Author: Denis Avetisyan

Generative AI adoption in the U.S. banking sector initially lowers productivity but ultimately amplifies systemic risk through interconnected algorithms and network effects.

This paper examines the short-term costs and long-term systemic risks of generative AI adoption in U.S. banking, employing spatial econometrics to model algorithmic coupling and network spillovers.

Despite the promise of increased efficiency, the rapid adoption of generative artificial intelligence within the U.S. banking sector presents a complex paradox of initial costs and emergent risks. This paper, ‘The Innovation Tax: Generative AI Adoption, Productivity Paradox, and Systemic Risk in the U.S. Banking Sector’, investigates this dynamic, revealing that while AI implementation initially depresses bank returns-creating a significant “implementation tax”-it simultaneously fosters positive network spillovers and increases systemic interconnectedness through “algorithmic coupling.” Our analysis, employing spatial econometric models and a synthetic difference-in-differences approach, demonstrates that these spillovers disproportionately benefit larger institutions, raising concerns about financial stability. Could this growing algorithmic interdependence create new channels for systemic contagion, necessitating a reevaluation of regulatory oversight in the age of AI-driven finance?

The Evolving Financial Landscape: Promise and Peril

The financial sector is experiencing a rapid evolution driven by generative artificial intelligence, a technology poised to redefine established practices and unlock novel opportunities. Beyond automating routine tasks, these AI systems are demonstrating the capacity to generate synthetic data for stress testing, personalize financial advice at scale, and even detect fraudulent activities with greater precision. This isn’t simply about incremental improvements; generative AI facilitates the creation of entirely new financial products and services, promising increased efficiency, reduced costs, and enhanced customer experiences. The technology’s potential extends to areas like algorithmic trading, risk management, and regulatory compliance, suggesting a fundamental shift in how financial institutions operate and compete in the coming years.

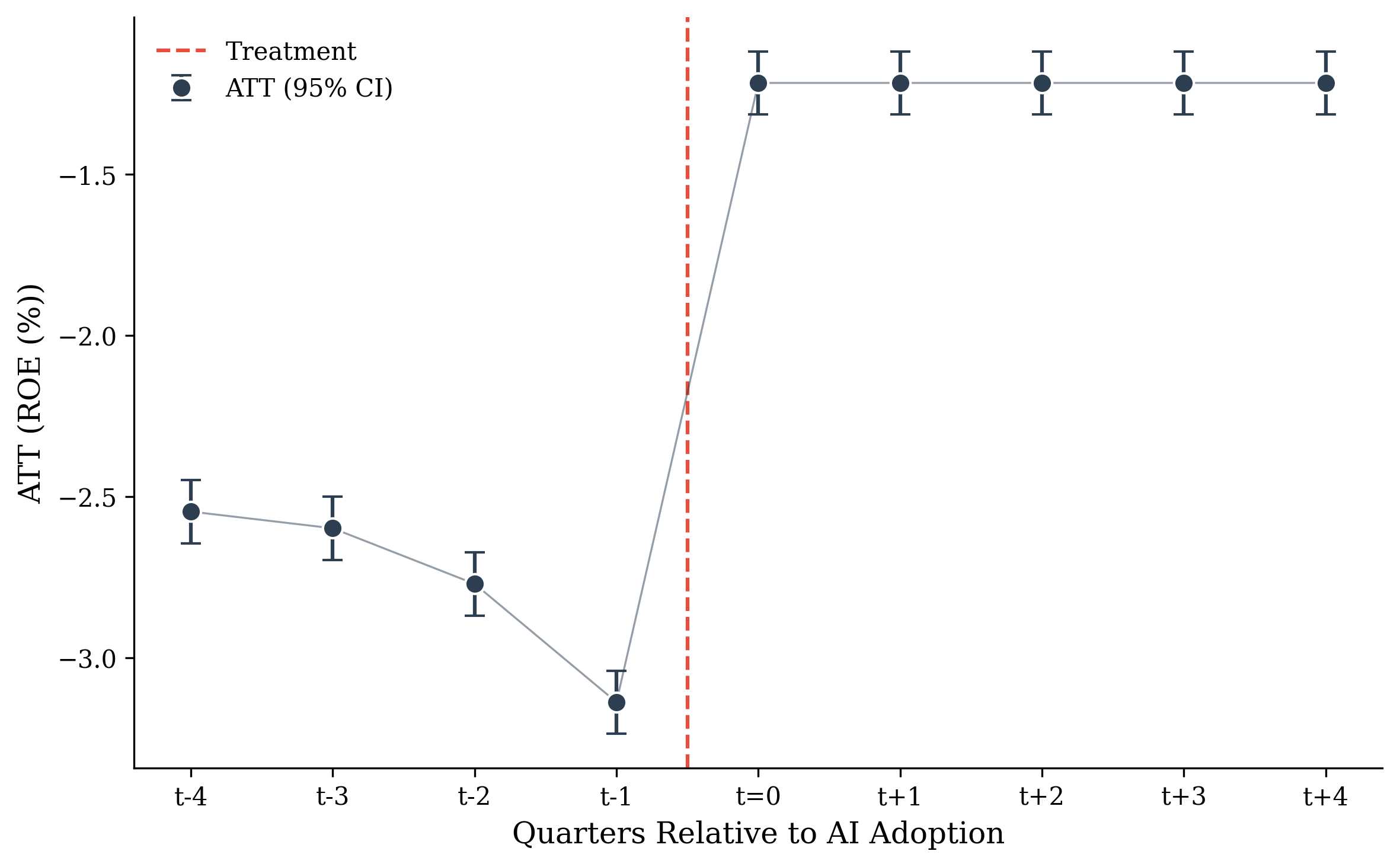

Despite the transformative potential of generative AI in finance, initial adoption isn’t guaranteed to yield immediate benefits; research indicates a surprising productivity dip. A comprehensive analysis reveals that firms undergoing AI implementation experienced a notable decline of 428 basis points in Return on Equity (ROE) before realizing any gains. This suggests a significant upfront investment in integration, training, and process adjustments is required before AI’s efficiencies materialize. Furthermore, the interconnectedness of modern financial systems introduces systemic risks; flawed algorithms or biased datasets could propagate errors rapidly, potentially destabilizing markets. Careful risk management, robust testing, and ongoing monitoring are therefore crucial to mitigate these challenges and unlock the true promise of generative AI in the financial sector.

The Innovation J-Curve: A Temporary Productivity Dip

The implementation of Generative AI technologies is frequently accompanied by an initial reduction in operational productivity, termed the ‘Implementation Tax’. This temporary decline stems from the resources required to integrate new AI systems with existing infrastructure and the associated learning curves for personnel adapting to these tools. These costs include system configuration, data migration, employee training, and the inevitable troubleshooting of initial deployments. While representing a short-term efficiency loss, this dip is a predictable component of technology adoption and is expected to be offset by long-term gains in productivity and return on investment as the organization fully leverages the AI’s capabilities.

The initial productivity decrease observed with Generative AI implementation aligns with the established ‘Innovation J-Curve’ phenomenon. This curve illustrates that investments in new technologies often yield short-term reductions in performance metrics due to factors like integration costs, employee training, and process adjustments. While counterintuitive, these temporary losses are considered a predictable component of innovation; the expectation is that sustained investment and refinement will eventually lead to significant, long-term gains exceeding the initial dip. This pattern is not unique to Generative AI and has been documented across various technological adoptions, representing a necessary phase before realizing the potential benefits of increased efficiency and new capabilities.

Research utilizing a Synthetic Difference-in-Differences methodology quantifies the initial productivity impact of Generative AI implementation as an average Return on Equity (ROE) decline of 428 basis points. This decline is not uniform across institutions; smaller banks experience a significantly larger ROE decrease of 517 basis points, compared to the 129 basis point decline observed in larger banks. The methodology isolates the effect of AI implementation by creating a synthetic control group, allowing for a rigorous measurement of the temporary productivity dip and its duration across different bank sizes.

Network Effects and Systemic Risk: The Interconnected Web

Generative AI adoption within the financial sector generates ‘Network Spillovers’ as the benefits of implementation are not isolated to the adopting institution. These spillovers manifest through two primary channels: knowledge diffusion, where competitors learn from the adopting bank’s experiences and adapt their own strategies; and increased competitive pressure, forcing non-adopting banks to innovate or risk losing market share. This dynamic means that even banks which do not directly invest in generative AI can experience positive impacts on their performance metrics, effectively extending the initial investment’s reach beyond the boundaries of the adopting firm. The extent of these spillovers is quantifiable, and analysis indicates a measurable impact on the financial performance of competitor institutions.

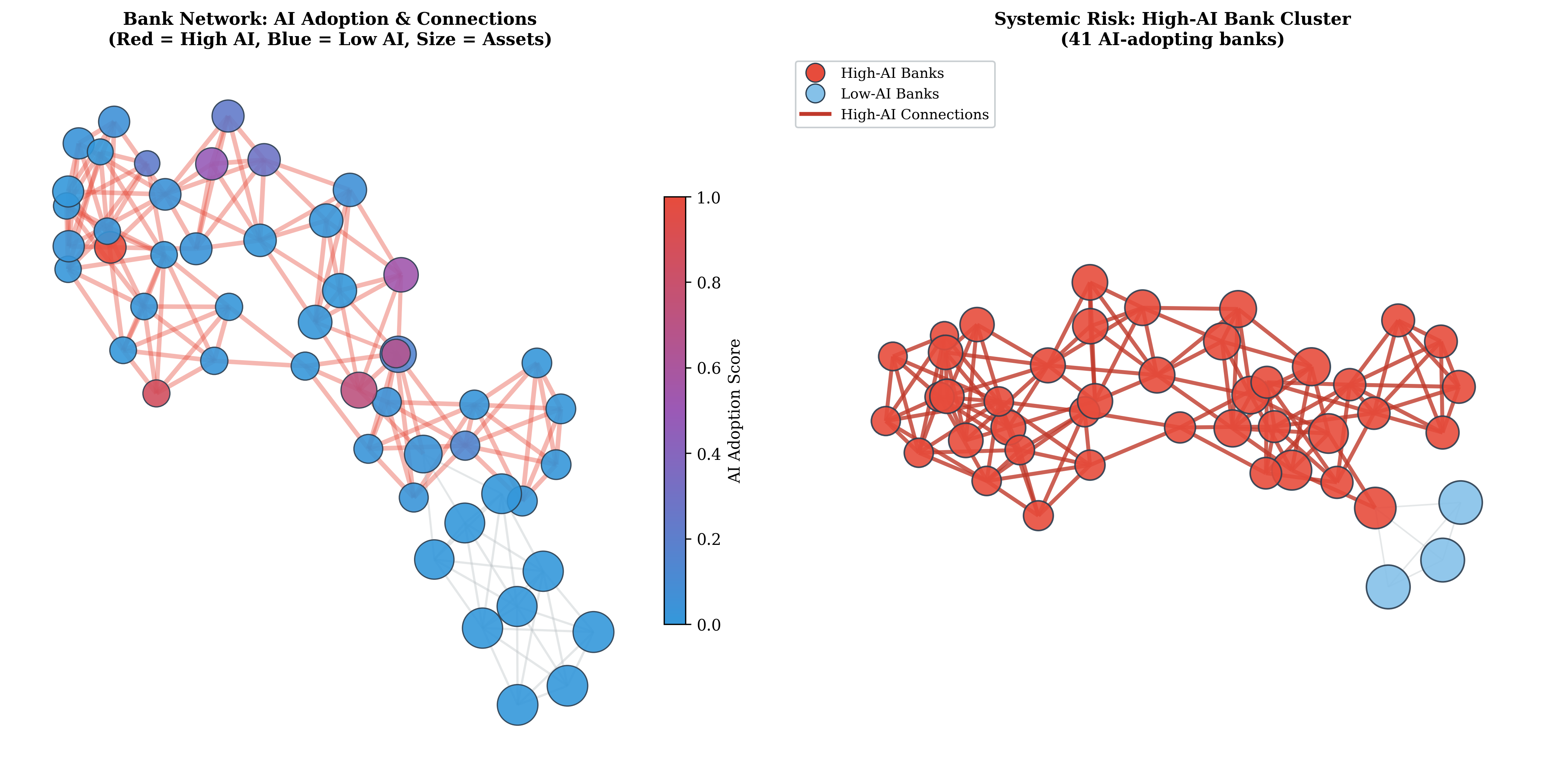

A Dynamic Spatial Durbin Model was employed to quantify the spillover effects of generative AI adoption on financial performance. The analysis revealed a spillover coefficient (θ) of 0.161 for Return on Assets (ROA), indicating that a one-unit increase in AI adoption at one bank is associated with a 0.161 unit increase in the ROA of neighboring banks. Similarly, the model identified a spillover coefficient of 0.679 for Return on Equity (ROE), suggesting a more substantial positive impact on the ROE of interconnected institutions due to AI adoption by peer banks. These coefficients demonstrate statistically significant positive externalities resulting from the diffusion of AI technologies within the financial network.

Interdependence fostered by shared Artificial Intelligence systems creates algorithmic coupling, increasing systemic risk within the financial network. This effect is particularly pronounced for larger banks; analysis indicates a Return on Equity (ROE) spillover coefficient of 3.13 for these institutions. This suggests that a positive shock to the ROE of one large bank, facilitated by AI adoption, can propagate to others at over three times the initial magnitude, amplifying potential instability across the network. The observed coefficient highlights the potential for correlated failures stemming from shared algorithmic infrastructure and the increased sensitivity of larger banks to the performance of their peers.

A Two-Tier System Emerging: Disparities in Adoption

The financial landscape is poised for a significant shift, with research indicating that larger banking institutions are substantially better equipped to leverage the transformative power of Generative AI. This advantage isn’t merely incremental; it suggests a developing ‘Two-Tier Banking System’ where a handful of major players pull ahead in efficiency, innovation, and profitability. These institutions possess the existing technological infrastructure, data resources, and specialized talent necessary to rapidly integrate and scale AI solutions – from enhanced customer service and fraud detection to more accurate risk assessment and personalized financial products. Consequently, smaller banks, lacking comparable resources, risk falling behind, potentially leading to increased market concentration and reduced competition within the financial sector. This disparity in AI adoption isn’t simply a matter of technological advancement; it represents a fundamental reshaping of the competitive dynamics within banking, with long-term implications for financial stability and access to services.

Analysis reveals a significant ‘Implementation Tax’ associated with adopting Generative AI, impacting smaller banks far more acutely than their larger counterparts. This disparity stems from the substantial upfront investments in infrastructure, talent acquisition, and data management required to effectively integrate these technologies. Consequently, smaller banks experienced a 517 basis point decline in Return on Equity (ROE) following AI implementation, a stark contrast to the 129 basis point decline observed in larger banks. This widening gap in financial performance underscores a growing imbalance in efficiency and competitiveness within the banking sector, potentially solidifying the position of larger institutions and creating a two-tiered system where smaller banks struggle to keep pace with innovation.

The observed disparity in returns following Generative AI implementation underscores a critical need for proactive policy interventions. Without careful consideration, the benefits of these advanced technologies risk accruing disproportionately to larger financial institutions, potentially exacerbating existing inequalities and fostering increased financial concentration. Policymakers must prioritize strategies that democratize access to AI tools and resources for smaller banks, perhaps through subsidized adoption programs or the development of shared infrastructure. Addressing this imbalance isn’t simply about leveling the playing field; it’s about safeguarding the stability and inclusivity of the financial system as a whole, ensuring that innovation serves a broad range of institutions and, ultimately, their customers.

Tracing the Digital Footprint: Data-Driven Insights

A detailed examination of Securities and Exchange Commission (SEC) filings provides a unique lens through which to track the burgeoning adoption of Generative AI within the banking sector. This methodology moves beyond broad industry reports by pinpointing specific institutions actively investing in and deploying these technologies. Researchers analyze textual data within 10-K reports, risk disclosures, and investor presentations to identify explicit mentions of Generative AI initiatives – from customer service chatbots and fraud detection systems to algorithmic trading platforms and risk modeling applications. This granular approach reveals not only which banks are embracing AI, but also the specific areas of implementation and the associated financial commitments, offering a far more nuanced understanding of technological diffusion than previously available. The resulting data illuminates a dynamic landscape of innovation, highlighting early adopters, emerging trends, and the pace at which Generative AI is reshaping the financial services industry.

A comprehensive understanding of Generative AI adoption within banking extends beyond simply identifying which institutions are implementing the technology; a robust financial health assessment is crucial. Researchers correlate data gleaned from regulatory filings – specifically, FR Y-9C reports detailing bank holdings and activities – with each institution’s Tier 1 capital ratio, a key measure of financial strength. This pairing allows for a nuanced evaluation of risk; banks with stronger capital positions appear better equipped to absorb the costs and navigate the uncertainties associated with integrating novel technologies like Generative AI. Conversely, institutions with lower ratios may face increased vulnerability, suggesting a more cautious approach to AI implementation is warranted. This analytical framework provides stakeholders with a valuable tool for gauging the sustainability and potential impact of AI-driven innovation across the banking landscape.

Successful integration of Generative AI within banking isn’t simply about adopting a new technology; it fundamentally relies on pre-existing levels of digitalization. Institutions with robust digital infrastructure – encompassing data management systems, cloud computing capabilities, and automated processes – demonstrate a significantly higher capacity to effectively leverage AI’s potential. These banks aren’t starting from scratch; they possess the foundational elements necessary to ingest, process, and utilize the vast datasets required to train and deploy Generative AI models. Consequently, digitalization acts as a critical enabler, transforming theoretical AI benefits into tangible improvements in operational efficiency, risk management, and customer service – while those lacking such infrastructure face substantial hurdles in realizing similar gains.

The study illuminates a crucial temporal dynamic within complex systems-specifically, how initial decreases in productivity, stemming from generative AI implementation costs, are ultimately offset by positive network spillovers. This echoes Albert Camus’ observation: “The only way to deal with an unfree world is to become so absolutely free that your very existence is an act of rebellion.” The ‘rebellion’ here is the systemic adaptation to technological advancement. While initial costs represent a temporary ‘decay,’ the resulting algorithmic coupling and increased systemic risk, as identified by the research, demonstrate that even improvements age faster than expected, requiring constant recalibration and proactive regulatory responses to maintain stability within the financial network.

The Long Game

The observed initial dip in productivity following generative AI adoption is less a paradox and more a predictable phase. Every architecture lives a life, and this paper illuminates the costly adolescence of algorithmic integration within the banking sector. The focus now shifts from quantifying immediate gains to understanding the accumulating effects of systemic coupling. Spatial econometrics offer a snapshot, but the true measure lies in observing how these networks evolve-and inevitably, how they begin to fray.

Current regulatory frameworks, designed for a world of discrete risk, struggle to address the emergent properties of tightly-knit algorithmic systems. The question is not whether these couplings will amplify shocks, but rather, what form those amplifications will take. Improvements age faster than one can understand them; thus, a static approach to oversight is inherently self-defeating. Future research must prioritize dynamic modeling, attempting to anticipate-however imperfectly-the fault lines that will appear as these networks mature.

The findings here suggest that the innovation tax isn’t merely a financial burden, but a temporal one. The costs of integration are paid in the present, while the benefits-and the risks-accumulate over longer horizons. It remains to be seen whether the resulting system will age gracefully, or succumb to the inevitable entropic forces that govern all complex systems.

Original article: https://arxiv.org/pdf/2602.02607.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- What time is It: Welcome to Derry Episode 8 out?

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

- Donald Glover’s Canceled Deadpool Show: A Missed Opportunity For Marvel & FX

- The dark side of the AI boom: a growing number of rural residents in the US oppose the construction of data centers

2026-02-04 12:28