Author: Denis Avetisyan

Researchers have developed a novel approach to predict credit exposures and systemic vulnerabilities within the rapidly evolving landscape of decentralized finance.

DeXposure-FM is a time-series graph foundation model designed to forecast credit risk and enhance macroprudential monitoring in decentralized financial networks.

The increasing interconnectedness of decentralized finance (DeFi) presents unique systemic risks due to implicit credit exposures and complex token-mediated dependencies. To address this, we introduce ‘DeXposure-FM: A Time-series, Graph Foundation Model for Credit Exposures and Stability on Decentralized Financial Networks’, a novel foundation model that forecasts inter-protocol credit exposure using a graph-tabular encoder trained on a comprehensive dataset of over 43.7 million data entries. This approach consistently outperforms state-of-the-art methods, enabling the creation of tools for macroprudential monitoring and stress testing, including protocol-level systemic importance scores. Can this model provide early warnings for potential contagion events and ultimately contribute to a more stable and resilient DeFi ecosystem?

Decoding Systemic Vulnerabilities in Decentralized Finance

Decentralized Finance, while promising a revolution in financial services, operates with an inherent interconnectedness that creates novel systemic risks. Unlike traditional finance, where centralized intermediaries provide oversight and absorb shocks, DeFi relies on composability – the ability of protocols to seamlessly interact. This creates a web of dependencies where the failure of one protocol can rapidly cascade through the ecosystem, impacting numerous others. Current risk management tools, developed for centralized systems, struggle to account for these complex, multi-directional exposures. The speed and automation characteristic of DeFi further exacerbate the problem, potentially leading to contagion events that unfold far more quickly than those experienced in conventional markets. This necessitates the development of new, sophisticated risk assessment methodologies tailored to the unique characteristics of decentralized systems, focusing on granular exposure mapping and real-time monitoring of inter-protocol dependencies.

Current evaluations of risk within Decentralized Finance (DeFi) frequently lean on metrics such as Total Value Locked (TVL), a figure representing the aggregate assets deposited in smart contracts. However, this approach offers a limited understanding of the true vulnerabilities present. DeFi protocols are rarely isolated; they are deeply interwoven, with assets flowing between lending platforms, decentralized exchanges, and yield aggregators. A high TVL, therefore, doesn’t necessarily equate to stability if those assets are heavily exposed to another protocol experiencing distress. This interconnectedness creates a complex web of counterparty risk that simplified metrics fail to capture, meaning a localized issue can quickly propagate throughout the ecosystem. More sophisticated modeling is needed to trace these inter-protocol exposures and accurately assess the potential for cascading failures, moving beyond simply quantifying the amount of capital at stake to understanding how it’s connected.

The architecture of many Decentralized Finance (DeFi) protocols heavily depends on stablecoins as the primary medium of exchange and collateral, creating a centralized vulnerability within a purportedly decentralized system. While designed to maintain a one-to-one peg with fiat currencies, stablecoins are ultimately backed by varying reserves – often a combination of fiat, other cryptocurrencies, or algorithmic mechanisms – and are therefore subject to the risks associated with those underlying assets or the issuing entity. This concentration of value in a limited number of stablecoins means that a shock to even a single major provider – be it regulatory action, a loss of confidence, or a technical failure – could trigger a cascading effect throughout the DeFi ecosystem. Consequently, sophisticated risk monitoring must move beyond simple metrics and focus on granular analysis of stablecoin reserves, redemption mechanisms, and potential contagion pathways to accurately assess systemic exposure and prevent widespread destabilization.

The architecture of Decentralized Finance, while promising, presents a unique susceptibility to cascading failures should accurate risk modeling remain absent. Interconnected protocols, operating with limited oversight, create pathways for financial distress to propagate at unprecedented speeds; a failure in one protocol can quickly trigger liquidations and defaults across numerous others. Current risk assessments, often focused on superficial metrics, fail to account for these complex interdependencies and the potential for correlated failures. Simulations demonstrate that even seemingly isolated events can escalate into systemic crises, rapidly eroding confidence and destabilizing the entire ecosystem-potentially freezing assets and halting market activity. Without granular, dynamic modeling capable of capturing these contagion effects, the DeFi space remains vulnerable to shocks that could undermine its long-term viability and broader financial stability.

Introducing DeXposure-FM: A Graph-Based Foundation for Systemic Insight

DeXposure-FM is a foundation model specifically designed for analyzing time-series data within the Decentralized Finance (DeFi) ecosystem. Its primary function is the measurement and forecasting of credit exposures that exist between different DeFi protocols. This is achieved by representing the DeFi landscape as a graph, where protocols are nodes and financial relationships – representing credits or debts – are edges. The model’s time-series capabilities allow it to track these exposures dynamically over time, offering a continually updated view of systemic risk. Unlike traditional methods, DeXposure-FM aims to provide a generalized framework applicable across various DeFi protocols and blockchain networks, enabling a holistic assessment of inter-protocol financial dependencies.

DeXposure-FM utilizes the GraphPFN (Graph-based Propagation and Fusion Network) architecture as its foundation, building upon existing graph neural network methodologies to specifically address the complexities of inter-protocol relationships within DeFi. While traditional graph networks often treat relationships as static, DeXposure-FM incorporates mechanisms to model the temporal dynamics of these connections. This is achieved through the propagation of information across the protocol graph, weighted by exposure values, and then fused to generate a representation that captures evolving credit risk. The GraphPFN framework allows the model to infer dependencies and potential contagion pathways based on observed exposure data, extending beyond simple pairwise relationships to consider multi-hop connections and systemic risk.

DeXposure-FM utilizes a dataset of over 43.7 million weekly inter-protocol exposure data entries to quantify relationships within the Decentralized Finance (DeFi) ecosystem. This dataset encompasses data from more than 4,300 unique DeFi protocols deployed across 602 distinct blockchains. Each data entry represents a quantified exposure – the amount of collateral or assets at risk – between two protocols in a given week. The scale of this data collection provides a broad and detailed representation of interdependencies across the DeFi landscape, enabling analysis of systemic risk and potential contagion effects. Data is updated weekly to reflect the dynamic nature of DeFi protocol interactions and asset flows.

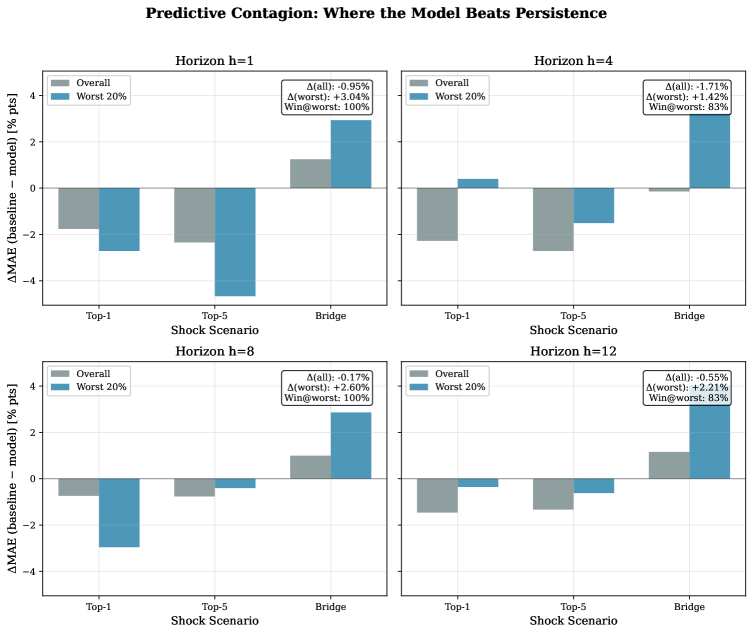

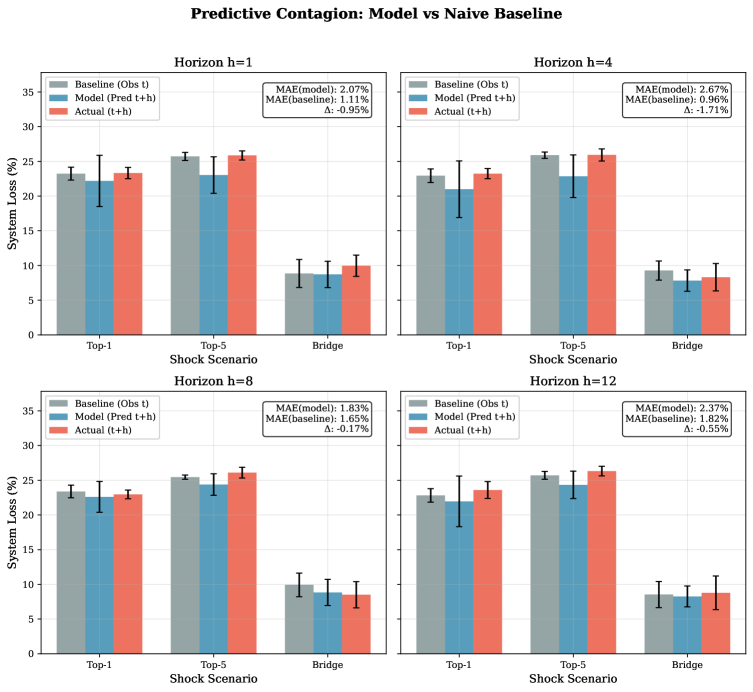

DeXposure-FM facilitates improved contagion stress testing by simulating how financial distress in one DeFi protocol propagates to others through inter-protocol exposures. The model quantifies these exposures – representing assets at risk – and allows for scenario analysis under various stress conditions, such as protocol failures or liquidity crises. This capability extends beyond static network analysis by dynamically updating exposure calculations weekly, reflecting changes in on-chain activity. Proactive risk management is enabled through early identification of systemic vulnerabilities and concentration risks within the DeFi ecosystem, allowing institutions and protocols to adjust positions and mitigate potential losses before adverse events occur. The model’s output provides data-driven insights for capital allocation, collateralization strategies, and overall portfolio risk assessment.

Quantifying Systemic Importance and Mapping Spillover Effects

DeXposure-FM calculates a Systemic Importance Score (SIS) for each protocol within the Decentralized Finance (DeFi) ecosystem to quantify its potential risk to network stability. The SIS is derived from a network analysis that considers each protocol as a node and inter-protocol dependencies – typically established through smart contract interactions – as edges. Higher SIS values indicate protocols whose failure or disruption would likely have a disproportionately large impact on the broader network, as measured by factors such as the total value locked (TVL) of interconnected protocols and the number of affected pathways for value transfer. This scoring system allows for prioritized risk assessment and the identification of critical infrastructure within DeFi.

DeXposure-FM is capable of identifying and quantifying cross-sector spillover effects within the Decentralized Finance (DeFi) ecosystem. The model achieves this by analyzing inter-protocol relationships and mapping the propagation of risk between distinct DeFi segments – such as lending, decentralized exchanges, and stablecoins. This analysis demonstrates that a shock to a single protocol within one sector can generate systemic risk impacting protocols in seemingly unrelated sectors, due to interconnected dependencies. The model’s calculations provide a granular view of these spillover pathways, enabling the assessment of potential contagion effects and highlighting vulnerabilities beyond the initially affected protocol.

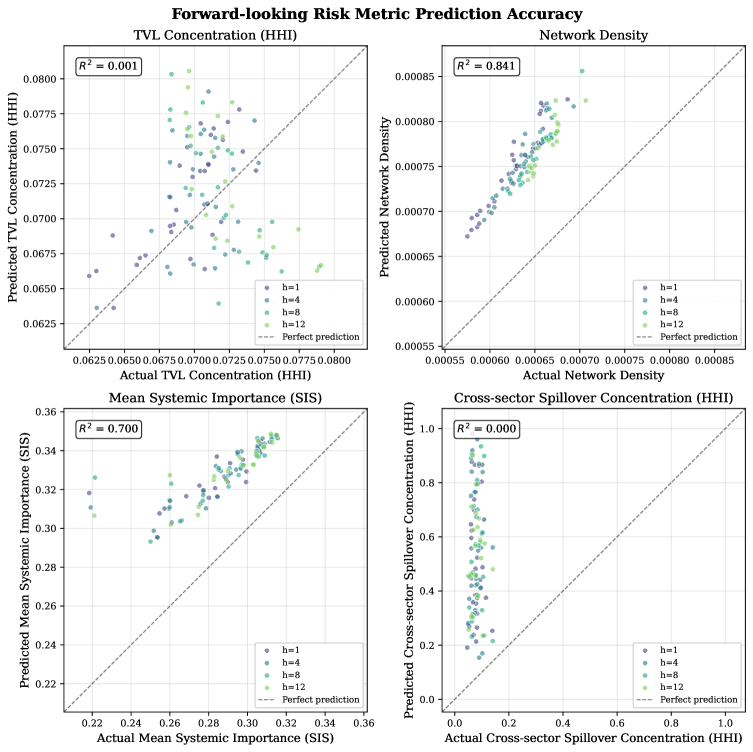

DeXposure-FM incorporates multi-step forecasting to predict changes in key network characteristics, including edge weights, node Total Value Locked (TVL), and overall network structure. This forecasting capability achieves an Area Under the Receiver Operating Characteristic curve (AUROC) of 0.91 when predicting edge existence over multiple time steps. This performance metric indicates a high degree of accuracy in anticipating future network connections and demonstrates the model’s ability to proactively identify potential shifts in systemic risk profiles within the DeFi ecosystem. The multi-step approach allows for a more comprehensive assessment of future network states compared to single-step predictions.

DeXposure-FM demonstrates superior forecasting accuracy when compared to baseline Temporal Graph Neural Networks (TGNN). Quantitative evaluation reveals that DeXposure-FM consistently outperforms TGNN in predicting changes within the DeFi network, specifically in forecasting edge weights, node Total Value Locked (TVL), and overall network structure. This improved performance is substantiated by an Area Under the Receiver Operating Characteristic curve (AUROC) of 0.91 achieved on multi-step forecasting of edge existence, a metric where TGNN results are comparatively lower. The model’s architecture and methodology therefore provide a more reliable predictive capability for assessing systemic risk within the DeFi ecosystem.

Building a Resilient DeFi Ecosystem: Implications and Future Directions

DeXposure-FM offers a detailed mapping of interconnected risk exposures within the decentralized finance (DeFi) ecosystem, moving beyond broad systemic risk metrics. This granular approach allows regulators and DeFi participants to pinpoint specific vulnerabilities – such as concentrated liquidity positions or over-collateralized loans susceptible to cascading failures – before they trigger wider instability. By illuminating these hidden connections and potential failure points, the model facilitates proactive intervention, enabling targeted adjustments to protocol parameters, collateralization ratios, or liquidity provision. Consequently, DeXposure-FM doesn’t merely flag risk; it empowers stakeholders to build a more resilient DeFi landscape through preventative measures and informed decision-making, effectively shifting the focus from reactive crisis management to proactive risk mitigation.

DeXposure-FM’s capacity to anticipate systemic risk within decentralized finance offers a proactive pathway to fortifying protocol stability. By forecasting potential vulnerabilities before they materialize, the model allows for the dynamic adjustment of capital allocation strategies, ensuring resources are directed to areas most susceptible to cascading failures. Furthermore, this predictive capability directly informs collateralization ratios; protocols can preemptively increase collateral requirements for assets identified as high-risk, thereby bolstering their resilience against market shocks and reducing the likelihood of liquidations. This adaptive approach to risk management moves beyond reactive measures, enabling DeFi protocols to not only withstand adverse conditions, but also to maintain operational continuity and user confidence even during periods of heightened market volatility.

DeXposure-FM represents an advancement in decentralized finance (DeFi) risk assessment by integrating the strengths of both Auto-regressive Models and Diffusion Models. Traditional Auto-regressive Models excel at forecasting based on historical data, but often struggle with the complexity and non-linearity inherent in DeFi markets. Diffusion Models, conversely, are adept at capturing intricate relationships and generating realistic scenarios, yet can be computationally expensive. DeXposure-FM strategically combines these approaches, leveraging Auto-regressive Models for efficient baseline forecasting and then refining predictions with the nuanced insights provided by Diffusion Models. This hybrid architecture not only enhances the accuracy of risk assessments but also provides a significantly more scalable solution capable of handling the rapidly evolving landscape of decentralized finance and its thousands of interconnected tokens – a critical feature for proactive risk management and systemic stability.

A robust dataset encompassing over 24,300 unique tokens forms the foundation of enhanced risk assessment within the decentralized finance (DeFi) ecosystem. This extensive compilation offers an unprecedentedly comprehensive view of the DeFi landscape, moving beyond analyses focused on a limited selection of assets. The breadth of the dataset allows for the identification of interconnectedness and potential vulnerabilities across a far wider range of tokens, improving the accuracy of systemic risk evaluations. By incorporating data from a significantly larger proportion of the DeFi universe, the model is better equipped to detect subtle but critical exposure pathways that might otherwise remain hidden, ultimately strengthening the resilience of the entire system and informing more effective risk mitigation strategies.

DeXposure-FM’s architecture reflects a holistic understanding of decentralized finance, recognizing that systemic risk isn’t isolated to individual exposures but emerges from the network’s interconnectedness. This approach aligns with the sentiment expressed by Marvin Minsky: “You can’t solve problems using the same kind of thinking that created them.” The model doesn’t simply extrapolate from past credit data; it constructs a representation of the entire network, allowing for the identification of emergent vulnerabilities. This echoes the core idea of the paper-that a comprehensive, graph-based approach is vital for effective macroprudential monitoring and stress testing in DeFi, where understanding the whole system is paramount to predicting its stability.

Future Directions

The introduction of DeXposure-FM, while a step forward, only illuminates the contours of a much larger challenge. Forecasting systemic risk in decentralized finance is not merely a matter of improved algorithms; it demands a fundamental re-evaluation of risk itself. Current approaches, even those leveraging graph neural networks, remain tethered to the notion of quantifiable exposure – a simplification that feels increasingly precarious as these networks evolve. The model excels at predicting exposure, but it does not address the underlying fragility inherent in permissionless systems.

Future work must move beyond prediction toward a more holistic understanding of network behavior. The elegance of a system often lies in its constraints, and the absence of central control in DeFi creates a complexity that resists simple modelling. A truly robust framework will require integrating agent-based modelling with graph representation learning – a synthesis that acknowledges the interplay between individual actions and emergent systemic effects. If a design feels clever, it’s probably fragile.

Ultimately, the most pressing question is not whether one can forecast a crisis, but whether the very architecture of these networks invites one. Focus should shift towards designing for resilience – systems that degrade gracefully rather than collapse catastrophically. The pursuit of ever-more-accurate predictions feels increasingly like rearranging deck chairs on a rapidly tilting ship.

Original article: https://arxiv.org/pdf/2602.03981.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- Gold Rate Forecast

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

- What does Avatar: Fire and Ash mean? James Cameron explains deeper meaning behind title

- What time is It: Welcome to Derry Episode 8 out?

- Landman Recap: The Dream That Keeps Coming True

- James Cameron Gets Honest About Avatar’s Uncertain Future

2026-02-05 08:55