Cardano’s native token ADA has dusted off the snooze button and wandered back into the sunlight, creeping up almost 10% today to trade around $0.27 after a bruising flirtation at $0.22 earlier this week. The sharp recovery has stirred cautious optimism among investors and prompted fresh chatter about whether ADA is primed for a bigger rally-perhaps with a side of popcorn.

Institutional & Whale Buying Boosts ADA Confidence

One of the catapults behind this revival is a reawakened appetite from institutions. Grayscale, the big-splash investment firm juggling over $35 billion, has quietly boosted its ADA stash.

The firm nudged Cardano’s weight in its Smart Contract Fund from 18.55% to 19.50%, which is exactly the sort of numbers that make spreadsheets gasp in admiration and investors think it’s all wonderfully serious.

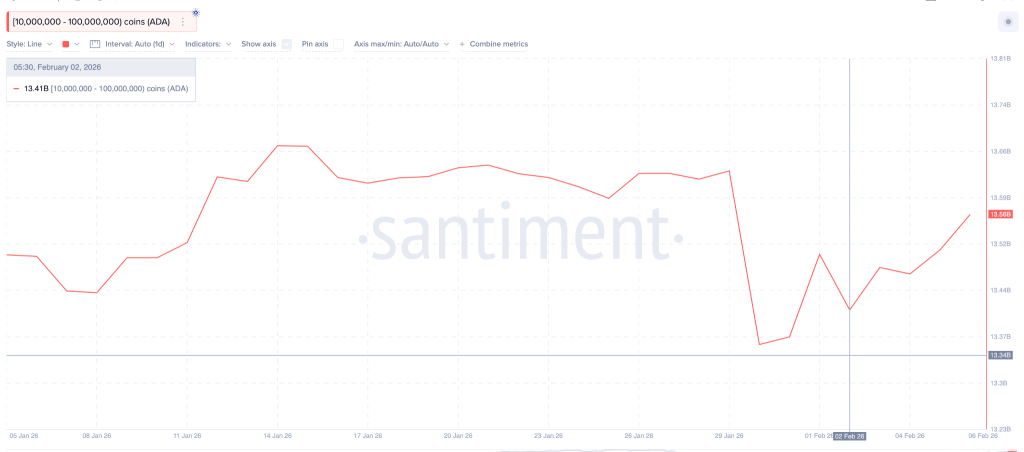

Data from Santiment shows the big players scooped up bargains. Wallets between 10 million and 100 million ADA crept up their collective bags from about 13.41 billion to 13.56 billion ADA since early February, an accumulation of roughly $40 million worth of tokens-enough to make a small asteroid blush.

More crucially, these mid-sized whales did not sell their snacks during the crash. Their holdings remained stubbornly steady even when prices briefly wandered down to $0.22, as if they were guarding a fragile teacup from chaos.

Big Milestone Ahead: ADA Futures on CME

Adding to the buoyant mood, Cardano futures are due to launch on the CME exchange on February 9. The regulatory-backed contracts will grant professional investors a sanctioned route to trade ADA. CME will offer both standard contracts of 100,000 ADA and smaller micro contracts of 10,000 ADA.

This forthcoming launch could spruce up liquidity and coax more professional players into the Cardano market, which is basically the financial equivalent of inviting a grown-up guest to your treehouse.

Cardano ADA Price Outlook

On the weekly chart, ADA has been treading water for ages after its last heroic peak. The price is carving higher lows near the $0.26 support zone, suggesting a polite but determined level of buying interest. ADA is also testing a long-term resistance line that has previously blocked rallies taller than a very small bookshelf.

A weekly close below $0.20 would undermine the bullish structure and invalidate the current setup. That level serves as the bulls’ main line of defense, like a velvet rope at a trendy club.

However, if momentum gets its act together, analysts whisper of a mid-cycle dash toward the $2 to $3 range-because sometimes the universe likes to remind us that gravity is optional until it isn’t.

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

- New survival game in the Forest series will take us to a sci-fi setting. The first trailer promises a great challenge

- These are the last weeks to watch Crunchyroll for free. The platform is ending its ad-supported streaming service

- What time is It: Welcome to Derry Episode 8 out?

- James Cameron Gets Honest About Avatar’s Uncertain Future

- KPop Demon Hunters Just Broke Another Big Record, But I Think Taylor Swift Could Stop It From Beating The Next One

- Digimon Story: Time Stranger’s theme “wherever you are” by reche is now available on Spotify and Apple Music

2026-02-07 12:36