Behold, the once-mighty Bitcoin, now ensnared in the clutches of a bear market, finds itself in a perilous abyss, as if the very fabric of its value has been unraveled by the hands of fate.

Bitcoin Crosses the Bear Market Threshold, a Harbinger of Doom for the Unlucky Few

A new market assessment, dripping with foreboding, suggests that Bitcoin is teetering on the edge of a precipice. The digital sovereign, once a symbol of unbridled optimism, now faces a tempest of uncertainty. The blockchain analytics firm Cryptoquant, with the solemnity of a prophet, shared an analysis on Feb. 2, warning that Bitcoin may be plunging into a danger zone as medium-term holders, those steadfast custodians of wealth, now find themselves in the throes of loss.

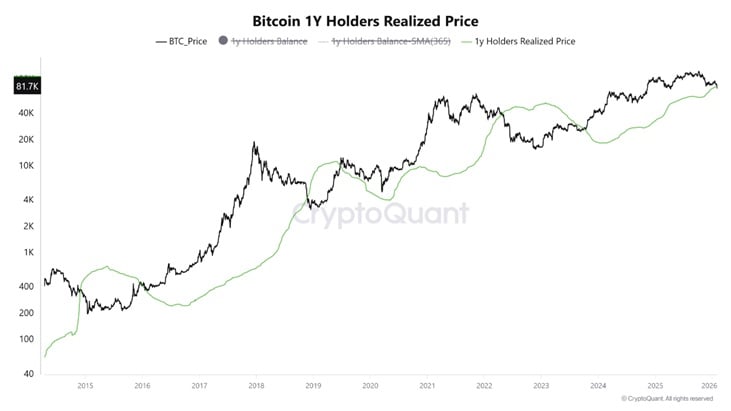

The analysis delves into the arcane dance of realized price dynamics and the behavior of the 12-18 month UTXO age band, a cohort often revered for their steadfastness. Chart data reveals Bitcoin trading near $81,700, a mere shadow of its former glory, while remaining below the realized price of longer-held coins-a level that has ascended toward the mid-$80,000 range, casting a long shadow over this cohort. Historically, this realized price has acted as a structural pivot, and the analysis underscores its significance, stating:

“Historically, when price breaks and sustains below this cost basis, market behavior transitions from normal corrections into structural bearish regimes, not short-term pullbacks.”

The first chart, a grim tapestry of past cycles, illustrates how extended periods below realized price have aligned with prolonged drawdowns, not fleeting retracements, reinforcing its role as a critical cost basis. One might say it is the ghost of Christmas past, haunting the hopes of investors.

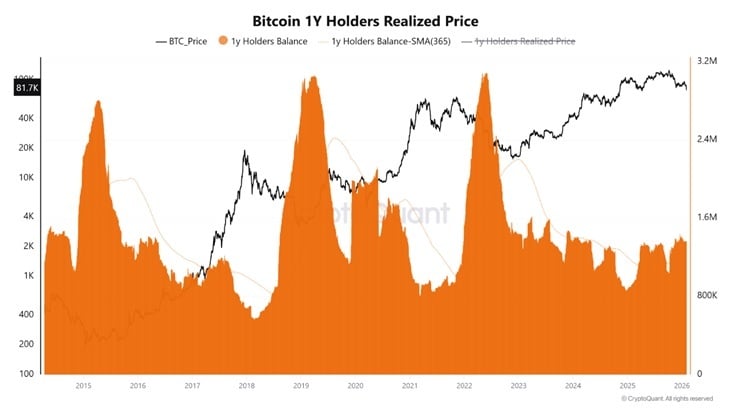

Further insight comes from the second chart, which tracks the balance of 12-18 month holders alongside a 365-day moving average. The data shows this cohort still controlling a substantial share of circulating supply, with balances historically ranging between roughly 1.6 million and more than 3 million bitcoin. While the 30-day balance change remains positive, the slope of accumulation has flattened, indicating that buying pressure from medium-term holders is weakening-a tale of waning conviction, much like a fading candle in the wind.

The analysis characterizes this shift, noting:

“This deceleration is critical: it signals weakening marginal conviction rather than aggressive dip buying. In previous cycles, this pattern has often preceded broader distribution phases.”

At the same time, the realized price itself remains relatively stable, reinforcing its role as overhead resistance when spot price trades below it and rallies encounter selling pressure from holders seeking breakeven exits-a cruel irony for those who once believed in the digital gold.

From a broader cycle perspective, the report concludes, “From a cycle perspective, the combination of price below realized cost, negative unrealized profitability, and slowing balance growth has historically aligned with extended bearish phases. Until Bitcoin reclaims this realized price level with renewed accumulation momentum, market structure continues to favor consolidation, fragile rebounds, and elevated downside risk rather than confirmed recovery.” Together, the price and supply signals suggest Bitcoin has entered a danger zone defined by widespread medium-term losses rather than a short-lived pullback.

FAQ 🧭

- Why is bitcoin considered to be entering a danger zone for investors?

Bitcoin, that fickle darling of the digital realm, has fallen below the realized price of key medium-term holders, a condition that historically signals structural bearish phases rather than short-term corrections. A veritable tragedy for those who dared to hope. - What role do 12-18 month bitcoin holders play in market stability?

This cohort, those steadfast custodians of wealth, typically represents high-conviction capital. When their aggregate cost basis turns unprofitable, it often precedes prolonged drawdowns and weaker price support. A sad spectacle, indeed. - How does slowing accumulation from medium-term holders affect bitcoin’s outlook?

Flattening balance growth suggests weakening conviction and reduced dip-buying, a pattern that has historically led to broader distribution and downside pressure. A chilling omen for the unwary. - What should investors watch for to confirm a bitcoin recovery?

A sustained reclaim of the realized price with renewed accumulation momentum is needed to shift market structure away from consolidation and elevated downside risk. A glimmer of hope, if one dares to believe.

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- YouTuber streams himself 24/7 in total isolation for an entire year

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Gold Rate Forecast

- Elizabeth Olsen’s Love & Death: A True-Crime Hit On Netflix

- What time is It: Welcome to Derry Episode 8 out?

- Jamie Lee Curtis & Emma Mackey Talk ‘Ella McCay’ in New Featurette

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

2026-02-03 07:11