Oh, what a tale of woe! XRP, that most enigmatic of cryptids, now finds itself teetering on the edge of a fiscal cliff, its price as fragile as a dachshund’s dignity. The altcoin sector, ever the tragic hero, continues its slow-motion collapse, while the bulls, those valiant but delusional knights, struggle to defend their crumbling castles. The market, that fickle mistress, seems to whisper, “You’re all going to die, but let’s do it with style.”

Yet, amid this chaos, the on-chain data reveals a curious twist-a CryptoQuant report, penned by the enigmatic CryptoOnchain, unveils a dramatic drop in XRP reserves on Binance. A spectacle! Fewer tokens on the exchange, a ballet of scarcity, suggesting that the bears are not as ruthless as they seem. Perhaps they’re merely taking a nap? Or maybe they’re plotting a grander scheme, like a Russian novel’s villain with a penchant for cryptocurrency.

This divergence between price and supply is as baffling as a poet debating the merits of a toaster. While XRP’s chart screams “panic!” the on-chain signals hint at a potential for a rally, if only the market could remember how to feel optimism. A relief rally, they call it-because nothing says “hope” like a group of investors collectively forgetting their losses.

As XRP hovers near $1.90, the coming days will be a test of wills. Will the shrinking exchange supply be enough to counteract the technicals’ grim predictions? Or will we witness a descent into the abyss, where even the most ardent believers question their faith? The suspense is palpable, like a thriller set in a Bitcoin casino.

Exchange Reserves Hit Multi-Month Low as XRP Tests Key Demand Zone

On-chain data, that most elusive of truths, reveals a shocking development: XRP balances on Binance have plummeted to a six-month low. A record! A spectacle! The market, that eternal jester, now wonders if the bears have finally retired their pitchforks. Or perhaps they’ve simply moved their tokens to a safer, more private location-a vault, perhaps, where the only thing more valuable than XRP is the silence of the guards.

Historically, such a decline in exchange reserves is a sign of hope, or at least a temporary reprieve from the chaos. Investors, those fickle creatures, are moving their tokens to self-custody, as if fleeing a haunted house. The market, ever the optimist, whispers, “Maybe this time, it’s different.” But then again, the market is also known for its penchant for irony.

As XRP tests the $1.80-$1.90 zone, the stage is set for a dramatic showdown. Will the bulls rise to defend their territory, or will the bears revel in their victory? The RSI, that ever-loyal courtier, suggests bearish pressure is waning, but the crowd remains skeptical. After all, the market is a fickle lover, and trust is hard to come by.

The alignment of shrinking supply and technical support offers a glimmer of hope, but the specter of a breakdown looms large. If the $1.80 level falls, the bears will have their way, and the market will descend into a deeper abyss. But for now, the drama continues, and the curtain has yet to fall.

XRP Tests Long-Term Demand as Weekly Structure Weakens

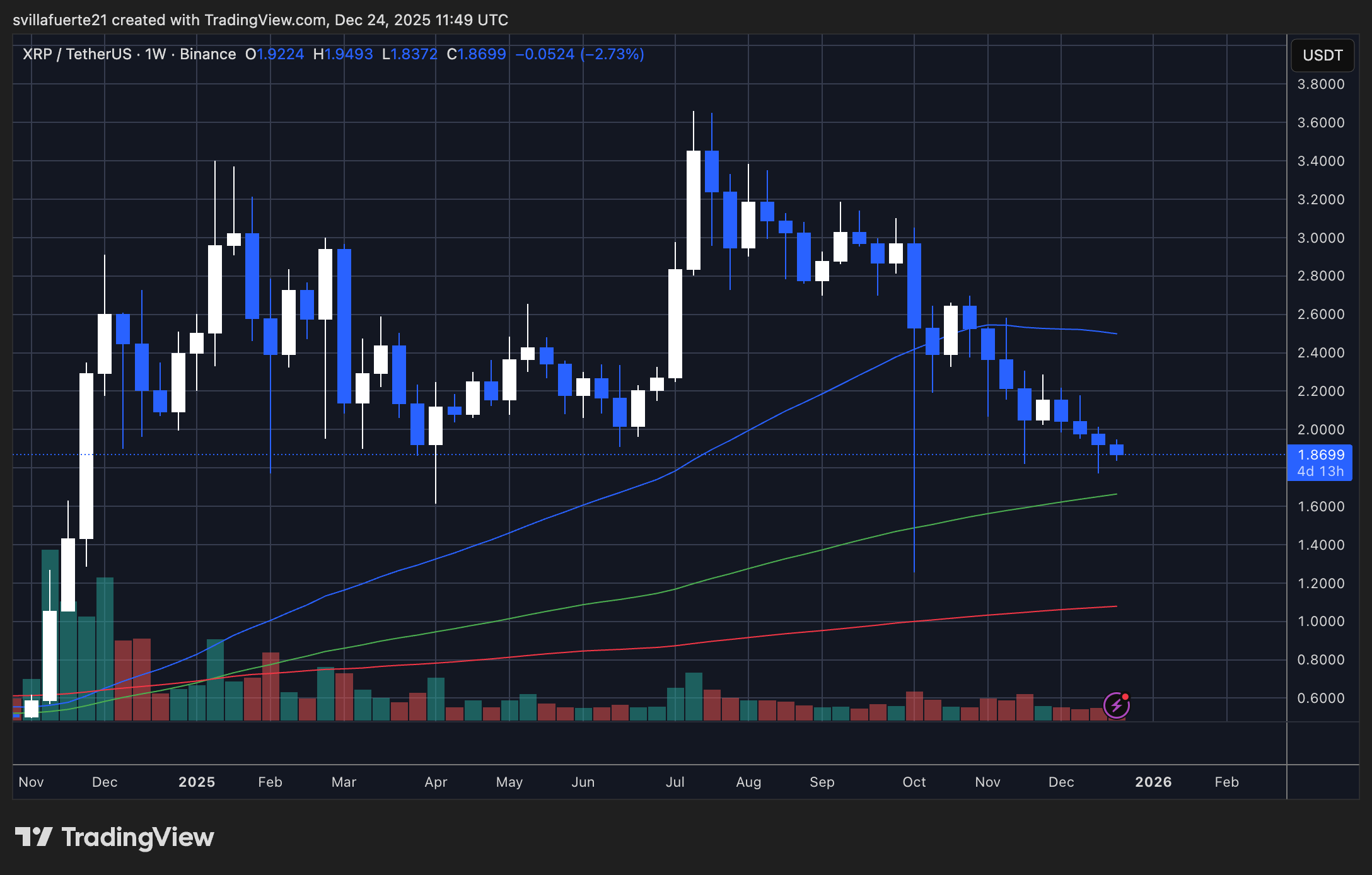

XRP, that most elusive of cryptids, now trades near $1.87, a price that feels as precarious as a tightrope walker on a windswept cliff. The weekly chart, that most reliable of oracles, reveals a prolonged corrective move, a tale of decline and despair. After soaring above $3.40-$3.60, the price has consistently printed lower highs and lows, a testament to the market’s ever-growing pessimism.

From a trend perspective, XRP has lost its key weekly moving averages, a sign that the bulls are in retreat. The price, now firmly below the faster average, faces a new resistance around $2.40-$2.60. The longer-term averages, those distant stars, remain well below the current price, hinting at a macro uptrend that is technically intact but increasingly fragile.

The $1.80-$1.90 area, that critical demand zone, stands as the last line of defense. A sustained close below $1.80 would signal a deeper breakdown, a move toward $1.50 or lower. The selling activity, that relentless tide, has increased during the breakdown, while recent weeks show declining volume-a sign of exhaustion, not accumulation.

For XRP to regain strength, it must reclaim the $2.20-$2.40 region and establish acceptance above former support-turned-resistance. But until then, the market remains a stage of uncertainty, where every candlestick is a potential twist in the tale. The curtain is drawn, the actors await their cues, and the audience holds its breath.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- All Poppy Playtime Chapter 5 Characters

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- EUR INR PREDICTION

2025-12-25 03:09