Author: Denis Avetisyan

A new analysis explores how to optimize liquidity provision in decentralized finance, addressing market impact and the growing threat of stablecoin instability.

This review applies the Kelly Criterion and catastrophe bond principles to improve automated market maker designs and mitigate de-pegging risk in DeFi.

Despite the rapid growth of decentralized finance, prevailing liquidity models often fail to capture realistic market dynamics and inherent risks. This paper, ‘Automated Liquidity: Market Impact, Cycles, and De-pegging Risk’, develops a framework for optimizing liquidity provision using the Kelly Criterion, revealing inefficiencies in constant product market makers and linking stablecoin de-pegging events to catastrophe bond pricing. These findings demonstrate that growth optimization can mitigate systemic risk and provide a novel insurance mechanism for stablecoins facing regulatory constraints. Will this approach pave the way for more robust and resilient automated market infrastructure?

Unveiling the Limits of Simplicity: AMMs and the Illusion of Efficiency

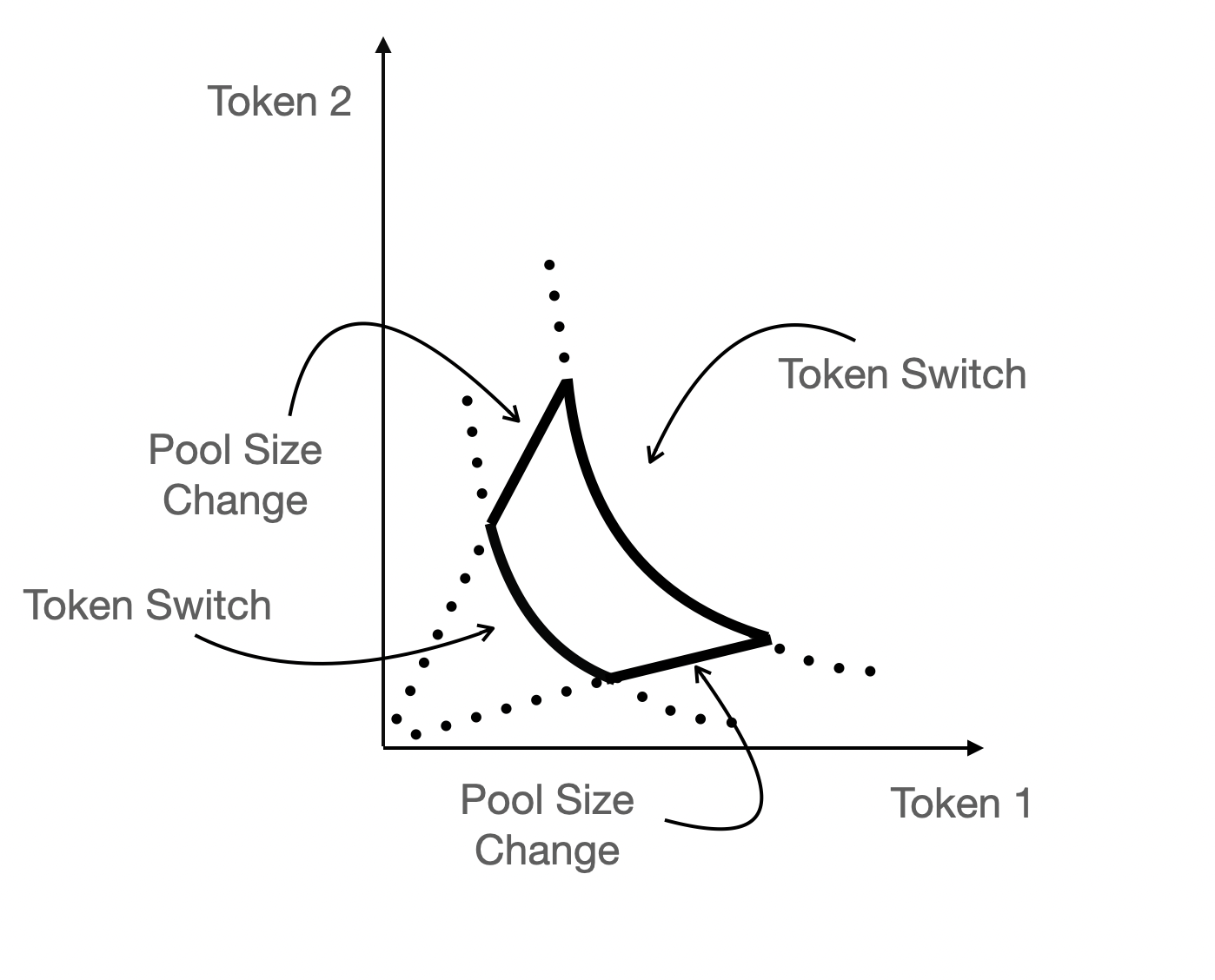

The advent of Automated Market Makers (AMMs), most notably Constant Product Market Makers (CPMMs) like those employing the x*y=k formula, dramatically reshaped decentralized finance (DeFi) by enabling permissionless liquidity provision and trading. However, the very simplicity that propelled their initial success also introduces inherent limitations in modeling price impact. While CPMMs excel at maintaining liquidity under normal conditions, their constant function design struggles to accurately reflect the dynamic shifts caused by substantial trades. This simplification results in price impact models that often underestimate slippage-the difference between the expected price and the actual execution price-particularly for larger transaction sizes. Consequently, traders may experience unfavorable outcomes, and the theoretical efficiency gains of AMMs are diminished as the models fail to capture the full complexity of real-world market interactions.

Existing methods for predicting price impact frequently fall short when confronted with substantial trades within automated market makers. These approaches often rely on simplified assumptions about liquidity distribution and trade execution, failing to account for the dynamic interplay between order size, pool composition, and the resulting price adjustments. Consequently, traders experience suboptimal execution prices and unexpectedly high slippage – the difference between the expected and actual trade price. This discrepancy stems from the fact that large trades disproportionately affect the price, shifting the equilibrium beyond the range accurately modeled by linear or basic curve estimations. The limitations of these traditional models highlight the need for more sophisticated tools capable of capturing the intricacies of large-scale decentralized exchange transactions and minimizing adverse price movements for traders.

The elegance of Constant Function Market Makers (CFMMs) stems from their mathematical simplicity – maintaining a constant value through token swaps. However, this very simplicity introduces limitations when faced with dynamic market conditions. Unlike more sophisticated models, a CFMM’s fixed function – commonly x \cdot y = k – doesn’t inherently account for external factors influencing asset valuation, such as shifts in market sentiment or broader economic trends. Consequently, the model assumes a perfectly balanced exchange, struggling to efficiently manage imbalances caused by large trades or asymmetric information. This inflexibility manifests as significant price impact, particularly for assets with lower liquidity, as the constant function prioritizes maintaining the equation over reflecting true market value, ultimately hindering optimal trade execution and potentially increasing slippage for users.

Beyond Proportionality: Modeling Impact with Reality

The Square Root Market Impact model represents a refinement in understanding price impact by linking it to the behavior of optimal liquidity providers. Unlike linear models which assume price impact is directly proportional to trade size, this model is grounded in the Ornstein-Uhlenbeck (OU) process, a stochastic process used to model phenomena exhibiting mean reversion. This process defines how liquidity providers optimally adjust their quotes in response to trades, leading to an impact that scales with the square root of the trade quantity ΔP ∝ σ²/k√Q, where σ represents volatility, k is a liquidity coefficient, and Q is the trade quantity. By basing impact on this modeled liquidity provider behavior, the Square Root model provides a more nuanced and theoretically sound approach compared to simpler proportional impact assumptions.

The Square Root Market Impact model deviates from linear price impact assumptions by positing a relationship where price change (ΔP) scales with the square root of trade quantity (Q). This is mathematically represented as ΔP ∝ σ²/k√Q, where σ² represents volatility and k is a constant reflecting liquidity. This formulation indicates that increasing trade size yields diminishing returns in terms of price impact; doubling the trade quantity does not double the price change, but rather increases it by a factor of √2. This non-linear scaling is rooted in the model’s foundation of optimal liquidity provision, contrasting with simpler models that assume a direct proportionality between trade size and price movement.

The Hurst Exponent, a measure of long-term memory in time series data derived from Fractional Brownian Motion, provides insight into the efficiency of Constant Product Market Makers (CPMMs). As the delay between block updates and high-frequency trade execution increases, the Hurst Exponent approaches 1. This indicates a stronger positive autocorrelation in price movements, meaning past price increases are more likely to be followed by further increases. Consequently, delayed updates lead to increased capital misallocation within CPMMs, as the system fails to accurately reflect real-time market conditions and exacerbates the effects of front-running and other adverse selection issues. A Hurst Exponent nearing 1 signifies a deviation from efficient price discovery and highlights the importance of minimizing latency in CPMM operation.

Strategic Execution: Optimizing for Growth and Mitigating Risk

Growth Optimal Behavior utilizes the Square Root Market Impact model to define a trading strategy that balances maximizing expected returns with minimizing the impact of trades on asset prices. This model posits that the price impact of an order is proportional to the square root of the order size relative to market depth; therefore, optimal order execution involves strategically sizing trades to achieve the most favorable price with minimal adverse movement. The strategy considers both the expected return of an asset and its price variance, with higher variance necessitating smaller trade sizes to avoid significant price impact and preserve profitability. By dynamically adjusting order sizes based on these factors, the approach aims to capture alpha while mitigating the costs associated with market impact, ultimately leading to improved risk-adjusted returns.

The Kelly Criterion is a mathematical formula used to determine the optimal size of a series of bets to maximize long-term growth. For a single asset, the optimal fraction f of capital to allocate is calculated as f = 1 - q/r, where q represents the probability of success and r represents the net profit rate of a successful bet. This formula balances the potential reward against the risk of loss, aiming to maximize the geometric mean of wealth. Allocating a fraction greater than the Kelly Criterion increases risk, while allocating a fraction lower than the Kelly Criterion suboptimally limits potential returns. The criterion assumes that the probabilities and payoffs are known and remain constant, which is rarely the case in real-world scenarios, and requires consistent rebalancing of the portfolio.

The optimal investment fraction f^<i> for a two-bond portfolio is calculated using the formula f^</i> = 1/2 - q/r - q^2/(2r^2) - q/(3r)(q/r)^2, where q represents the probability of loss and r denotes the rate of return. This refinement of the Kelly Criterion accounts for the cross-correlation between the two bonds, which impacts the overall portfolio variance. By incorporating this correlation, the formula aims to maximize risk-adjusted returns by identifying the optimal proportion of capital to allocate to each bond within the portfolio, exceeding the performance achievable with a single-asset allocation or without considering bond correlations.

Systemic Resilience: Insuring Against the Inevitable

The foundational stability of Decentralized Finance (DeFi) ecosystems is increasingly reliant on stablecoins, cryptocurrencies designed to maintain a fixed value – but this very reliance introduces a systemic risk: de-pegging. Should a stablecoin lose its intended 1:1 value with its backing asset – be it the US dollar or another currency – the consequences can rapidly cascade throughout the DeFi landscape. Automated market makers (AMMs) and lending protocols, heavily populated with the de-pegged asset, experience dramatic imbalances, triggering liquidations and potentially insolvency. This isn’t merely a localized issue; the interconnectedness of DeFi means a significant de-pegging event can propagate across multiple protocols and blockchains, freezing liquidity, eroding trust, and ultimately threatening the entire system. The speed and scale of these potential failures highlight the urgent need for robust risk mitigation strategies designed to protect against, and absorb the impact of, stablecoin de-pegging events.

DeFi ecosystems are particularly vulnerable to periods of intense selling pressure, often termed “toxic flow,” which represents a concentrated stream of adverse orders that can rapidly destabilize markets. This isn’t simply typical trading volume; it’s characterized by imbalances that overwhelm liquidity pools, disproportionately impacting Liquidity Providers (LPs) who bear the brunt of slippage and impermanent loss. When substantial sell orders flood a decentralized exchange, LPs are forced to absorb the impact, potentially facing significant financial losses as the price of the asset plummets. This, in turn, erodes confidence in the system, triggering further withdrawals and accelerating the downward spiral – a process that amplifies market instability and can lead to cascading failures across interconnected DeFi protocols. Understanding and mitigating the effects of toxic flow is therefore crucial for bolstering the resilience of stablecoin-backed DeFi and safeguarding against systemic risk.

Catastrophe bonds represent an innovative approach to mitigating systemic risk within decentralized finance, functioning as a form of insurance against potentially devastating events like stablecoin de-pegging. These bonds transfer risk from DeFi protocols – and crucially, their Liquidity Providers – to capital markets investors, who receive premium payments in exchange for accepting the financial consequences should a pre-defined catastrophic event occur. Essentially, investors are compensated for bearing the brunt of a severe shock, thereby protecting the underlying DeFi ecosystem from cascading failures. This mechanism not only enhances the resilience of stablecoin-backed DeFi protocols, but also introduces a more sophisticated risk management framework, potentially unlocking greater institutional participation and fostering a more stable and reliable financial environment. The structure allows for pre-defined trigger events – such as a sustained drop in stablecoin value – that automatically activate payouts to cover losses, offering a transparent and efficient method for absorbing financial shocks.

The study of automated liquidity reveals a fascinating tension between theoretical efficiency and real-world market behavior. The paper’s exploration of the Hurst Exponent, and its implications for identifying cyclical patterns, underscores a core principle: systems reveal their weaknesses under stress. This resonates with Ralph Waldo Emerson’s observation: “Do not go where the path may lead, go instead where no path exists.” The authors, in effect, abandon the well-trodden path of conventional market making to forge a new understanding, demonstrating that true progress requires challenging established norms and actively seeking out the boundaries of existing models. The use of catastrophe bonds to mitigate de-pegging risk is a prime example of this – a deliberate attempt to engineer resilience by anticipating and preparing for failure.

Where Do We Go From Here?

The neatness of the Kelly Criterion, applied to liquidity provision, feels almost…taunting. It suggests an optimal strategy exists within the chaos of decentralized finance, a precise ratio for extracting value. But the model itself relies on assumptions-stationarity, accurate price impact functions-that the very nature of these markets seems designed to violate. The true test isn’t whether the Criterion can optimize, but how gracefully it fails when reality inevitably refuses to cooperate.

The proposed use of catastrophe bonds to hedge against stablecoin de-pegging is a particularly interesting, if cynical, maneuver. It acknowledges the inherent fragility of these systems-the emperor has no clothes-and attempts to profit from the inevitable unraveling. One wonders if this represents a genuine attempt at risk mitigation, or simply a more sophisticated form of front-running the apocalypse. The practical implementation, of course, will expose a delightful array of unforeseen edge cases.

Ultimately, this work highlights the fundamental problem with current automated market makers: they are, at their core, remarkably inefficient. The constant product formula, while elegant, demonstrably leaks value. The next step isn’t simply tweaking the parameters, but dismantling the assumption that any formula can perfectly capture the dynamics of a truly decentralized, and therefore irrational, market. Perhaps the most fruitful avenue for research lies not in optimization, but in embracing the inherent messiness of price discovery.

Original article: https://arxiv.org/pdf/2601.11375.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Gold Rate Forecast

- Stephen King Is Dominating Streaming, And It Won’t Be The Last Time In 2026

- Stranger Things Season 5 & ChatGPT: The Truth Revealed

- 10 Worst Sci-Fi Movies of All Time, According to Richard Roeper

- Pokemon Legends: Z-A Is Giving Away A Very Big Charizard

- Fans pay respects after beloved VTuber Illy dies of cystic fibrosis

- Six Flags Qiddiya City Closes Park for One Day Shortly After Opening

- Bitcoin After Dark: The ETF That’s Sneakier Than Your Ex’s Texts at 2AM 😏

- AAVE PREDICTION. AAVE cryptocurrency

- Hytale Devs Are Paying $25K Bounty For Serious Bugs

2026-01-20 00:41