Author: Denis Avetisyan

A new approach to Bitcoin price prediction leverages the combined strengths of multiple machine learning models to achieve significantly improved accuracy.

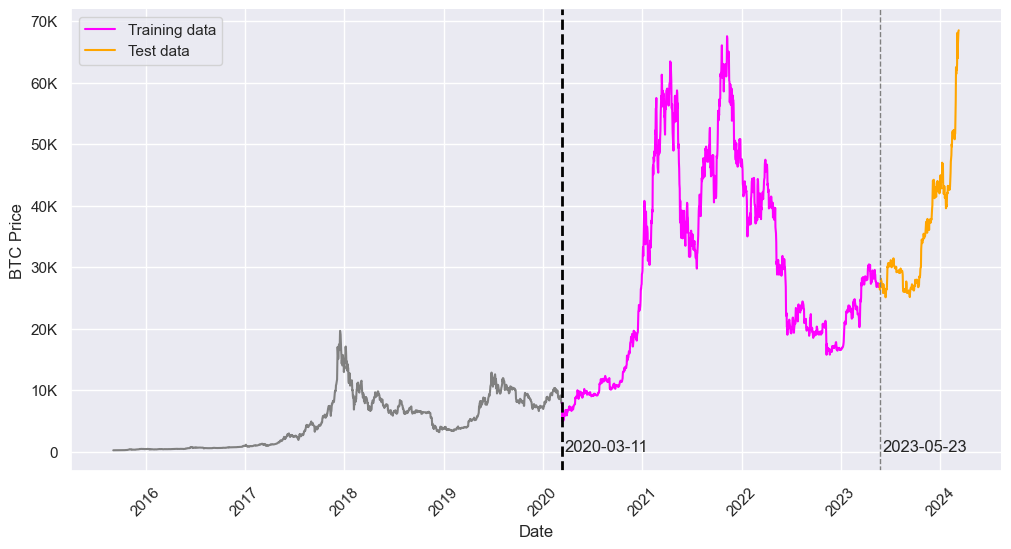

This review details a Combinatorial Fusion Analysis technique that outperforms individual models and prior research in forecasting Bitcoin prices, as measured by RMSE and MAPE.

Accurate financial forecasting remains a persistent challenge despite advances in machine learning. This paper, ‘Bitcoin Price Prediction using Machine Learning and Combinatorial Fusion Analysis’, introduces a novel approach to Bitcoin price prediction leveraging Combinatorial Fusion Analysis (CFA) to integrate the strengths of diverse models. Results demonstrate that CFA significantly improves prediction accuracy, achieving a Mean Absolute Percentage Error (MAPE) of 0.19% and outperforming both individual models and existing benchmarks. Could this model fusion technique unlock more robust and reliable forecasting across other volatile financial markets?

The Foundation of Decentralized Trust

Bitcoin’s inception represented a significant departure from established financial norms by introducing a purely peer-to-peer electronic cash system. Traditional models rely on centralized intermediaries – banks and financial institutions – to validate and process transactions, creating potential points of control, failure, and associated fees. Bitcoin, however, eliminates these intermediaries, allowing individuals to transact directly with one another. This disintermediation is achieved through a distributed network where transactions are verified by network participants, rather than a central authority. The system’s design directly challenges the conventional dependence on trust in these institutions, instead building trust through cryptographic proof and a publicly auditable, decentralized ledger. This innovative approach aimed to create a more resilient, transparent, and potentially more equitable financial system, accessible to anyone with an internet connection.

Bitcoin’s security isn’t guaranteed by a central authority, but rather through a sophisticated interplay of cryptography. Each transaction is secured using digital signatures, a mathematical scheme ensuring only the rightful owner can authorize a transfer. This is further reinforced by a ‘Proof-of-Work’ mechanism, which demands significant computational effort to validate transactions and add them to the blockchain. This process, akin to solving a complex puzzle, deters malicious actors from attempting to tamper with the transaction history, as the cost of doing so would be prohibitively high. Effectively, this cryptographic foundation transforms Bitcoin into a self-defending system, where security is intrinsically linked to the network’s collective computational power and the inherent difficulty of reversing verified transactions.

At the heart of Bitcoin lies blockchain technology, a fundamentally new approach to record-keeping. This isn’t a centralized database held by a single entity, but rather a distributed ledger replicated across a vast network of computers. Each ‘block’ contains a batch of transaction data, cryptographically linked to the preceding block, forming a continuous, chronological ‘chain’. This structure, coupled with cryptographic hashing, ensures immutability; altering any past transaction would require recalculating all subsequent hashes – a computationally prohibitive task. Consequently, the blockchain offers unparalleled transparency, as all transactions are publicly verifiable, while simultaneously preventing tampering and establishing a secure, auditable record of every Bitcoin exchange. The distributed nature also eliminates a single point of failure, bolstering the system’s resilience and fostering trust in a decentralized environment.

The Challenge of Predicting Market Volatility

Accurate Bitcoin price prediction is fundamentally important for multiple stakeholders in the cryptocurrency market. Investors utilize predictive models to inform asset allocation decisions and maximize returns, while traders rely on these forecasts to execute short-term trading strategies and profit from price fluctuations. Effective risk management, both for individual portfolios and institutional holdings, necessitates the ability to anticipate potential price declines and implement appropriate hedging strategies. Furthermore, accurate predictions contribute to market stability by reducing volatility stemming from uncertainty and allowing for more informed capital deployment; the potential financial implications of inaccurate forecasts can be substantial, leading to significant losses for individuals and systemic risk within the broader financial ecosystem.

Traditional time series models, such as ARIMA and Exponential Smoothing, are frequently employed as initial benchmarks for Bitcoin price forecasting due to their established methodologies and relative simplicity. However, these models often demonstrate limited efficacy when applied to Bitcoin data. This is primarily because Bitcoin’s price is not stationary – it lacks a constant mean and variance over time – violating a key assumption of these models. Furthermore, Bitcoin’s price is influenced by a multitude of factors beyond historical price data, including market sentiment, regulatory news, technological advancements, and macroeconomic indicators, all of which contribute to non-linear and volatile price movements that traditional linear time series models struggle to adequately capture. Consequently, forecasts generated by these methods often exhibit significant errors and lack predictive power in the dynamic Bitcoin market.

Long Short-Term Memory (LSTM) networks and Convolutional Neural Networks (CNNs) are increasingly utilized in Bitcoin price forecasting due to their capacity to process sequential data and identify non-linear relationships. LSTMs, a type of recurrent neural network, excel at capturing temporal dependencies within historical daily Bitcoin price data, addressing the limitations of traditional time series models which often assume linearity. CNNs, commonly employed in image recognition, can be adapted to analyze price charts as pseudo-images, identifying patterns and features indicative of future price movements. Both methods require substantial datasets of historical prices, trading volume, and potentially other relevant indicators; however, their ability to automatically learn complex patterns from data differentiates them from methods requiring manual feature engineering. Evaluation metrics typically include Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), and directional accuracy to assess predictive performance.

Cognitive Feature Aggregation: Harnessing Diversity for Accuracy

Cognitive Feature Aggregation (CFA) is a Bitcoin price prediction methodology that moves beyond simple averaging or weighted averaging of individual models. Instead, CFA dynamically combines predictions from multiple models – each representing a distinct forecasting approach – to create a composite prediction. This is achieved through a process that identifies and leverages the unique strengths of each model, effectively reducing the overall prediction error. Unlike traditional ensemble methods, CFA doesn’t assume all models contribute equally; rather, it intelligently weights contributions based on their individual performance characteristics and, crucially, their dissimilarity to other models in the ensemble. This intelligent combination aims to capitalize on cognitive diversity, enhancing the robustness and accuracy of Bitcoin price forecasts.

Cognitive Diversity, as applied within the CFA framework, is quantified through the correlation of prediction errors generated by individual models. Specifically, the dissimilarity between models is measured by calculating the Pearson correlation coefficient between their respective error vectors; lower correlation values indicate greater cognitive diversity. This metric is then used to weight the contributions of each model within the aggregation process, prioritizing those with lower correlations to maximize the ensemble’s predictive power. The rationale is that models which make uncorrelated errors are more likely to offer complementary insights, reducing overall prediction error and improving forecasting accuracy compared to ensembles of highly correlated models.

The performance of Cognitive Feature Aggregation (CFA) is directly dependent on the Rank Score Characteristics (RSC) of the constituent models; these characteristics quantify how consistently a model ranks potential outcomes. CFA prioritizes combining models exhibiting diverse RSC profiles, as models that consistently agree on predictions offer limited incremental value. Specifically, CFA benefits from models that assign different ranks to the same potential outcomes, increasing the overall predictive robustness by leveraging a broader range of perspectives. A higher degree of dissimilarity in RSC among the models used within CFA correlates with improved forecasting accuracy, as it indicates a more comprehensive exploration of the solution space and reduces the risk of systematic errors.

Rigorous evaluation of the Cognitive Feature Aggregation (CFA) model utilized Root Mean Squared Error (RMSE) and Mean Absolute Percentage Error (MAPE) as key performance indicators. Results demonstrated a MAPE of 0.19%, indicating a substantial improvement in forecasting accuracy. This figure represents a significant reduction compared to previously published studies, which reported MAPE values ranging from 0.245% to 4.49%. Correspondingly, the achieved RMSE of 175.22 was markedly lower than the RMSE values obtained from the individual base models, which averaged 738.21. These metrics collectively validate the efficacy of CFA in enhancing the precision of Bitcoin price predictions.

Evaluation of the Cognitive Feature Aggregation (CFA) model demonstrates a substantial improvement in forecasting accuracy when compared to existing methodologies. Specifically, CFA achieved a Mean Absolute Percentage Error (MAPE) of 0.19%, which represents a significant reduction from the range of 0.245% to 4.49% reported in prior studies. Furthermore, the Root Mean Squared Error (RMSE) obtained with CFA was 175.22, considerably lower than the RMSE values observed in the base models used for comparison, which averaged 738.21. These metrics indicate a measurable and statistically relevant enhancement in predictive performance through the implementation of the CFA approach.

Refining the Signal: Technical Indicators and Future Implications

Prediction models for Bitcoin price movements benefit significantly from the incorporation of established technical indicators. By layering data from instruments like the Exponential Moving Average (EMA) and the Moving Average Convergence Divergence (MACD) onto daily Bitcoin price data, analysts can gain a more nuanced understanding of market trends and potential reversals. EMA, which emphasizes recent price data, helps identify short-term trends, while MACD highlights the relationship between two moving averages, signaling potential buy or sell opportunities. This integration doesn’t merely add complexity; it provides additional dimensions for the model to analyze, potentially distinguishing genuine price signals from random fluctuations and increasing the accuracy of forecasts. The resulting systems can move beyond simple price history, incorporating momentum and trend information to provide a more holistic and informed prediction.

Technical indicators function as vital tools for discerning patterns within the volatile Bitcoin market, ultimately sharpening a prediction model’s foresight. Exponential Moving Averages (EMAs) smooth out price data to reveal the direction of a trend, while the Moving Average Convergence Divergence (MACD) highlights shifts in momentum, pinpointing potential buy or sell signals. By analyzing these indicators in conjunction with historical price data, the model gains the ability to anticipate not only the continuation of established trends, but also crucial turning points where price direction is likely to change. This enhanced sensitivity allows for more informed decision-making, potentially leading to improved accuracy in forecasting Bitcoin’s complex price fluctuations and capitalizing on emerging opportunities.

Combining Complex Feature Aggregation (CFA) with established technical indicators represents a significant step toward more nuanced Bitcoin price prediction. This approach moves beyond relying solely on historical price data by incorporating insights derived from indicators like Exponential Moving Averages and the Moving Average Convergence Divergence. The synergy between CFA – which skillfully distills patterns from multiple sources – and these technical tools allows the system to identify both broad trends and subtle shifts in market momentum. By integrating these diverse signals, the predictive model gains a more comprehensive understanding of Bitcoin’s price dynamics, potentially leading to increased accuracy and reliability in forecasting future price movements and offering enhanced capabilities for automated trading strategies.

The study demonstrates a robust performance of the Collective Forecasting Algorithm (CFA) when incorporating weighted rank combinations based on diversity strength. Across a rigorous testing period of 292 days, CFA demonstrably improved its predictive accuracy on 258 of those days. This consistent outperformance suggests the algorithm effectively leverages the strengths of diverse forecasting models while minimizing the impact of correlated errors. By prioritizing forecasts from models that offer unique perspectives, the weighted rank combination method effectively refines the overall predictive signal, establishing CFA as a reliable tool for time-series forecasting and analysis within dynamic financial environments.

The integration of refined predictive models, leveraging techniques like the Composite Feature Algorithm, extends beyond mere forecasting accuracy and carries significant implications for the broader cryptocurrency ecosystem. Algorithmic trading strategies can be substantially improved, enabling more efficient price discovery and liquidity provision, while simultaneously reducing the potential for manipulative practices. Crucially, enhanced prediction capabilities contribute to more robust risk management protocols for investors and institutions, mitigating potential losses during periods of high volatility. This, in turn, fosters greater confidence in Bitcoin and other cryptocurrencies, potentially attracting wider adoption and contributing to increased financial stability within this rapidly evolving digital asset landscape. Ultimately, a more predictable and stable cryptocurrency market benefits all participants and promotes the long-term viability of blockchain technology.

The pursuit of accurate Bitcoin price prediction, as detailed in this study, echoes a fundamental tenet of mathematical rigor. The demonstrated improvement achieved through Combinatorial Fusion Analysis-integrating multiple models rather than relying on a single, potentially flawed approach-highlights the value of systematic validation. This methodical approach mirrors the spirit of Jean-Jacques Rousseau, who observed, “A life lived in conformity with virtue is a life well-lived.” Similarly, a model built on robust, combined analysis, rather than heuristic convenience, strives for a form of ‘correctness’ that transcends mere functional performance, aligning with the core idea of enhancing prediction accuracy through comprehensive model fusion.

What Remains Invariant?

The pursuit of accurate prediction, particularly in a system as deliberately chaotic as a decentralized cryptocurrency market, presents a fundamental challenge. This work demonstrates marginal gains through ensemble methods, but begs the question: Let N approach infinity – what remains invariant? The improvements achieved via Combinatorial Fusion Analysis are, mathematically speaking, bounded by the inherent noise within the data itself. Reducing error metrics like RMSE and MAPE is a local optimization; it does not address the core issue of whether price, as a reflection of collective belief, is truly predictable beyond trivial horizons.

Future research should not solely focus on algorithmic refinement. A more fruitful avenue lies in exploring the limits of predictability. Can information theory, specifically Kolmogorov complexity, be applied to quantify the irreducible randomness of Bitcoin’s price action? The current emphasis on model fusion, while producing incremental improvements, risks obscuring the underlying epistemological problem. The question is not simply how to predict, but whether prediction, beyond a certain granularity, is even possible.

Furthermore, the reliance on historical time series data implicitly assumes stationarity – a dangerous assumption in a rapidly evolving technological and regulatory landscape. A more robust approach might involve integrating exogenous variables – not merely as predictive features, but as indicators of systemic shifts that render past data irrelevant. True progress demands a shift from seeking increasingly complex models to understanding the fundamental constraints on knowledge itself.

Original article: https://arxiv.org/pdf/2602.00037.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- YouTuber streams himself 24/7 in total isolation for an entire year

- Jamie Lee Curtis & Emma Mackey Talk ‘Ella McCay’ in New Featurette

- What time is It: Welcome to Derry Episode 8 out?

- Elizabeth Olsen’s Love & Death: A True-Crime Hit On Netflix

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Southern Charm Recap: The Wrong Stuff

- Now you can get Bobcat blueprint in ARC Raiders easily. Here’s what you have to do

2026-02-03 16:23