Oh, dear reader! Gather round, for the tale of Hyperliquid (HYPE) unfolds with all the drama of a Russian opera! In this latest act, our protagonist has soared higher than a lark, gaining a staggering 25%-a figure that would make even the most stoic accountant raise an eyebrow. As traders flock to the HIP-3 derivatives markets like crows to shiny objects, one can only wonder if the illustrious whales-those mysterious giants of finance-are up to their usual shenanigans.

Indeed, HYPE now struts among the titans of decentralized exchanges, all while the broader altcoin markets languish in the depths of indecision, as if caught in a particularly tedious ballet. But fear not! This rally does not appear to be a mere figment of speculative fancy; nay, it seems driven by actual usage growth and capital inflows-like a well-prepared borscht simmering with real ingredients instead of mere water!

With volumes and on-chain data now singing a harmonious tune, HYPE dares to trade like a re-rated asset rather than a fleeting fancy. It brings forth the eternal question: is this merely a response to the bustling trading activity, or the dawn of a grand repricing cycle? Only time will tell, and possibly a fortune teller who specializes in crypto.

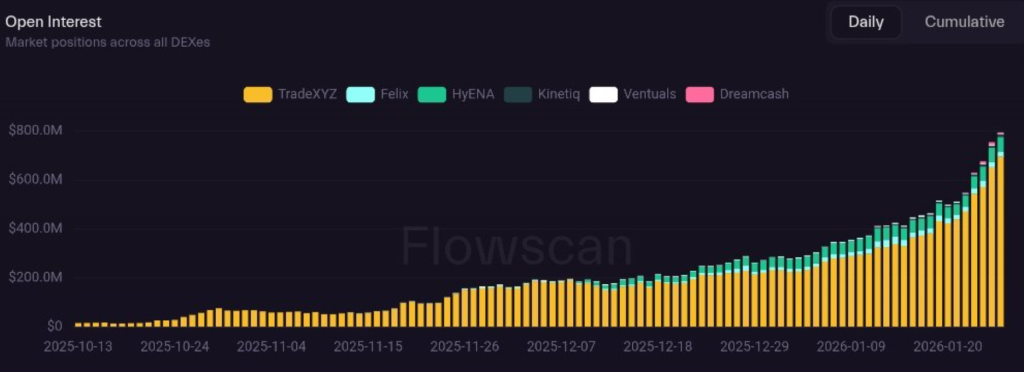

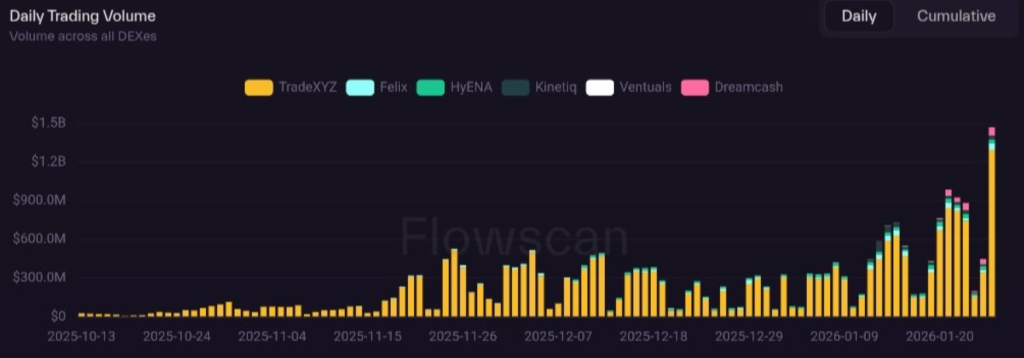

HIP-3 Metrics Activity Signal

Since the grand unveiling of HIP-3, open interest on Hyperliquid has climbed from the proverbial gutter of under $200 million to the lofty heights of $700-800 million. This meteoric rise could make one ponder whether Hyperliquid has lured its users with promises of wealth akin to a magician pulling rabbits from hats. Traders, it seems, are no longer capriciously rotating their capital but have taken up a more serious, long-term approach-like a peasant carefully planting potatoes for the winter.

As if that weren’t enough, daily trading volume has surged past the magical barrier of $1 billion-a number that sounds suspiciously like the budget of a small country! And lo and behold, this heightened activity shows no sign of fading, proving to be as steadfast as a dog guarding its bone. This consistency points to deeper liquidity and broader engagement among the assets supported, which is quite the achievement for any merchant of dreams.

It seems HIP-3 is the mastermind behind this transformation. With enhanced capital efficiency and a veritable buffet of asset support, traders now frolic within Hyperliquid like children in a candy store. The depth of execution has improved, leverage utilization has skyrocketed, and liquidity provision has become so alluring that even the most cautious of whales might find themselves tempted to take the plunge.

What Does Whale Activity Signals?

Now, let us turn our gaze to the mysterious world of our aquatic friends-the whales. On-chain data reveals that one hefty whale has begun to shed a long-held HYPE position after hoarding it for over a year, rather like a miser finally deciding to share his gold coins. Reports indicate the wallet initially spent a princely sum of $2.58 million USDC to acquire 295,917 HYPE at an average price of $8.74, before staking the entire treasure for about 14 moons.

14 months ago, a whale spent 2.58M $USDC to buy 295,917 $HYPE at $8.74 and staked them.

Today, he unstaked and sold the entire position for 7.51M $USDC, realizing a $4.92M profit.

At the peak, his profit exceeded $15M.

– Lookonchain (@lookonchain) January 27, 2026

And what a week it has been! The same wallet has now unstaked and sold its entire bounty for a remarkable $7.51 million USDC, locking in a neat profit of approximately $4.92 million. At the height of this financial opera, the unrealized profit had even surpassed $15 million-a figure that would make any financier swoon with delight! Such distribution reflects a healthy market dynamic where long-term holders indulge in their winnings while fresh capital eagerly gulps down the supply.

HYPE Price Chart Shows Breakout: Major Rally Next?

Alas, dear audience, the HYPE price chart reveals a wondrous spectacle-an audacious breakout from a multi-month falling channel, indicating a shift from the monotonous corrective behavior into a lively trend reversal. This breakout has occurred with a flourish of elevated volume and rising open interest, favoring a bullish outlook that would make even the sunniest Russian summer day seem dreary by comparison. Currently, the HYPE price has soared above both the 20-day and 50-day EMA, boldly marching toward the immediate $30 supply zone, like a gallant knight heading into battle.

Should the HYPE price triumphantly clear the $30 hurdle, a major short-covering rally would send it racing toward $42, followed ever so closely by the tantalizing $50 mark in the near term. However, should it falter at the $30 level, we might see a retest of the $20-$24 zone-an event that would surely send shivers down the spine of many an optimistic trader. In the midst of this cheerful sentiment, Hyperliquid’s current rally may gather even more momentum, continuing to outshine all competitors in the coming days.

FAQs

Why is Hyperliquid (HYPE) price rising sharply right now?

Ah, the age-old question! HYPE is rallying due to surging HIP-3 trading volume, rising open interest, and those enigmatic whale participants, all propelled by genuine platform usage growth.

What is HIP-3 and how does it impact Hyperliquid?

HIP-3 is the secret ingredient that enhances capital efficiency and liquidity on Hyperliquid, attracting larger traders like moths to a flame and boosting derivatives volume across supported markets.

Is Hyperliquid growth driven by speculation or real usage?

The current evidence suggests a hearty mix of real usage growth, as sustained volume and rising open interest point to longer-term positioning rather than fleeting whims of speculation.

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Ragnarok X Next Generation Class Tier List (January 2026)

- Answer to “A Swiss tradition that bubbles and melts” in Cookie Jam. Let’s solve this riddle!

- Gold Rate Forecast

- Best Doctor Who Comics (October 2025)

- 2026 Upcoming Games Release Schedule

- ‘That’s A Very Bad Idea.’ One Way Chris Rock Helped SNL’s Marcello Hernández Before He Filmed His Netflix Special

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- All Songs in Helluva Boss Season 2 Soundtrack Listed

2026-01-27 14:01