In the grand theater of modern finance, where fortunes are made and lost quicker than one can say “blockchain,” there stands a man named Thomas Lee. This esteemed chairman of BitMine, a role he plays with all the gravitas of a Russian prince, has recently taken center stage to ponder the calamity that has befallen the crypto market, akin to the tragic misfortunes of the characters in a Tolstoy novel.

‘The Stage is Set for a Dramatic Turnaround’

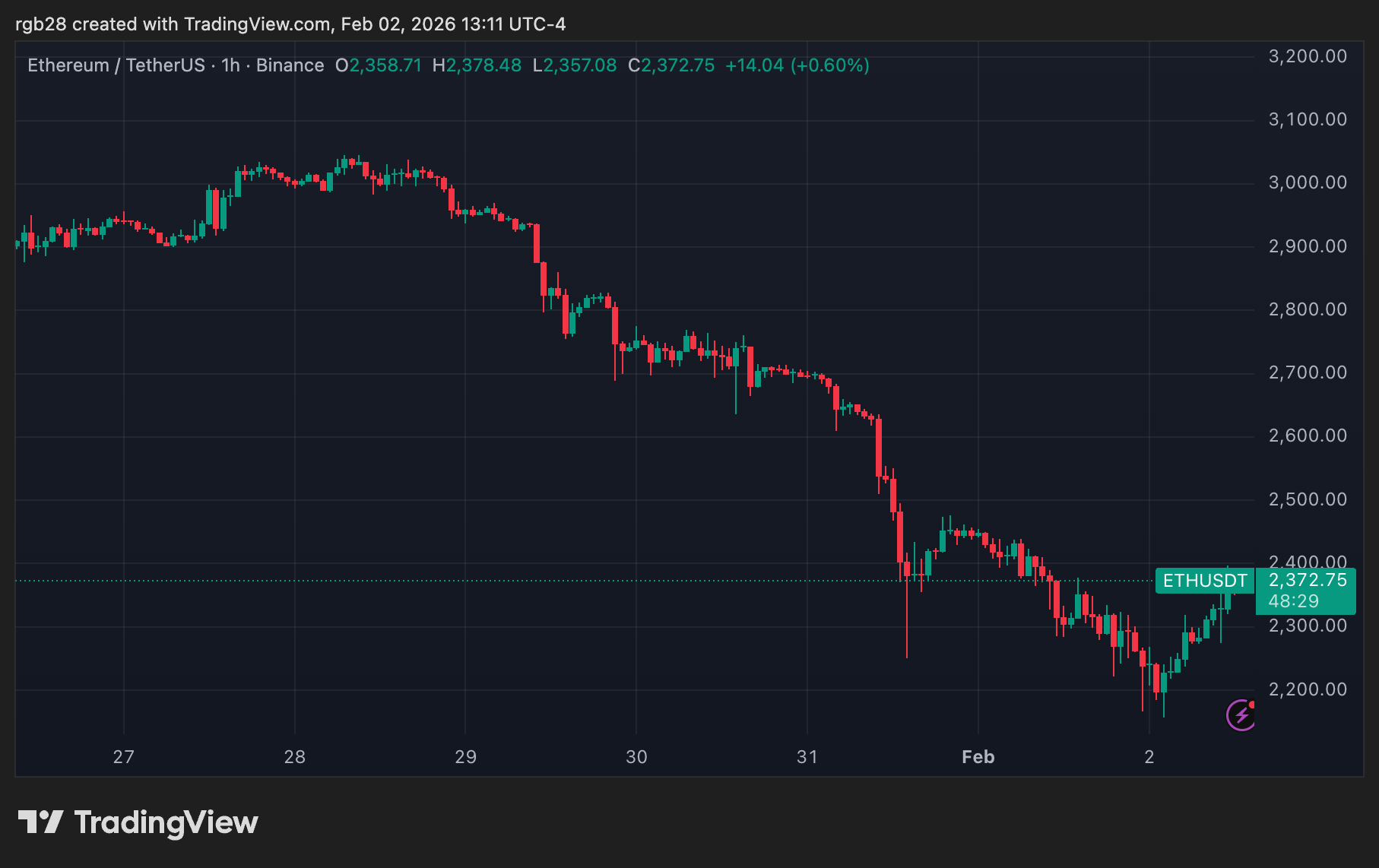

On the bleak Monday morning, reminiscent of the coldest winter in Moscow, Mr. Lee shared his thoughts on the recent market debacle which has, like an unexpected frost, obliterated approximately 13% of the total value of cryptocurrencies over the past week. One might imagine him shaking his head in disbelief, as he condemned the market’s reaction to this calamity as “much worse than expected”-oh, how the mighty have fallen!

In a conversation that could easily be mistaken for a philosophical discourse rather than an economic analysis, he attributed this fall from grace to non-fundamental factors-those pesky little gremlins that meddle in affairs far beyond mere numbers. Among these, he highlighted the absence of leverage-a concept as elusive as happiness in the Russian countryside. “We sort of deleveraged in October,” he mused, “and now we feel the aftershocks.”

Moreover, as if adding salt to an already festering wound, he noted the meteoric rise of precious metals, which has ensnared the risk appetite of investors into a vortex of FOMO-fear of missing out-a sensation all too familiar to anyone who has ever watched a Tolstoy character chase after fleeting happiness.

As if addressing a gathering of mourners at a funeral, he lamented the geopolitical tensions and regulatory uncertainties looming over the United States, stating, “There’s a lot of uncertainty because of Washington picking winners and losers.” A situation so reminiscent of a Tolstoy saga, where characters are often caught in the web of fate woven by those in power.

Yet, beneath the shroud of despair, Mr. Lee articulated a glimmer of hope, asserting that the fundamentals of crypto remain robust. “All the pieces are in place for crypto to be bottoming right now,” he declared, like a prophet proclaiming the coming of spring after a harsh winter.

BitMine’s Heart Lies with Ethereum

In a twist that would make even the most astute observer raise an eyebrow, Mr. Lee also turned his attention to Ethereum, whose on-chain activity has flourished despite the market’s descent into chaos. In his reflection on the past winters of crypto-those bleak periods of 2021-2022 and 2018-2019-he noted that, unlike then, Ethereum’s vitality continues to thrive. “We see a heartbeat where others see a tomb,” he seemed to suggest.

BitMine, that mighty titan in the world of crypto treasuries, has continued to bet on Ethereum throughout this turbulent phase. Recently, they announced their acquisition of 41,788 ETH, amounting to $110 million-a sum that could purchase a small estate in the countryside, yet here it sits within the digital void, a testament to their unwavering faith.

Even as the specter of unrealized losses loomed large, threatening to engulf the company in historical infamy, Mr. Lee remained undaunted, asserting, “We view this pullback as attractive.” Indeed, he believes that the current price of ETH is not reflective of its utility-an assertion that might prompt one to ponder the deeper mysteries of value in both finance and life itself.

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- YouTuber streams himself 24/7 in total isolation for an entire year

- What time is It: Welcome to Derry Episode 8 out?

- James Cameron Gets Honest About Avatar’s Uncertain Future

- 8 Tim Burton Movies That Still Hold Up as Gothic Masterpieces

- Every Sarah Paulson Performance in a Ryan Murphy Show, Ranked

- Jane Austen Would Say: Bitcoin’s Turmoil-A Tale of HODL and Hysteria

- Now you can get Bobcat blueprint in ARC Raiders easily. Here’s what you have to do

2026-02-03 15:27