The year of our Lord 2025 has proven to be a most capricious one for those engaged in the pursuit of Ethereum, beginning with a distinctly unfavorable disposition. One observed, with no small degree of dismay, a decline of sixty percent or more by the month of April! Yet, as is so often the case with these modern speculations, a surprising recovery did occur, with Ethereum briefly attaining heights of $4,955 in August – a temporary triumph, it would seem.

Now, however, the price has retreated some forty percent from that peak, causing many a nervous investor to clutch their pearls. Mr. Ali Martinez, a gentleman of some repute in these financial circles, has kindly provided his observations, highlighting certain price levels upon which the hopes of the bullish speculators now rest. One wonders if such prognostications are worth the paper they are written on… or, rather, the digital space they occupy.

A Most Curious Accumulation at $2,772 – And What It Might Signify

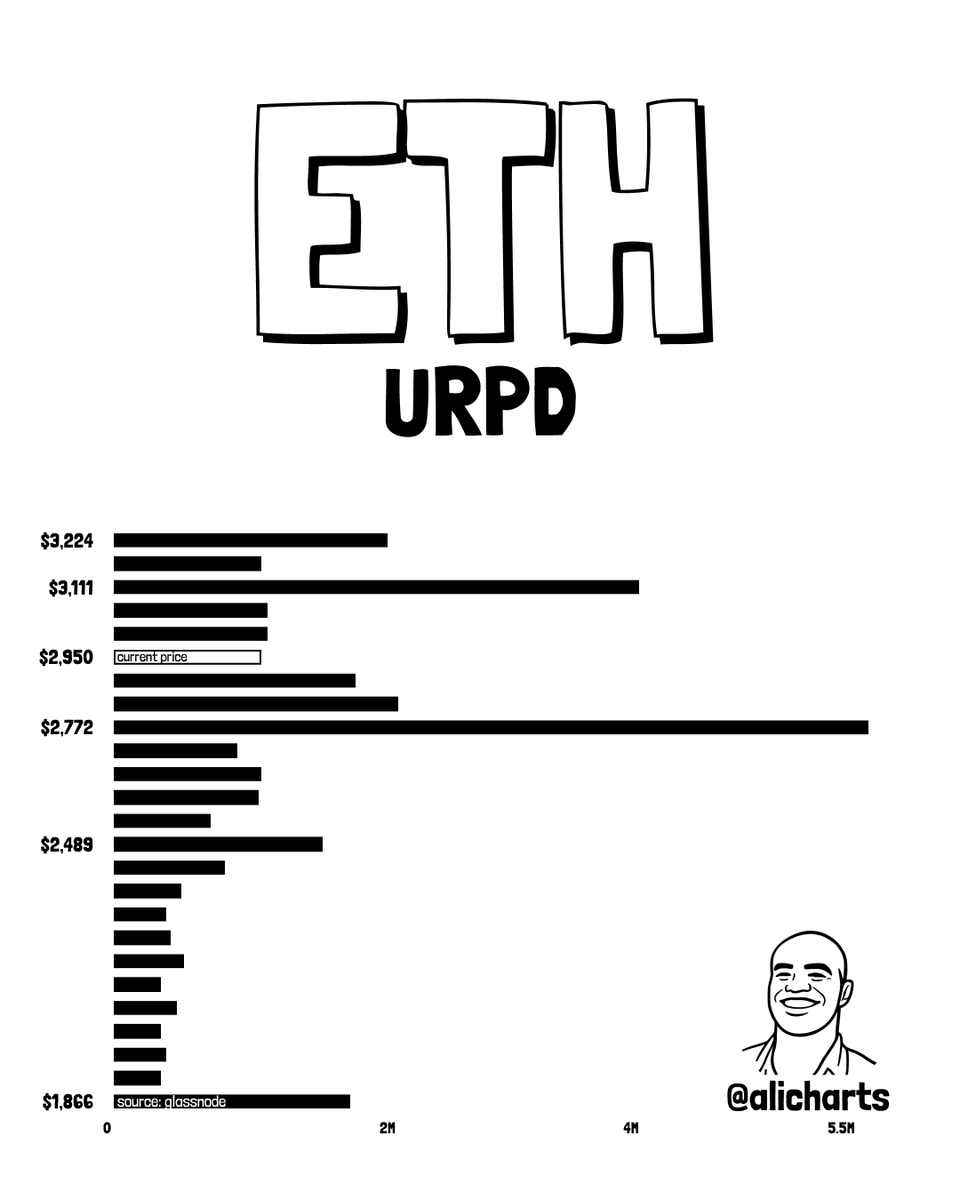

Mr. Martinez informs us, via a missive posted on the X platform (a rather vulgar name, don’t you think?), that certain price zones may offer some small comfort against further decline. He relies upon a metric called URPD, a most complicated arrangement of numbers which, according to him, reveals at what price the current supply of Ethereum last changed hands.

The accompanying chart displays a rather dense concentration of purchases around the $2,772 mark – a price at which numerous investors apparently deemed it prudent to acquire holdings. The presumption, naturally, is that these individuals will be most unwilling to see their investments diminished, and will therefore defend this level with… enthusiasm. One can only hope their enthusiasm is sufficient!

Indeed, it is anticipated that further purchases will be made at this price, bolstering the resistance against further losses. Should Ethereum attempt a more ambitious ascent, however, obstacles await at $3,211 and $3,224. One can practically smell the resistance!

Furthermore, it appears a considerable outflow of Ethereum has occurred from exchanges, amounting to $978 million. A sign of prudent purchasing, or merely a fleeting fancy? Time, as always, will tell. 🧐

Should $2,772 Prove Insufficient, What Then?

Should this heavily-defended position falter, a further descent is anticipated, with $2,489 serving as the next point of, shall we say, limited support. Though a reasonable amount of Ethereum was transacted at this level, it appears to be rather insignificant in the grand scheme of things… a mere pebble attempting to halt an avalanche, one might observe. Temporary relief, perhaps, but little more.

The ultimate refuge, it seems, lies at $1,866. Were Ethereum to reach such depths, a most dramatic shift in sentiment would undoubtedly occur. Should the price fall thus, one fears for the constitutions of many an investor! As of this moment, Ethereum is valued at approximately $2,987, having enjoyed a modest gain of 5.56% in the last twenty-four hours. A reprieve, perhaps, but the drama, alas, continues.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- All Itzaland Animal Locations in Infinity Nikki

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

2025-12-20 15:12