Ah, memecoins-those cheeky little tokens that made us all dream of early retirement, only to pull the rug out from under us at the most inconvenient moment. Yes, folks, 2025 has proven to be a most challenging year for our beloved meme-driven cryptocurrency market. Prices have plummeted, and all the while, a glorious $1.7 billion worth of long positions went down in flames, with Coinglass playing the part of the bearer of bad news today. What a lovely day for liquidations!

The data is absolutely breathtaking: $1.7 billion worth of leveraged positions vaporized, leaving traders holding onto their virtual wallets and contemplating life choices. Naturally, this has wreaked havoc across the board, including the memecoin sector. As macroeconomic uncertainty takes a lovely stroll through the market, investor sentiment has decided to take a sharp nosedive.

Liquidations, Memecoins, and More Liquidations

Now, if you’re wondering what exactly caused this delightful dip, look no further than the staggering $1.7 billion in long liquidations within just 24 hours-the largest liquidation event of the year. The memecoin market, always a volatile beast, found itself nestled among heavyweights like Bitcoin, Ethereum, and Solana on the Coinglass liquidation list. Oh, how they suffer together!

Dogecoin, our faithful Shiba Inu mascot of the crypto world, was among the biggest losers, claiming the fifth spot with over $60 million in liquidations-despite all that ETF hype. If only excitement could pay the bills, right?

Meanwhile, other memecoins weren’t exactly enjoying a spa day either. PEPE, the meme frog, saw a meager $5 million vanish, while PUMP-famous for minting successful memes on Solana-had $12 million disappear into the ether. Such a tragic and entirely avoidable disaster. It’s almost like the universe is mocking us.

Oh, Memecoin, Why Have You Forsaken Us?

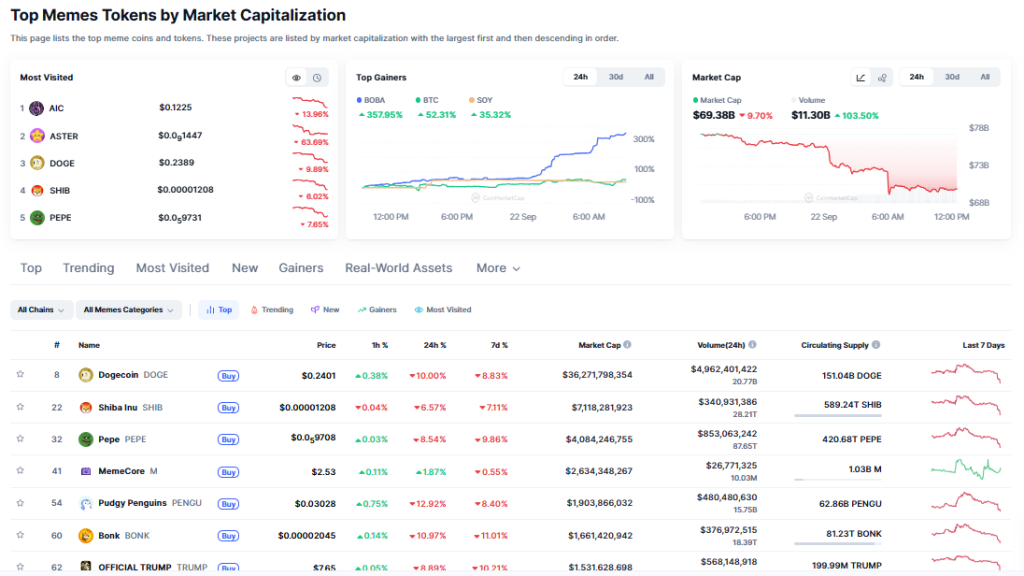

According to CoinMarketCap, the meme market cap dipped by 10% intraday to a paltry $69.38 billion. The sad red chart lines everywhere are a testament to the crumbling of what was once a bright future. Dogecoin bore the brunt of the damage, but Shiba Inu, PEPE, PENGU, BONK, and even TRUMP-all the usual suspects-suffered double-digit declines. It’s like watching a whole family of overhyped tokens march to their doom.

The selloff has undone weeks of gains. One minute you’re riding high on those speculative rallies, the next, you’re staring at the wreckage. The lesson? Don’t get too attached to things that have the financial stability of a house made of cards.

Traders, not surprisingly, cite weak momentum and profit-taking as contributors to the carnage. That, and the lovely backdrop of macroeconomic woes.

The Fed, Bond Yields, and a Dismal Forecast

Ah, yes, the Federal Reserve-the gift that keeps on giving. Initially, the rate cut was a hopeful glimmer of light for risky assets. But alas, the market quickly adjusted its gaze to the ever-so-charming upcoming U.S. economic data releases. With Fed Chair Jerome Powell set to speak and Q2 GDP plus August inflation figures looming, it’s a race to see whether traders will even bother making fresh positions. Will they, or will they wait for the other shoe to drop? Place your bets!

On the global stage, bond yields have become the true villains of the story, consistently sending Bitcoin and altcoins packing. If the U.S. Treasury’s 2-year yields dip further, we could see a shift in the global capital dance, and you guessed it-the crypto market, including our dear memecoins, will be swept up in the drama.

The Forecast? Buckle Up, It’s Going to Be Bumpy

Short-term sentiment? Not exactly a rose garden. Even with the pullback, some traders cling to the faint hope that easing bond yields and a more favorable Fed policy might give memecoins a chance to rise from the ashes. However, the largest liquidation event of the year serves as a reminder that memecoins are particularly sensitive to the whims of broader market forces.

Lesson 2: Crypto follows macro conditions, not just hype.

We’ve had amazing crypto news – Strategic Bitcoin Reserve, pro-crypto presidency.

But prices are still down because of macro money conditions.

Less money in the economy means less money for risky assets like crypto.– Ben Simpson (@bensimpsonau) September 22, 2025

In the end, the memecoin market is a beautiful mess of liquidations, economic pressure, and profit-taking. Traders are watching key levels closely, wondering if this dip is just another blip or the beginning of a grander, more tragic correction.

Read More

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- James Cameron Gets Honest About Avatar’s Uncertain Future

- Player 183 hits back at Squid Game: The Challenge Season 2 critics

- Which hero to choose in Anno 117? Your decision determines what story you get

- BTC’s Descent: Traders Prepare for a Bitter New Year ❄️📉

- Save Up To 44% on Displate Metal Posters For A Limited Time

- Margot Robbie Has Seen Your Wuthering Heights Casting Backlash

- New survival game in the Forest series will take us to a sci-fi setting. The first trailer promises a great challenge

- These are the last weeks to watch Crunchyroll for free. The platform is ending its ad-supported streaming service

2025-09-22 17:52