Behold! The noble Ether, that ever-elusive spirit of the digital realm, has summoned its strength and reclaimed the coveted $3,000 mark! 🎉 With a trading volume that has skyrocketed by an astounding 100%, it seems our dear cryptocurrency is starting the week with a flourish, like a dramatic actor making an unexpected entrance after a long intermission.

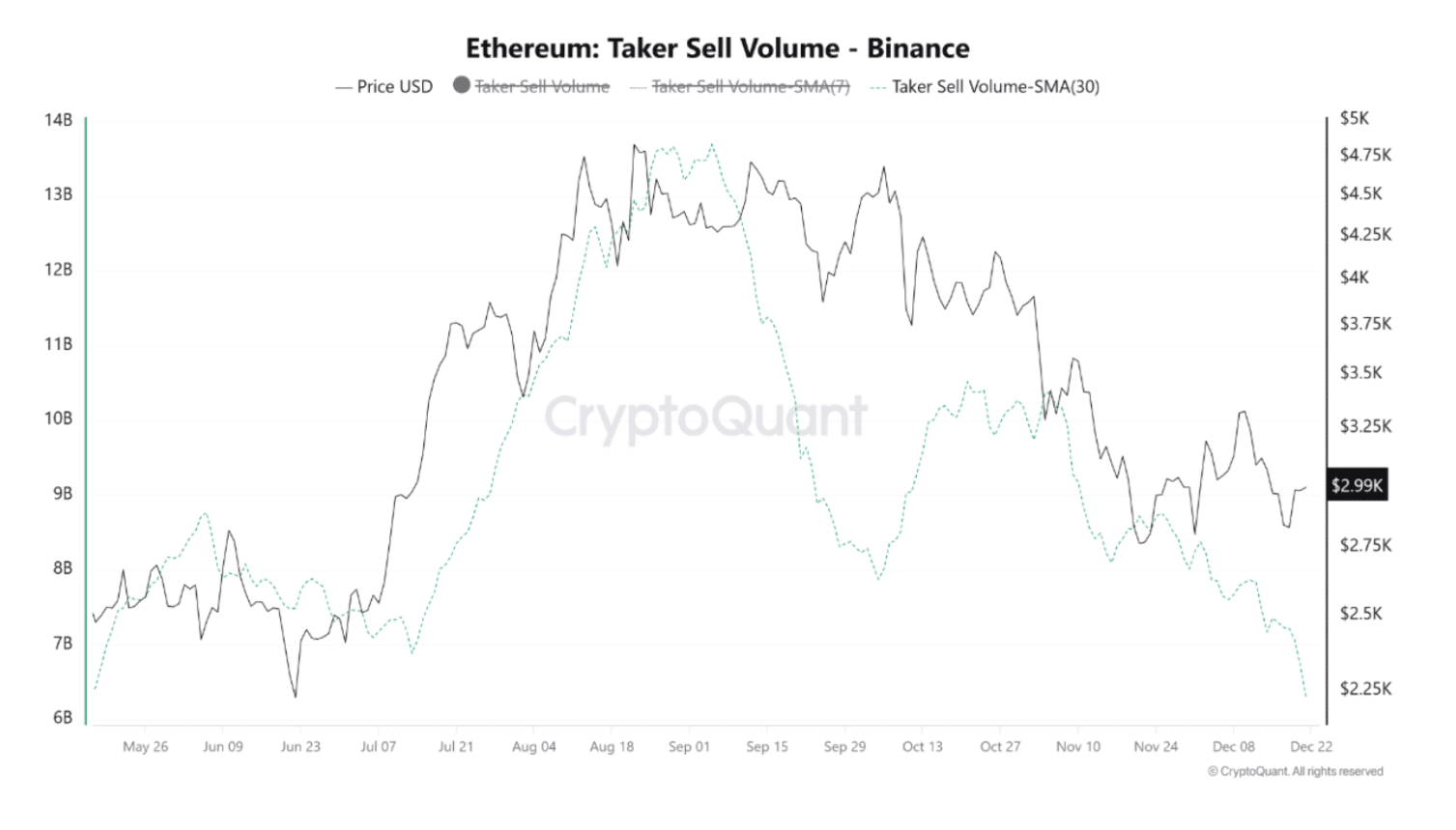

The winds of change blow favorably, as CryptoQuant reveals that the 30-day moving average of Ethereum Taker Sell Volume has dipped to a mere $6.3 billion-the lowest since the golden month of May! Such a decline suggests that traders, no longer gripped by panic, are quietly pondering their next moves while sipping herbal tea and contemplating the meaning of life.

Ethereum Taker Sell Volume 30-day SMA | Source: CryptoQuant

In a delightful twist of fate, Tom Lee’s Bitmine has decided to indulge in a shopping spree, acquiring 13,412 ETH, worth more than $40 million on this fine day of December 22. Who knew that crypto could be such a lucrative pastime? 🤑

It appears that Tom Lee (@fundstrat)’s #Bitmine just bought another 13,412 $ETH ($40.61M).

– Lookonchain (@lookonchain) December 22, 2025

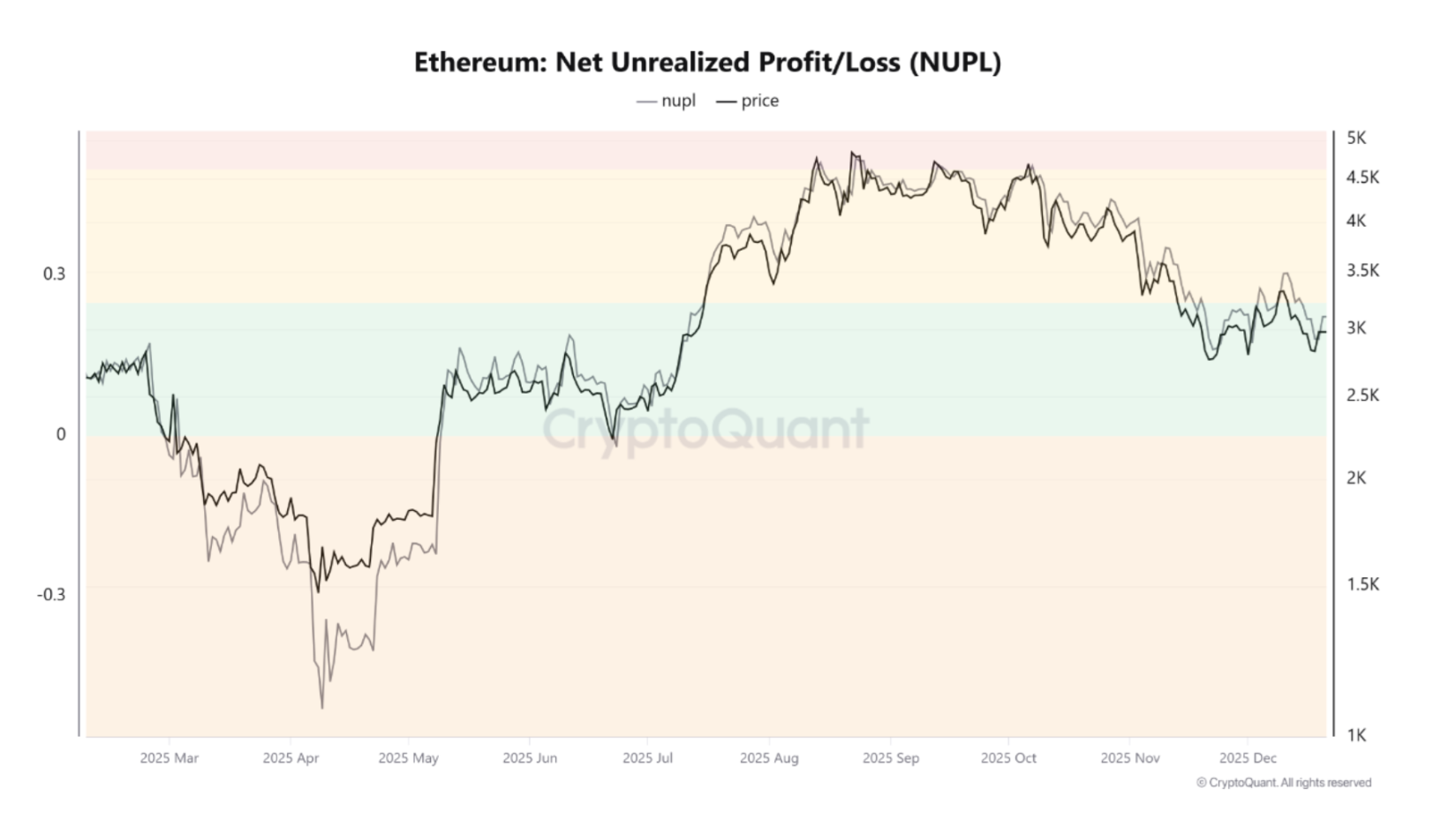

Our beloved Ether retains a Net Unrealized Profit and Loss indicator (NUPL) comfortably nestled at around 0.22, indicating that most ETH holders find themselves in relatively sunny financial weather, though not without a few clouds drifting overhead. ☁️

Ethereum NUPL | Source: CryptoQuant

This range whispers of cautious optimism, suggesting that the market is no longer shackled by fear, but neither is it dancing in the fiery embrace of euphoria. A delicate balance, indeed.

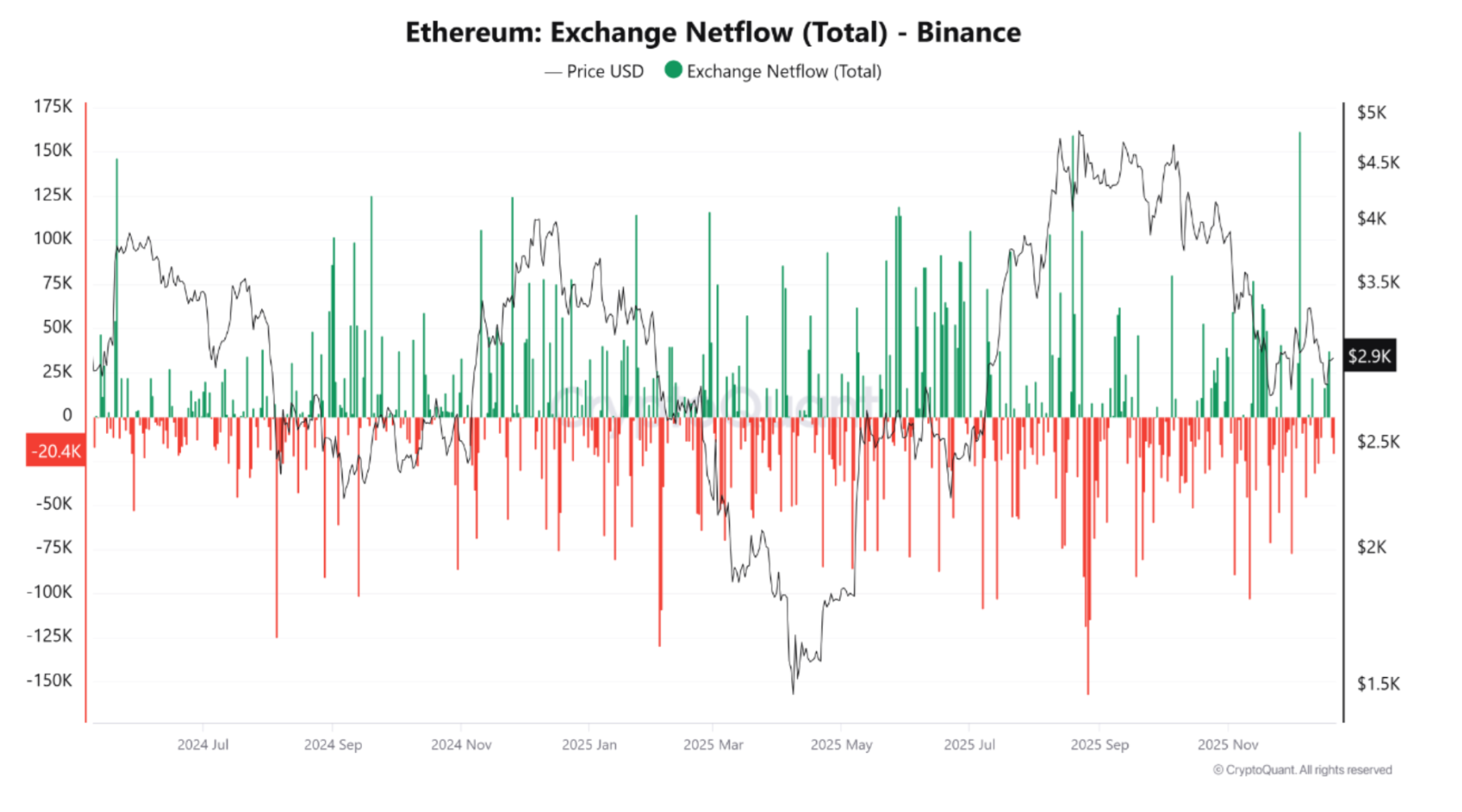

Meanwhile, Binance, that bustling bazaar of digital coins, has witnessed large net outflows of ETH, hinting at a reduction in near-term selling risks. How very reassuring! It seems our holders are not in a hurry to cash in their chips, despite the moderate gains they might harvest. 🍀

Ethereum netflow on Binance | Source: CryptoQuant

Recent Ether Price Weakness Still Suggests Caution

This pleasant easing of selling pressure follows a tumultuous period for Ethereum, when it dared to tread below the $2,800 threshold. Last week, spot ETH ETFs saw a staggering net outflow of $644 million. Not a single one of the nine funds could boast an inflow-what a sad party that must have been!

Wise crypto analyst CyrilXBT shared his musings on X, noting that while ETH seems to be bouncing back, it remains ensnared beneath crucial resistance levels. The area between $2,700 and $3,000 acts like a rickety bridge over troubled waters-one misstep could lead to a swift plunge downwards! 😲

Yet, there is hope! If ETH manages to soar above the $3,200 to $3,400 range, it may once again bask in the glow of good health.

$ETH

ETH is basically stuck in the same story: bouncing, but still under key overhead levels.

The orange band ($2.7-3.0k) is the battlefield. It’s support until it isn’t.

Above that, ETH needs to reclaim $3.2-3.4k to look “healthy” again. Expectation: hold $2.7-3.0k = chop +…

– CyrilXBT (@cyrilXBT) December 22, 2025

As I pen these words, ETH is trading near $3,031, up by approximately 2% over the past day-yet it remains a daunting 38% shy of its glorious August peak of $4,953. What a journey it has been!

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- All Itzaland Animal Locations in Infinity Nikki

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Gold Rate Forecast

- Star Trek’s Controversial Spock Romance Fixes 2 Classic TOS Episodes Fans Thought It Broke

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2025-12-22 15:24