Dear diary, the numbers are in and they’re doing that old Bridget Jones tango: inflation nudges up 0.3% from November to December 2025, and the markets sigh with the patience of a cat waiting for a sunbeam. The Fed? Still pretending to be unfazed, because drama is so last season.

December CPI Prints 0.3% Gain as Fed Rate Cut Looks Off the Table

In its report, the BLS said the CPI for all urban consumers “increased 0.3 percent on a seasonally adjusted basis in December.” Over the past year, the all-items index moved up 2.7% on an unadjusted basis. Shelter costs increased 0.4% in December, doing the heavy lifting for the month’s overall rise. If shelter could talk, it would probably say, “Nice try, but I’m the real MVP.”

The BLS added that food prices joined the party, up 0.7% with groceries and restaurant bills climbing. Energy prices joined the party too, inching up 0.3% in December. All the major stock indexes were treading water Tuesday, but by 10 a.m. Eastern time, each slipped into modest pullbacks. Bitcoin rose about 1.8% over the past day, gold gained 0.51%, and silver kept the momentum going with a 3.99% rise-if you’d told your younger self you’d be impressed by shiny things, she’d have laughed and bought more tote bags.

According to a CNBC report by Jeff Cox, markets aren’t penciling in a rate cut from the U.S. central bank when it meets Jan. 28. Cox cited Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management, who said: “We’ve seen this movie before – inflation isn’t reheating, but it remains above target. There’s still only modest pass-through from tariffs, but housing affordability isn’t thawing. Today’s inflation report doesn’t give the Fed what it needs to cut interest rates later this month.”

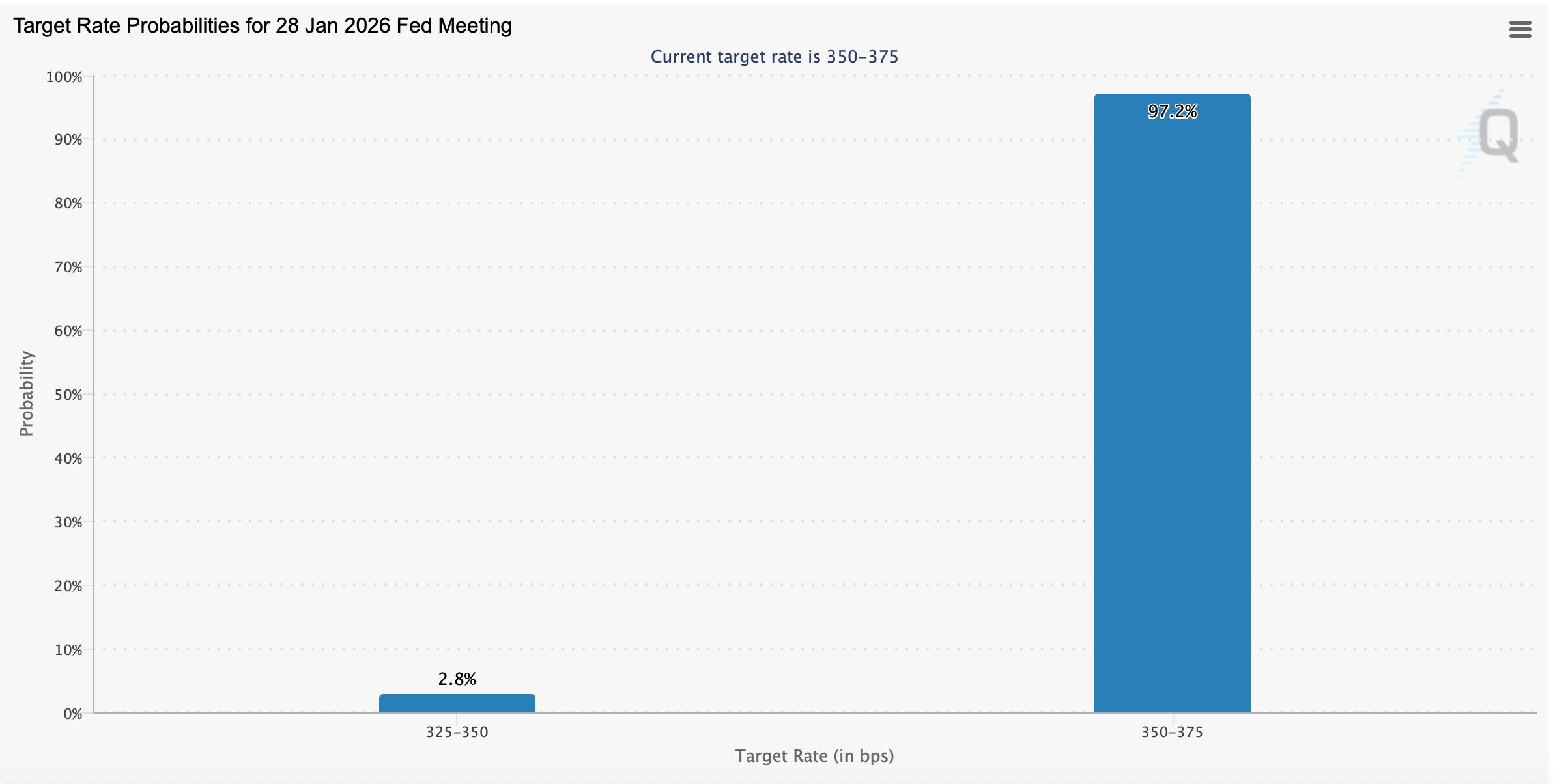

CME’s FedWatch tool shows markets firmly expecting no change, with a 97.2% probability the rate stays put. Hopes for a quarter-point trim are faint, clocking in at just 2.8%. Bettors on Polymarket and Kalshi peg the odds of no move at 96%.

Tuesday’s latest U.S. Bureau of Labor Statistics report did absolutely nothing to nudge those expectations. All of this unfolds as the Department of Justice continues probing the Fed’s renovation costs. Even so, the chances of Chair Jerome Powell facing charges by June 30, 2026, sit at a slim 12%.

Essentially, the data, the pricing, and the betting markets are all singing the same tune: the Fed is in wait-and-see mode. Inflation isn’t racing away, expectations are locked in, and even the noise around the renovation probe hasn’t dented confidence that rates stay right where they are. For now, markets appear content to watch the clock rather than the Fed’s scissors. 😂💼

FAQ ❓

- What did the December CPI report show? U.S. inflation rose 0.3% in December, pushing the annual all-items index to 2.7%, according to the U.S. Bureau of Labor Statistics.

- Will the Federal Reserve cut rates at its January meeting? Markets overwhelmingly expect the Fed to hold rates steady when it meets Jan. 28.

- Which prices drove the latest inflation increase? Shelter, food, and energy costs all moved higher, with housing carrying the most weight.

- How are markets reacting to the inflation data? Stocks dipped modestly, while bitcoin, gold, and silver posted gains as rate expectations stayed unchanged.

Read More

- Tom Cruise? Harrison Ford? People Are Arguing About Which Actor Had The Best 7-Year Run, And I Can’t Decide Who’s Right

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- Katanire’s Yae Miko Cosplay: Genshin Impact Masterpiece

- Balatro and Silksong “Don’t Make Sense Financially” And Are “Deeply Loved,” Says Analyst

- The Housewives are Murdering The Traitors

- Chimp Mad. Kids Dead.

- What Fast Mode is in Bannerlord and how to turn it on

- The King of Wakanda Meets [Spoiler] in Avengers: Doomsday’s 4th Teaser

- Is Michael Rapaport Ruining The Traitors?

- ‘Stranger Things’ Conformity Gate and 9th Episode Fan Theory, Explained

2026-01-13 19:27