Author: Denis Avetisyan

A new analysis quantifies the impact of artificial intelligence on the US economy, revealing a complex picture of investment, production, and value creation.

This paper examines AI’s macroeconomic effects through a national accounts framework, focusing on capital expenditure, data center contributions, and the role of imports in limiting GDP growth.

Despite the widespread discussion surrounding artificial intelligence, a comprehensive understanding of its macroeconomic effects remains elusive. This paper, ‘Artificial Intelligence and the US Economy: An Accounting Perspective on Investment and Production’, offers a national accounts-based analysis of recent AI-driven investment and production in the United States. Our findings suggest that while capital expenditure related to AI has boosted aggregate demand, its contribution to GDP growth is partially offset by the significant import content of AI hardware, with data centers emerging as critical infrastructure for future value creation. Will these short reinvestment cycles and evolving demand patterns ultimately fuel macroeconomic risks, or will AI continue to provide a sustained lift to the US economy?

Unveiling the Economic Currents: AI and Capital Expenditure

Artificial intelligence has transitioned from theoretical possibility to a tangible force reshaping the economic landscape, most notably through its influence on capital expenditure. The development and deployment of AI technologies necessitate substantial investments in computing infrastructure, specialized hardware, and data storage solutions – driving a significant reallocation of resources. This isn’t merely about incremental upgrades; it represents a fundamental shift in investment priorities, as businesses increasingly allocate capital towards AI-driven initiatives to enhance efficiency, foster innovation, and secure a competitive advantage. The resulting surge in capital expenditure isn’t confined to the technology sector either, extending to industries like manufacturing, healthcare, and finance as they integrate AI into their core operations, solidifying its position as a present-day driver of economic change.

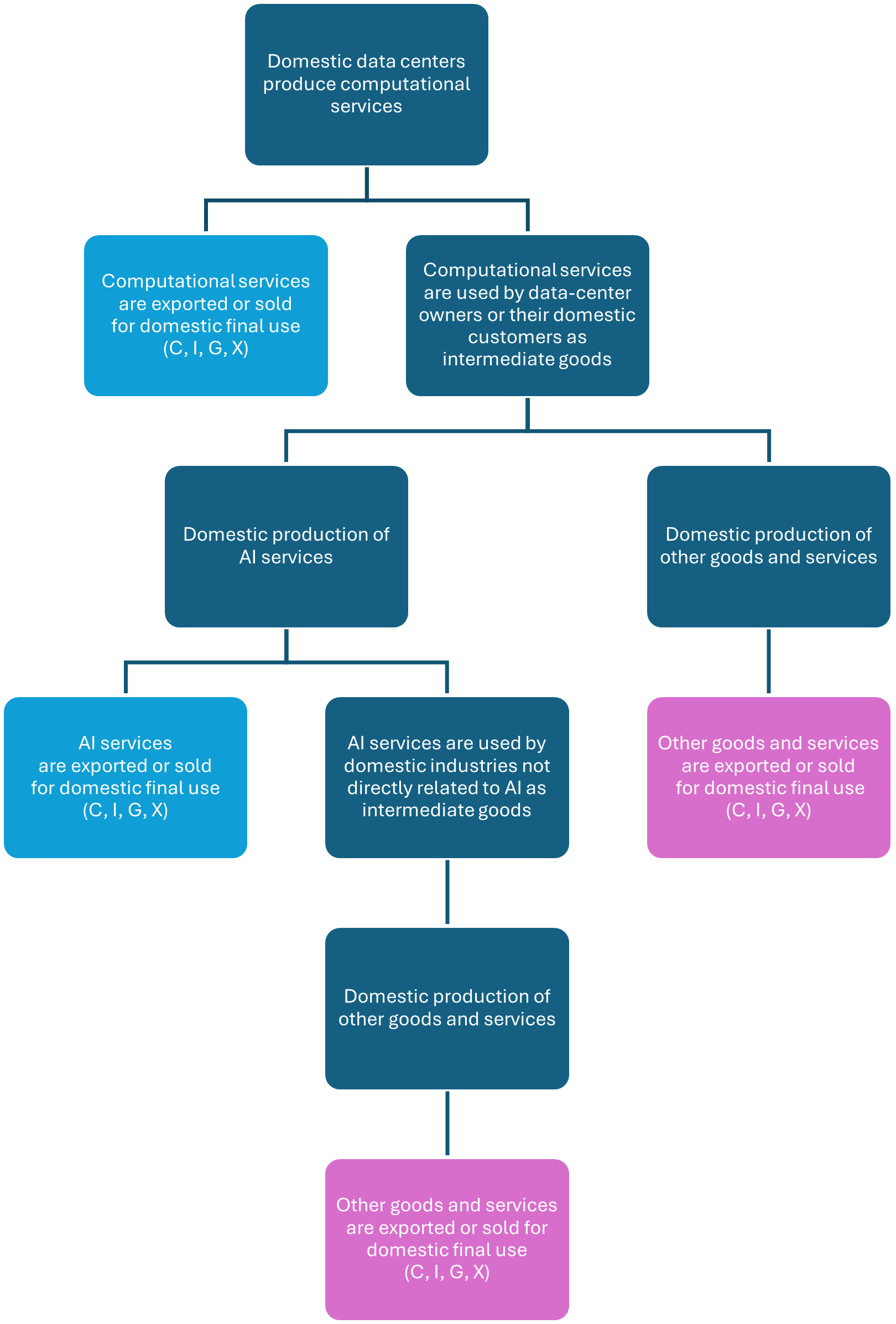

The escalating demands of artificial intelligence necessitate substantial and ongoing investment in data center infrastructure. Training increasingly complex AI models, and subsequently deploying them for real-world applications, requires immense computational power, storage capacity, and network bandwidth – all centrally provided by data centers. These facilities are no longer simply repositories of data, but active engines driving the AI revolution, necessitating upgrades to power grids, cooling systems, and physical security. Consequently, the growth of AI is inextricably linked to the expansion and sophistication of data center capabilities, representing a critical bottleneck and a key area of capital expenditure for organizations seeking to leverage the potential of artificial intelligence.

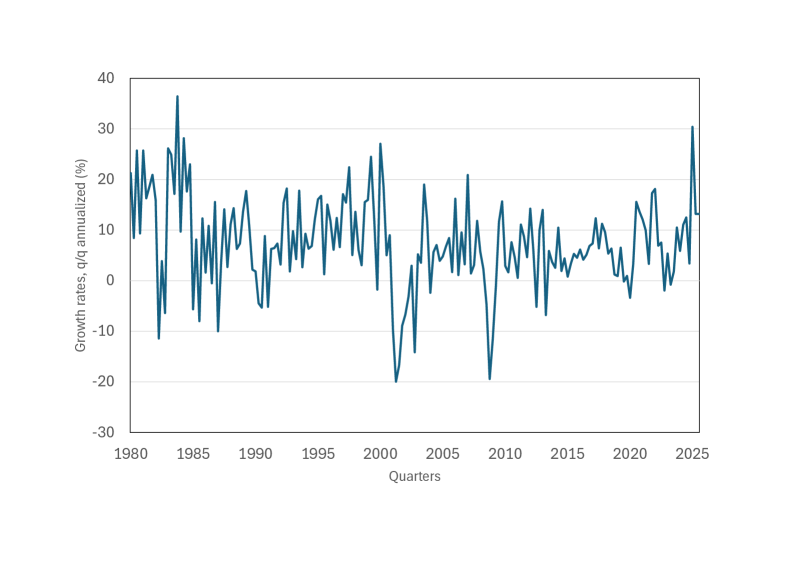

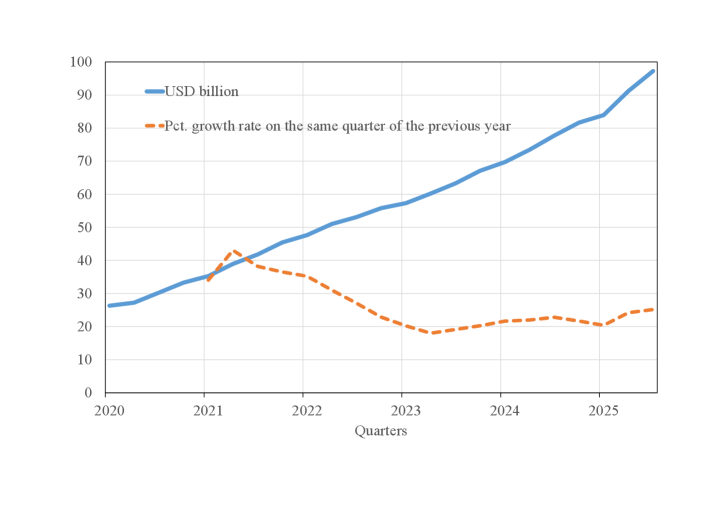

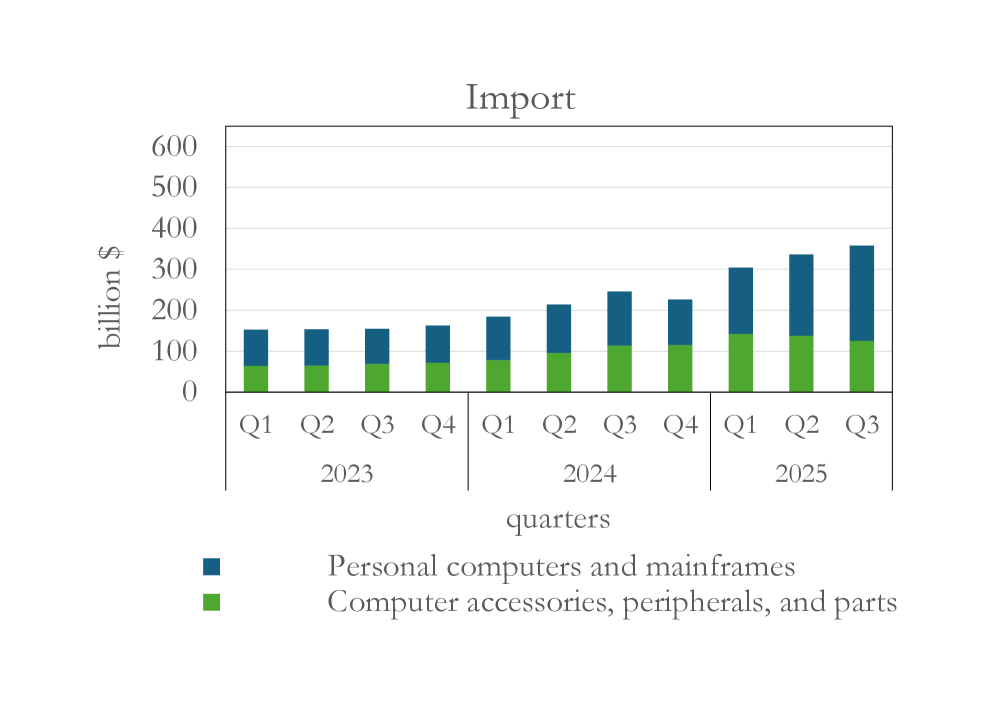

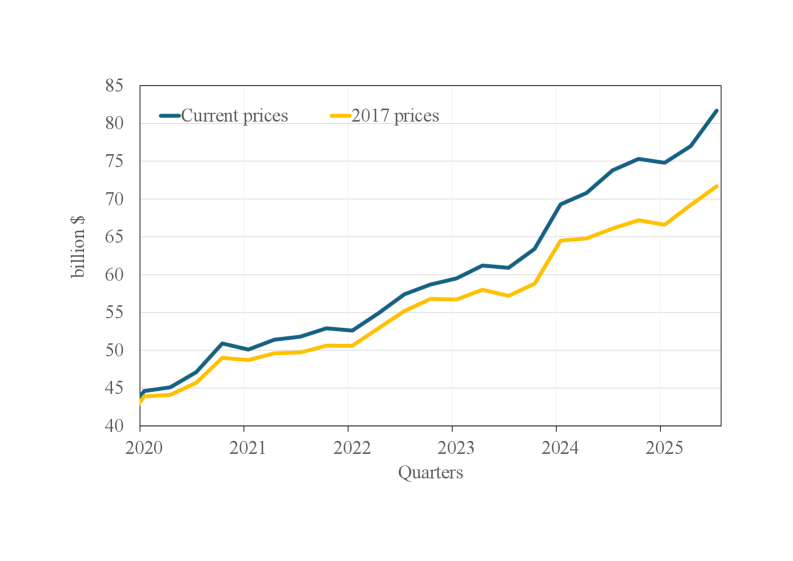

Artificial intelligence investments demonstrably boosted economic output in 2025, manifesting as increased capital expenditure; however, the overall impact on gross domestic product was tempered by substantial import reliance. Data reveals a robust pattern of growth in AI-related capital spending throughout the year, with annualized quarterly increases of 36% in the first quarter, followed by 20% in the second, and a continued, though decelerating, 5% rise in the third. While these figures highlight a significant influx of investment into AI infrastructure, a considerable portion of the necessary hardware and components were sourced internationally, diminishing the net contribution to domestic GDP and underscoring the complexities of measuring the true economic benefits of rapidly evolving technologies.

The Hardware Foundation: Enabling Intelligence at Scale

Artificial intelligence workloads are fundamentally enabled by specialized hardware, primarily Graphics Processing Units (GPUs) and Tensor Processing Units (TPUs). GPUs, originally designed for rendering graphics, provide the massive parallel processing capabilities required for the matrix operations central to most AI algorithms. TPUs, developed by Google, are application-specific integrated circuits custom-designed for machine learning tasks, offering further performance gains and efficiency. Both GPU and TPU resources are utilized across the entire AI lifecycle, from the computationally intensive process of model training – where algorithms learn from large datasets – to the subsequent phase of inference, where trained models apply learned knowledge to new data and generate outputs. The selection of hardware often depends on the specific AI task, with GPUs offering greater flexibility and TPUs excelling in specialized, high-volume inference scenarios.

Data centers are essential physical infrastructure for AI hardware deployment, providing the foundational resources required for operation. These facilities house the GPUs and TPUs that execute AI workloads and must deliver substantial and reliable power – often exceeding densities typical of traditional server deployments – to support intensive computation. Effective cooling systems, including liquid cooling solutions, are critical to dissipate the heat generated by these processors and maintain optimal performance. Furthermore, data centers require high-bandwidth, low-latency network connectivity to facilitate data transfer between processing units and external data sources, as well as to support distributed training and inference tasks.

Current market conditions indicate an approximate one-year return on investment for AI data centers, driven by strong demand for AI services and associated rental pricing. This rapid payback is facilitated by high-density data center architectures, such as the NVIDIA NVL72, which prioritize maximizing computational resources per square foot. The NVL72 architecture achieves this through optimized hardware integration and cooling solutions, enabling a significantly higher concentration of GPUs and associated processing power within a given data center footprint, and thus lowering the overall cost per unit of compute.

Quantifying the Impact: Challenges in National Accounting

Traditional National Accounts methodologies, designed to measure economic output, often struggle to fully reflect the economic benefits of Artificial Intelligence (AI) due to the nature of its value creation. While direct investments in AI hardware and software are quantifiable, a substantial portion of AI’s economic impact stems from improvements in efficiency and innovation across various sectors. These benefits manifest as reduced production costs, increased output with the same inputs, and the development of new products and services; however, these gains are frequently embedded within aggregate productivity statistics and are not explicitly attributed to AI investment. Consequently, current accounting practices may underestimate the true contribution of AI to overall economic growth by failing to adequately capture the value derived from these indirect, yet significant, efficiency and innovation effects.

A considerable reliance on imported AI hardware presents a methodological challenge for GDP calculations. While investments in computational power – such as GPUs and specialized AI accelerators – contribute to gross fixed capital formation, a large proportion of this investment represents imports rather than domestically produced goods. This results in an increased import value that offsets the potential increase in GDP from the enhanced computational capacity. Consequently, the net contribution of AI investment to GDP is reduced, as the value added through AI-driven productivity gains is not fully reflected in domestic production figures. This discrepancy necessitates adjustments to standard national accounting practices to accurately capture the economic impact of AI.

Analysis indicates that investment in Artificial Intelligence contributed 0.5 and 0.7 percentage points to overall Gross Domestic Product (GDP) growth in the first and second quarters, respectively. However, accurately assessing AI’s complete economic impact necessitates a methodological refinement beyond simply tracking direct investment. Current national accounting practices often fail to fully capture the indirect benefits stemming from AI implementation, such as gains in productivity, efficiency improvements across various sectors, and the value created through innovation. A comprehensive evaluation must therefore incorporate these secondary effects to provide a more accurate reflection of AI’s contribution to economic growth.

Democratizing Intelligence: The Rise of Cloud Services

The proliferation of cloud services is fundamentally reshaping the landscape of artificial intelligence adoption. Previously, developing and deploying AI solutions demanded substantial investments in specialized hardware, software, and expertise – resources largely confined to major corporations and research institutions. Now, cloud platforms offer on-demand access to powerful computational resources, pre-trained AI models, and development tools, effectively lowering the barriers to entry for businesses of all sizes. This democratization extends beyond mere access; it allows organizations to experiment with and implement AI solutions without the significant upfront costs and ongoing maintenance traditionally associated with such technologies. Consequently, a wider range of users – from startups to established enterprises – are now able to harness the potential of AI, driving innovation and fostering a more competitive market.

Cloud services are fundamentally reshaping access to artificial intelligence, dissolving traditional barriers that once limited AI implementation to organizations with substantial resources. Previously, the high costs associated with developing and maintaining the necessary infrastructure – including specialized hardware, extensive datasets, and skilled personnel – proved prohibitive for many. Now, these services offer on-demand access to pre-trained models, scalable computing power, and data storage, allowing businesses of any size – from startups to established enterprises – to integrate AI into their operations without massive upfront investments. This democratization fosters innovation across industries, enabling a wider range of companies to experiment with, and ultimately benefit from, AI-driven solutions, accelerating growth and leveling the playing field.

Recent analysis suggests a pivotal shift in the economics of artificial intelligence, forecasting that revenues generated from AI services are poised to match the initial investments in infrastructure and development. This isn’t simply a return on investment, but a signal of AI’s broadening accessibility and its capacity to fuel substantial economic gains. As AI tools become more readily available through cloud services, businesses are experiencing heightened productivity and are empowered to pursue novel innovations. This acceleration of both efficiency and creativity is projected to contribute significantly to sustained growth in gross domestic product, firmly establishing artificial intelligence not merely as a technological advancement, but as a fundamental driver of the modern economy.

The analysis within this paper underscores how investment in artificial intelligence, particularly the infrastructure surrounding data centers, shapes macroeconomic indicators. It reveals a complex interplay between domestic production and imported components, influencing the overall contribution of AI to GDP. This aligns with John Stuart Mill’s assertion that “It is better to be a dissatisfied Socrates than a satisfied fool,” as a rigorous accounting of AI’s impact demands a critical examination of its true value-moving beyond simple growth figures to understand the nuances of production and import dependencies. If a pattern cannot be reproduced or explained, it doesn’t exist.

Future Horizons

The paper highlights a curious asymmetry: significant capital expenditure directed toward artificial intelligence, yet a relatively modest contribution to measured GDP. It would be prudent to carefully check data boundaries and accounting methods to avoid spurious patterns, as the value generated by AI may be obscured by existing frameworks designed for more conventional production. The import content of AI-related infrastructure-servers, specialized chips-suggests a substantial portion of the investment’s benefit accrues elsewhere, a pattern deserving of sustained attention.

Further research should focus on refining methods for capturing the value generated by AI, particularly intangible benefits like improved efficiency and innovation. The crucial role of data centers, identified in this analysis, points toward a potentially limiting factor. Future studies might explore the geographical concentration of data center capacity and its impact on regional economic disparities, as well as the energy demands of these facilities and their sustainability implications.

Ultimately, understanding the macroeconomic impact of AI requires moving beyond simple accounting. The challenge lies in tracing the subtle shifts in production functions, the emergence of new organizational structures, and the evolving nature of value itself-a task that demands not just data, but a willingness to question the assumptions underlying conventional economic models.

Original article: https://arxiv.org/pdf/2601.11196.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Gold Rate Forecast

- Dev Plans To Voluntarily Delete AI-Generated Game

- Bitcoin After Dark: The ETF That’s Sneakier Than Your Ex’s Texts at 2AM 😏

- AAVE PREDICTION. AAVE cryptocurrency

- Six Flags Qiddiya City Closes Park for One Day Shortly After Opening

- Fans pay respects after beloved VTuber Illy dies of cystic fibrosis

- Stephen King Is Dominating Streaming, And It Won’t Be The Last Time In 2026

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- 10 Worst Sci-Fi Movies of All Time, According to Richard Roeper

- Stranger Things Season 5 & ChatGPT: The Truth Revealed

2026-01-19 09:32