The Bitcoin price in USD plods along in a polite sulk, a creature of habit with a stubborn streak, clearly reacting to a global mood swing that feels less like a chart and more like a council of wizards arguing about dinner. Bitcoin remains structurally sound in the long game, but capital is elbowing its way into the dependable crowd-precious metals that have the nerve to be traditional stores of value-thereby delaying any dramatic reversal for BTC even as the long-term accumulation pattern raises an eyebrow and says, “Yes, well, carry on.”

Liquidity Rotation Explains Why BTC Price Is Lagging

Right now, the grand jig of macro liquidity makes more sense than a dozen technical wizards waving their wands. Some market watchers whisper that robust Chinese liquidity historically favors GOLD, while stretches of expanding U.S. liquidity tend to give BTC a sympathetic nod. The current mood, however, tilts toward defensive capital allocation, as if the world pressed pause to check if it left the oven on.

As geopolitical tensions and economic unease persist, investors have parked themselves in full risk-off mode, prioritizing capital preservation like a librarian guarding a rare first edition. That’s why Gold and SILVER look irresistible: traditional stores of value, attracting inflows with the confidence of a dragon choosing the shiniest hoard. Central banks and institutional players have also boosted exposure to precious metals, nudging prices toward records while risk assets are left on the shelf with a price tag reading “do not disturb.”

Gold and Silver Lead During Defensive Market Phases

In moments when caution is king, capital rotation tends to favor assets seen as stable and non-correlated. Bitcoin, often chasing the “digital gold” fantasy, is still treated like a risk asset-moreakin to equities than to a treasure chest. Thus, short-term BTC price forecast narratives stay tucked in a drawer during risk-off spells, where uncertainty wears the crown and volatility takes coffee.

Historically, precious metals tend to absorb liquidity first when fear spikes. Only after volatility subsides does capital rotate back into higher-beta assets like Bitcoin. That pattern appears intact. For now, the strength in XAU/USD and XAG/USD has delayed meaningful upside for the BTC price chart.

Silver’s Extreme Volatility Highlights Capital Movement

Recent price action in SILVER has underscored the scale of liquidity currently bypassing crypto markets. Market data suggests Silver swung nearly $2 trillion in market capitalization within a single day, which would make even a magician blush.

Between 9:00 AM and 1:00 PM ET, SILVER added approximately $500 billion in market value. That was followed by a $950 billion drawdown by 4:30 PM ET, before rebounding with another $500 billion inflow later in the session.

This is absolutely insane:

Silver just swung nearly $2 TRILLION of market cap in 14 hours.

Between 9:00 AM ET and 1:00 PM ET, silver added +$500 billion of market cap.

Then, between 1:00 PM ET and 4:30 PM ET, silver lost -$950 billion.

Then, between 4:30 PM ET and 10:30 PM…

– The Kobeissi Letter (@KobeissiLetter) January 27, 2026

Such volatility highlights how capital is swirling within precious metals rather than slipping into BTC during this defensive phase, as if the metals are magnetized to the coins’ more sedentary cousins and BTC is stuck polishing its halo.

BTC Price Structure Remains Supported by Accumulation

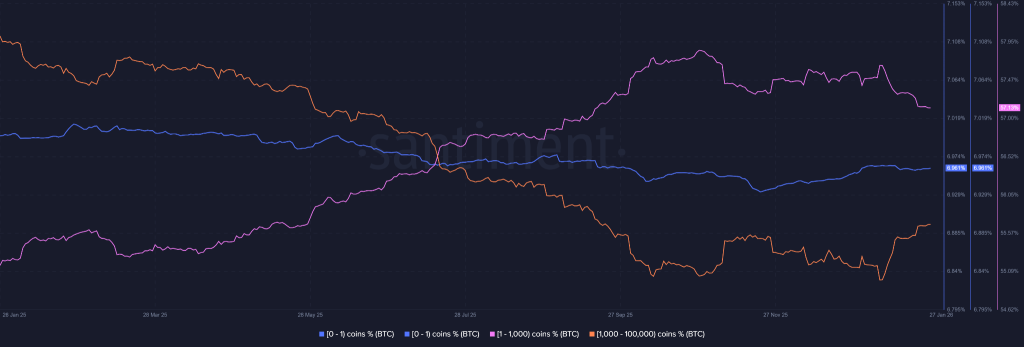

Despite the price lag, on-chain data suggests selling pressure remains modest. Wallets holding between 1,000 and 100,000 BTC keep quietly accumulating, like dwarves lining up to claim a fresh vein. Interestingly, even the smallest holders-addresses holding 0 to 1 BTC-are adding exposure, reinforcing a broad-based accumulation trend.

Meanwhile, addresses holding 1 to 1,000 BTC appear to be the primary sellers. Yet their distributions are being absorbed by both retail participants and larger holders. This is the sort of pattern you see during consolidation, when prices lag behind fundamentals and the cosmos politely applauds the long game.

From an analytical standpoint, this supply behavior hints that once capital rotation begins away from precious metals, BTC may respond with a rapid sprint as sidelined demand stumbles back into the arena.

Capital Rotation May Define the Next BTC Price Phase

That said, continued strength in GOLD and SILVER could still keep BTC in check in the near term. If precious metals keep climbing, Bitcoin may remain range-bound or drift modestly downward without signaling structural weakness-like a bard who loses his trumpet but still knows all the lines by heart.

However, higher metal prices also invite profit-taking. When that happens, historical rotation suggests capital will migrate toward assets like Bitcoin, Ethereum, and other alts. With institutional participation and government-linked accumulation still active, downside risk remains comparatively tempered even during consolidation.

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Answer to “A Swiss tradition that bubbles and melts” in Cookie Jam. Let’s solve this riddle!

- Ragnarok X Next Generation Class Tier List (January 2026)

- Gold Rate Forecast

- Best Doctor Who Comics (October 2025)

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- ‘That’s A Very Bad Idea.’ One Way Chris Rock Helped SNL’s Marcello Hernández Before He Filmed His Netflix Special

- 2026 Upcoming Games Release Schedule

- 9 TV Shows You Didn’t Know Were Based on Comic Books

2026-01-27 17:51