69,000. All this after Trump’s election had it feeling rather chipper. The CoinDesk 20 index? Down 17%. Dash it all, what a to-do!

- Other cryptos have taken a proper pasting, poor blighters. ETH down 22.4%, BNB 23.4%, and SOL 25.2%. It’s enough to make a chap weep into his cocktail.

- And as if that weren’t enough, Gemini’s decided to pack it in across the U.K., EU, and Australia, chucking out a quarter of its staff. Spot bitcoin ETF flows? Negative, old sport. Jolly grim.

So there you have it, Bitcoin’s had a bit of a wobbler, giving back its post-Trump gains like a fellow returning a borrowed fiver. The broader market’s taken a proper kicking too, with the CoinDesk 20 index losing more than 17% in a week. I mean, really, what’s the world coming to?

While Bitcoin’s only down 16.5% in the last seven days, its chums have fared worse. Ether’s lost 22.4%, BNB’s dropped 23.4%, and Solana’s taken a 25.2% tumble. Shares of crypto-linked firms have had a proper drubbing, though they did manage a Friday rebound when BTC briefly peeked above $70,000. Small mercies, eh?

Wintermute’s Jasper De Maere called it the worst single-day drawdown since the FTX collapse. “Sell at any price,” he said. Sounds like a chap trying to offload a dodgy antique at a car boot sale, what?

De Maere reckons institutional desks reported “small but manageable liquidations,” which doesn’t quite explain the size of the move. Rather like trying to explain why Jeeves always knows exactly what I’m thinking before I do. Mysterious, these things.

He also mentioned a wider cross-asset deleveraging. The Nasdaq 100 tracker QQQ fell 500 basis points over three sessions, while silver and gold dropped 38% and 12% below their cycle highs, respectively. Dash it, even the precious metals are feeling the pinch!

In crypto options, implied volatility’s shot up, with skew tilting toward expensive puts. De Maere flagged Ether as the “epicenter of the pain,” with traders scrambling for protection like a fellow reaching for his umbrella in a sudden downpour.

Bitcoin’s positioning suggests expectations of continued turbulence, with traders eyeing a range from $55,000 to $75,000. Rather like trying to predict whether Aunt Agatha will serve cold cuts or cold stares at her next dinner party.

And then there’s Gemini, shutting up shop in several regions and cutting staff. Bitfarms, meanwhile, has ditched its “bitcoin company” identity to focus on AI infrastructure. Bit of a career change, that, rather like Jeeves deciding to take up the banjo.

Market structure’s added to the turbulence, with Bitcoin’s average 1% market depth falling to $5 million from over $8 million in 2025. Makes price moves as abrupt as Bertie Wooster’s attempts at serious conversation.

Spot bitcoin ETF flows have turned negative, with $1.25 billion in net outflows over the past three days. Jim Bianco reckons the average ETF cost basis is near $90,000, leaving holders with $15 billion in unrealized losses. “Programmable money,” he calls it. Sounds more like a programmable nightmare, if you ask me.

Software stocks have taken a tumble too, thanks to Anthropic’s new automation tool. Salesforce, Adobe, and ServiceNow all down. BTIG’s Jonathan Krinsky says Bitcoin’s been correlated with software stocks lately. “Compelling evidence” of tactical lows, he says. Bottomed at $60,000, apparently. Jolly good show, what?

And finally, the Trump administration’s pro-crypto stance helped Bitcoin hit a new all-time high above $125,000 last year. But then, as we all know, what goes up must come down. Rather like Bertie after a few too many at the Drones Club.

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

- New survival game in the Forest series will take us to a sci-fi setting. The first trailer promises a great challenge

- James Cameron Gets Honest About Avatar’s Uncertain Future

- These are the last weeks to watch Crunchyroll for free. The platform is ending its ad-supported streaming service

- What time is It: Welcome to Derry Episode 8 out?

- KPop Demon Hunters Just Broke Another Big Record, But I Think Taylor Swift Could Stop It From Beating The Next One

- What does Avatar: Fire and Ash mean? James Cameron explains deeper meaning behind title

2026-02-07 19:15