In this ever-dynamic world, much like a serf witnessing the tides of change, the crypto market finds itself entrenched in a fascinating conundrum. Bitcoin and Ethereum, akin to once-innovative pretenders now grappling with a shameful bazaar of values, have succumbed to the bearish touch. Major altcoins like XRP are cast into a similar distressing tale-desolate, yet not without a peculiar air of irony, as both Gold and the S&P 500 bask in the glow of new records. Truly, to fathom these peculiarities is to engage in a spirited game of economic chess, my dear reader.

Such a maze of fortunes invites one to ponder: is this the harrowing collapse of old dreams or merely a sweet, albeit bittersweet, respite in an otherwise relentless progression?

Lo and behold the uncanny unraveling of leverage: a source of much jest, yet underlying truth!

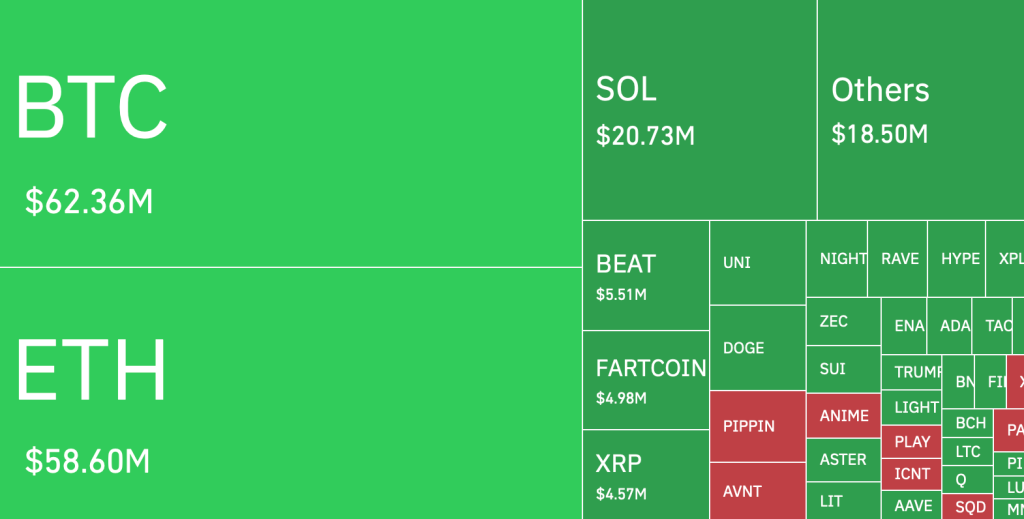

Imagine the once-lively, bustling crypto bazaar, over the previous day riddled with liquidations! More than $180-220 million worth of positions unceremoniously exited our stage, with Bitcoin and Ethereum playing lead roles in this tragicomedy by accounting for a significant 60%. Bitcoin, acting with a certain stoic grace, saw about $65-75 million vanish into thin air as its price dared to whisper below trivial support lines. The funding rates, akin to a debonair diplomat, once loftily announcing themselves between +0.015% to +0.02% on perpetual instruments, have now humbly stepped back to neutrality-a not-so-subtle cue of eras bygone.

The dwindling applause of spot buying: a tussle between joy and somber silence

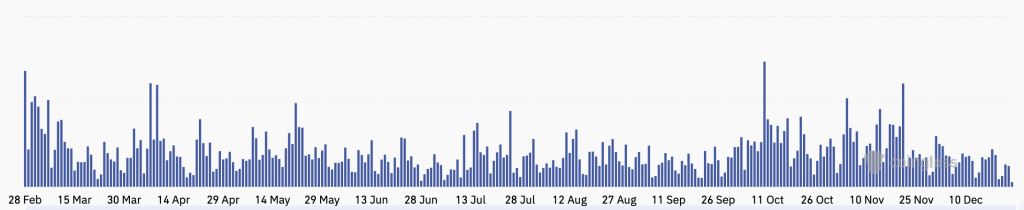

A nouveau, the fervor of spot market watchfulness diminishes as Bitcoin spot volumes have receded by an approximate 25-30% week-on-week. Exchange net flows maintain a neutral stance, resisting the lure of moving too passionately in either direction. The erstwhile influx from ETFs has decelerated-leaving less hearty backing for our financial theater. Thus, the frolic of derivative-driven selling inertia and the waning enthusiasm of spot buyers waltz hand in hand. When the orchestration of volume is led by leverage and the spot market’s attendees depart, it invariably casts a spectral descent until the forced sellers dissipate their wares.

What uncharted territory awaits the poetic Bitcoin and her kin in crypto realms?

As the cogs of time turn, the crypto market recoils at a time when Gold and the S&P 500 are akin to celebrated heroes carving their prosaic tales into goblets. The contrast here, between the clarity of traditional realms predicting stability and the dense fog enshrouding our capricious financial escapades, is quite the saga. The ponderous allure of slower-moving assets enjoys triumphs, whilst high-stakes crypto gallivants through enough tumult to convince one of its own existential quandary.

With intrigue turning to suspense as U.S. initial jobless claims loom near, traders have decidedly chosen prudence over the temerity of new ventures. If these claims hint at an upward surprise, akin to a winter frost on a blooming rose, they may harbor fears of economic downturns, tightening the lid further on risk appetites, thereby ensnaring crypto more firmly in its confining grip. Until clarity blesses us with its grace and the stubborn crucible of leverage cools appropriately, our beloved crypto treads the millstone path of consolidation, not yet ready to embark on rapid escapades.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- NBA 2K26 Season 5 Adds College Themed Content

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- 2026 Upcoming Games Release Schedule

2025-12-24 12:25