My dear reader, the venerable Bitcoin, once strutting about like a peacock in a henhouse, found itself suddenly cast down from its lofty perch of $95,500 to the humble abode of $93,000. A mere trifle in the grand scheme of things, you understand, but the swiftness of the descent was enough to send even the most seasoned traders scurrying for cover, their long contracts dissolving like sugar in tea. The altcoins, poor dears, followed suit with the grace of a penguin on ice, leaving a trail of liquidated dreams in their wake.

A Day of Turbulence and Tattered Portfolios

According to the esteemed CoinGlass, the crypto market’s recent shenanigans have been accompanied by a veritable feast of liquidations. One might imagine the scene as a ballroom of desperate traders, waltzing their way into oblivion as exchanges, with the mercy of a frostbitten penguin, shut down their contracts. Volatility, that old mischief-maker, has once again reigned supreme, and the past 24 hours were a particularly lively soiree of chaos.

In total, the digital asset sector has been left clutching its pearls after a staggering $874 million in liquidations. Of this, the long contracts-those optimistic souls who bet on sunshine-accounted for a rather unflattering $788 million. A lopsided affair, to be sure, but then again, what is finance without a touch of drama?

The cause? Why, the sudden swoon in Bitcoin’s fortunes, of course! From $95,500 to $93,000 in the blink of an eye, and Ethereum not far behind, plummeting from $3,350 to $3,200. A mere trifle in percentage terms, but the speed of it all was enough to send panic rippling through the market like a particularly aggressive game of dominoes.

And what of the source of this tumult? Ah, the ever-lovable Donald Trump, who, with the flair of a Victorian melodrama villain, has declared new tariffs on eight European nations. Denmark, Great Britain, Norway, Sweden, France, Germany, the Netherlands, and Finland-all now face an additional 10% import tariff come February 1st. And if Greenland remains out of reach for Uncle Sam, the tariffs will escalate to 25% by June. A geopolitical soap opera, if ever there was one!

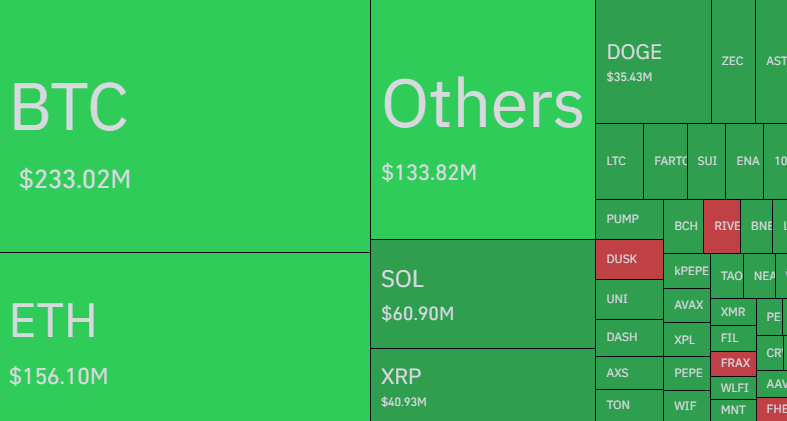

As the heatmap reveals, Bitcoin alone accounted for $233 million in liquidations, while Ethereum, that oft-ignored second son, managed $156 million. Among the altcoins, Solana, XRP, and Dogecoin took the lead in the tragic ballet of losses, with $61 million, $41 million, and $35 million respectively. One might wonder why Solana, despite its smaller stature, outperformed XRP. Ah, but it was the 6% plunge versus a mere 4%-a cruel twist of fate, no doubt.

The Resurgence of Bitcoin: A Fleeting Reprieve?

Bitcoin, ever the resilient showman, has since rebounded slightly, reclaiming $93,100 like a Victorian gentleman retrieving his hat after a tumble. But whether this is a mere intermission or the prelude to another dramatic collapse remains to be seen. For now, the market breathes a sigh of relief, though one suspects the plot thickens with every passing hour.

Read More

- Gold Rate Forecast

- Stranger Things Season 5 & ChatGPT: The Truth Revealed

- Stephen King Is Dominating Streaming, And It Won’t Be The Last Time In 2026

- Fans pay respects after beloved VTuber Illy dies of cystic fibrosis

- AAVE PREDICTION. AAVE cryptocurrency

- Pokemon Legends: Z-A Is Giving Away A Very Big Charizard

- Six Flags Qiddiya City Closes Park for One Day Shortly After Opening

- Mark Ruffalo Finally Confirms Whether The Hulk Is In Avengers: Doomsday

- Bitcoin After Dark: The ETF That’s Sneakier Than Your Ex’s Texts at 2AM 😏

- 10 Worst Sci-Fi Movies of All Time, According to Richard Roeper

2026-01-20 01:43