Imagine the scene: Bitcoin, that volatile little digital pet, has been jittering like a caffeinated squirrel all month. Now, as the weekend looms, it’s suddenly as calm as a yoga retreat. Range-bound, ranges tightening, intraday swings fading faster than your New Year’s resolutions. But don’t be fooled-beneath this tranquil facade, US traders are quietly selling into the abyss, as if trying to discreetly offload their Bitcoin socks without waking the bear. 🧸

Bitcoin’s Big Mind Game: Resilient or Just Lazy?

You may have heard that Bitcoin is absorbing all this selling pressure like a sponge in a hurricane. Traders are betting on a big move, but the weekend’s usually when Bitcoin schedules its afternoon nap. Liquidity’s thinner, price discovery’s slower, and the chart looks as confident as a cat on a windowsill. No major explosions expected-just a gentle, uneventful drift-until it isn’t. The pattern suggests we might see that final pullback before Bitcoin announces the big breakout, probably right after you’ve gone to sleep. The RSI’s climbing, which is fancy chart talk for “Hey, I might go up soon,” and everyone’s eyeing that shiny $100K mark when 2026 kicks in. Or maybe not-traders have a knack for dashing our hopes. 🤑

The chart shows Bitcoin playing it safe, consolidating like that one friend who refuses to commit but hints at a future plan. The pullback? Just the calm before the storm-or a sign you should buy more snacks. The pattern is aligned, the RSI’s making higher highs-basically, Bitcoin is promising a fireworks show, but only if a few more things fall into place. So, if you’re dreaming of a $100K Bitcoin by the first days of 2026, keep hoping-there’s a good chance it might happen… if traders can stop second-guessing themselves long enough.

US Traders Are Selling, But in a Fancy Way

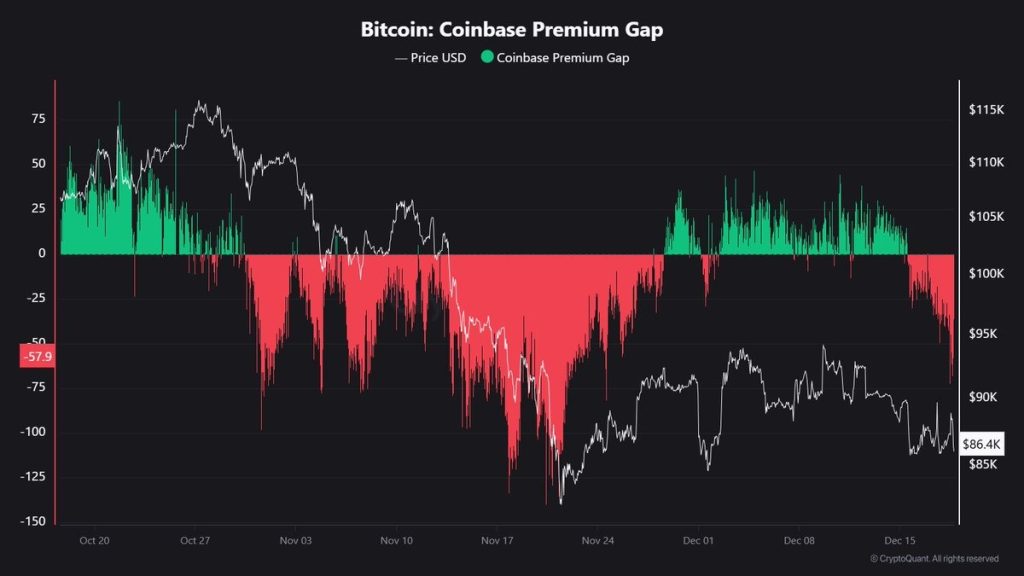

Meanwhile, the U.S. traders are behaving like that one cousin who sells furniture on Facebook Marketplace-selling at a discount and pretending it’s fine. The Coinbase Premium Gap has nosedived to -$57, signaling that US traders are offloading some Bitcoin at a bargain price while the market stays steadier than a yoga master. 🧘♂️

This isn’t panic selling, folks, it’s more like polite shopping: “Here’s my Bitcoin, it’s slightly cheaper today-no hard feelings.” Demand is still hanging around, snatching the supply, just like that one person at the buffet who takes a burger and then backs away slowly. When steady selling doesn’t break the market, it’s usually a sign that something’s brewing-either a gentle breeze or a hurricane, nobody’s quite decided yet.

What to Watch This Weekend: The Price Levels You Can’t Ignore

Bitcoin is caught between $86,000 and $89,500, humming along like a band in a garage. If it stays above $85K, the structure is solid, and the sellers’ plans might just fall flat. But break below $85K, and it’s a free fall into the $81.5K-$83K zone-where buyers once again show up like teenagers at a discount sale.

If Bitcoin dares to stay above $89,500, look for it to aim for the $92K-$94K range, possibly attracting some sellers who remembered that selling high is an art. Whatever happens, keep your eyes peeled-the market loves to surprise, especially when you’re distracted by weekend plans or Netflix marathons.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- EUR INR PREDICTION

- RaKai denies tricking woman into stealing from Walmart amid Twitch ban

- Peeniss Is Coming

2025-12-19 18:23