A Mild Disappointment, Actually…

- The Federal Reserve, in a gesture of pedestrian policy, saw fit to trim rates by a quarter-point – a move met with, shall we say, a distinct lack of enthusiasm in certain corners of the financial ecosystem, particularly regarding the capricious Dogecoin.

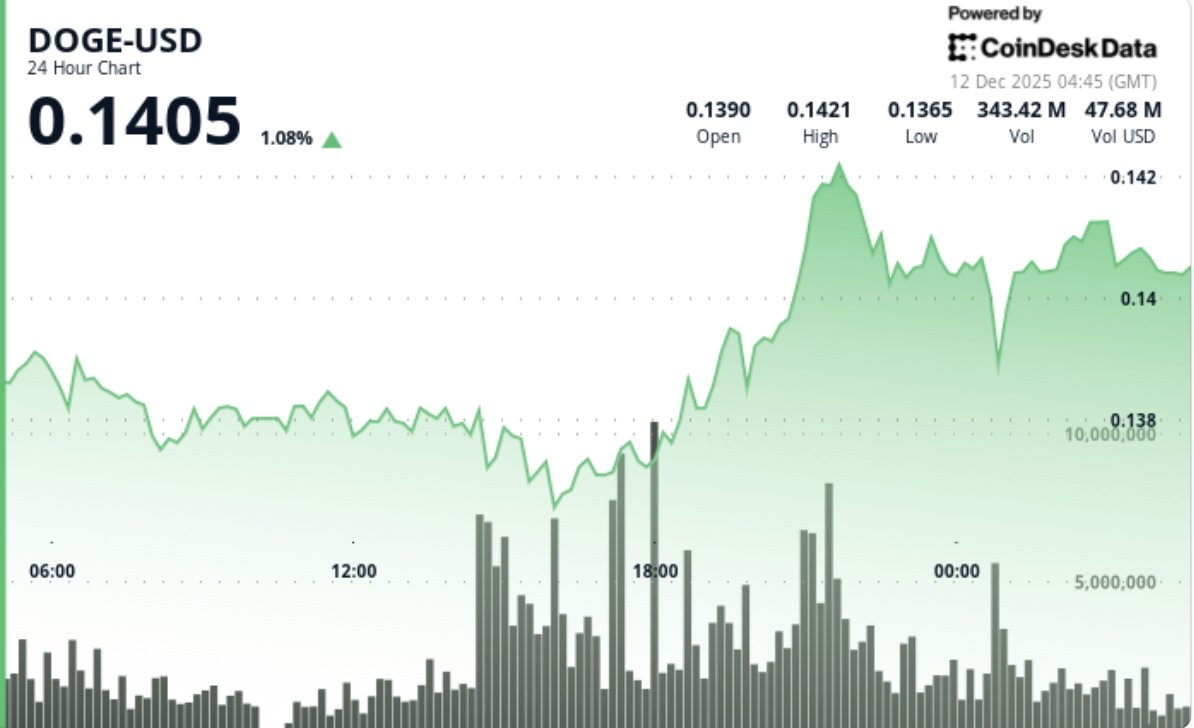

- Dogecoin, that meme-born marvel, continues its existence in a rather tightly-defined box, oscillating between $0.13 and $0.15. A most undramatic affair. Though, bless its heart, larger investors-those “whales” as the digital natives call them-are accumulating it, as if hoping sentiment might, at some point, actually change. 🤔

- Despite a flurry of activity, a resistance level near $0.1425 presents a rather stubborn obstacle. It all hinges, of course, on the whims of herd mentality, doesn’t it?

Dogecoin, in its infinite wisdom (or lack thereof), remained stubbornly inert following the Federal Reserve’s somewhat predictable pronouncements. It clung, with the tenacity of a limpet, to its established support level while traders pondered the implications of easier, yet barely perceptible, monetary policy.

A Brief Historical Note

- Our central bankers, in a fit of mild easing, reduced the benchmark rate by 25 basis points on Wednesday, settling into a range of 3.5%-3.75%. A subtle shift, hardly earth-shattering.

- The decision, it seems, wasn’t met with universal acclaim amongst the policymakers themselves. Some yearn for further easing to soothe the ailing labor market, while others murmur anxieties about sparking the dreaded inflation, like some monstrous, slumbering beast.

- This rather muddled message unsurprisingly dampened any immediate surge in risk appetite, leaving crypto prices…well, stable. How terribly bourgeois.

- Amidst this stasis, Dogecoin displayed a disconcerting level of on-chain engagement. The aforementioned whales, creatures of considerable capital, accumulated roughly 480 million DOGE – a hoarding instinct reminiscent of squirrels bracing for a particularly brutal winter. The launch of spot DOGE ETFs from Grayscale and Bitwise, predictably, failed to ignite any sustained momentum. A rather deflating experience, wouldn’t you agree?

Price Action, or the Lack Thereof

- DOGE experienced a modest uptick of 0.69%, reaching approximately $0.1405 over the past 24 hours, yet remained firmly ensconced within its $0.13-$0.15 holding pattern. Predictable. Utterly, bone-achingly predictable.

- Trading volume reached 651.7 million tokens, a marginal increase over the weekly average – suggesting a positioning exercise rather than enthusiastic accumulation. As if anyone truly believes.

- Attempt after attempt to breach the $0.1425-$0.1430 barrier were rebuffed, while buyers steadfastly defended the $0.1380 territory. A stalemate, in essence.

Technical Musings (for the Devotees)

- Technically, DOGE wallows in a state of compression. The $0.1380 support continues to hold, reinforcing its importance as a temporary reprieve.

- Momentum indicators, alas, remain stubbornly neutral, reflecting the confines of this range-bound existence.

- The chart resembles, rather unsettlingly, a pennant or, even worse, a volatility coil – suggesting a more dramatic move may be inevitable, though its direction remains, naturally, anyone’s guess.

- Unless the price manages to reclaim the upper limit, any upward excursions will likely be met with a swift and merciless sell-off.

Advice for the Gambling Enthusiast (I mean, Trader)

- With the rate cut now fully digested and policymakers signaling a distinct lack of conviction, Dogecoin appears to respond more to the broader market’s anxieties than any inherent value. Sad, really.

- Maintaining a position above $0.1380 preserves the structural integrity, but failing to conquer $0.1420-$0.1450 suggests the upside is severely limited.

- A breach above that zone unlocks the possibility of a climb toward $0.16-$0.18 (optimistic, I know), while a fall below $0.1380 exposes the lower end of the range.

- For the moment, DOGE is a consolidation play – a rather dull affair in a post-Fed, pause-and-assess market. A delightful ennui, one might say.

Latest Crypto News

Stablecoins Get Backing From Cross-Party UK Lawmakers Urging Pro-Innovation Rules

4 minutes ago

CFTC Gives No-Action Leeway to Polymarket, Gemini, PredictIt, LedgerX Over Data Rules

7 hours ago

Terraform’s Do Kwon Sentenced to 15 Years in Prison for Fraud

7 hours ago

U.S. Financial-Risk Watchdog, FSOC, Erased Digital Assets as a Potential Hazard

8 hours ago

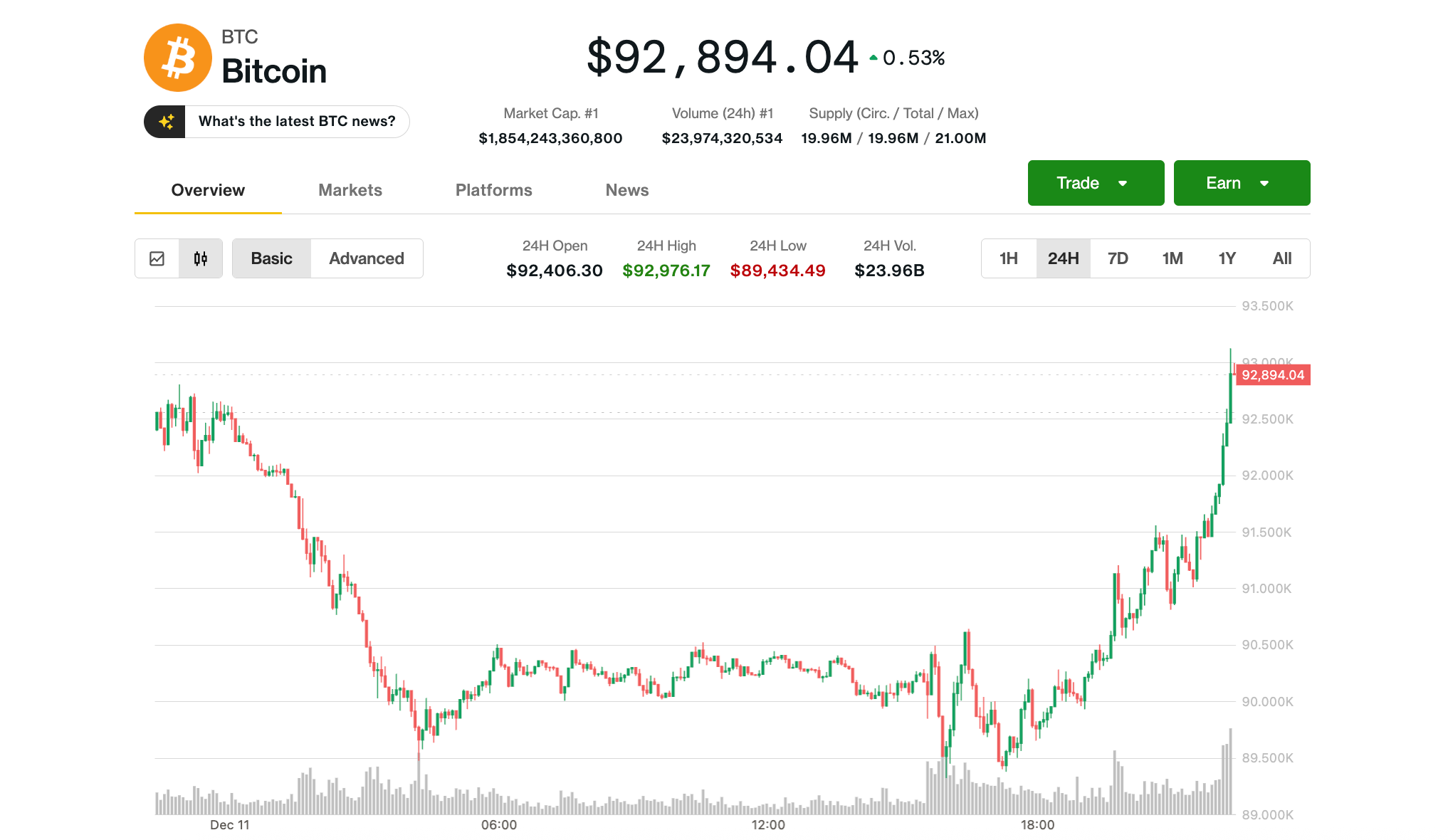

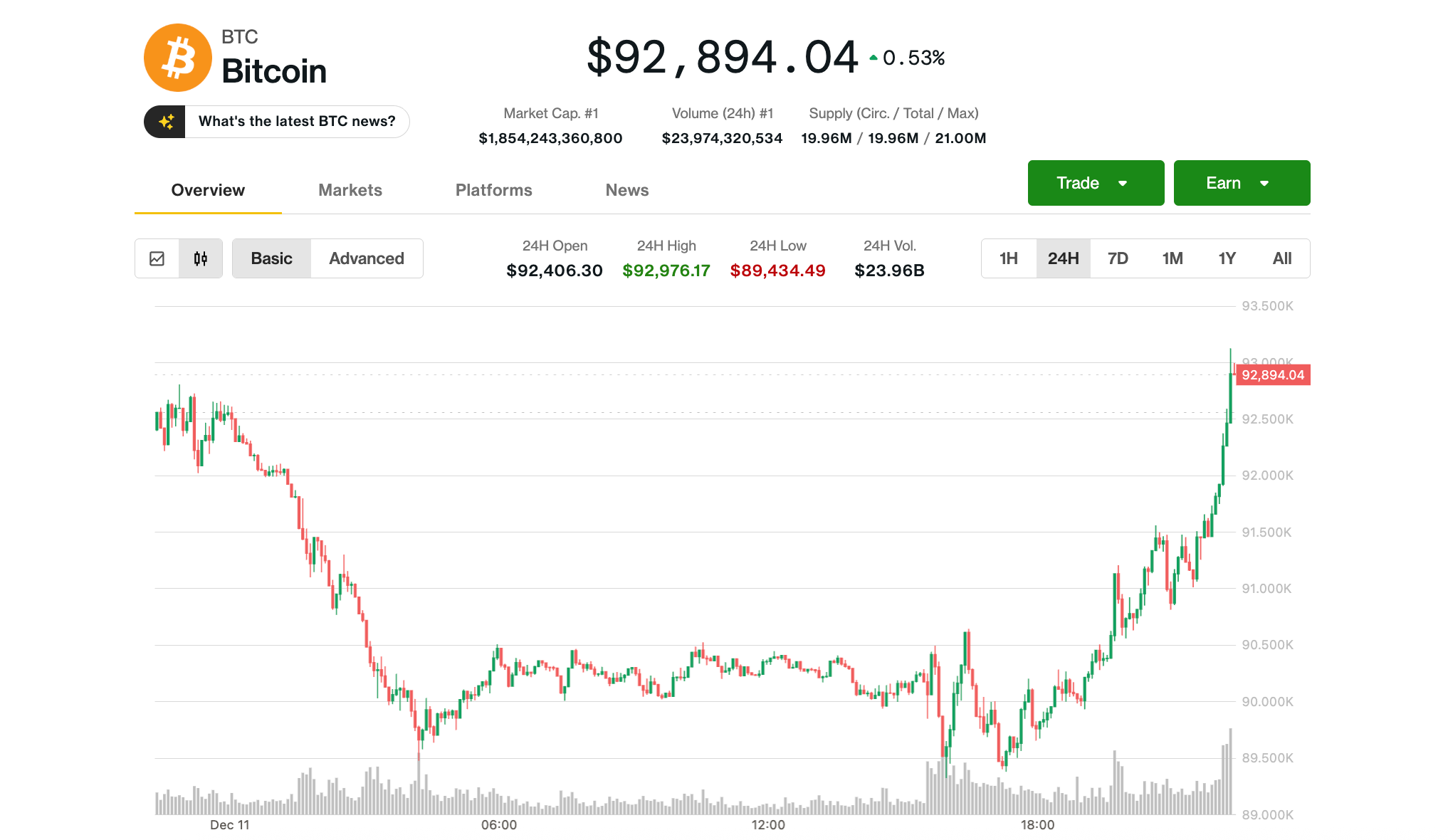

Bitcoin Rebounds to $93K From Post-Fed Lows, but Altcoins Remain Under Pressure

8 hours ago

Top Stories

XRP Lands on Solana, Ethereum and Others, in Boost for Ripple Ecosystem

1 hour ago

Terraform’s Do Kwon Sentenced to 15 Years in Prison for Fraud

7 hours ago

CFTC Gives No-Action Leeway to Polymarket, Gemini, PredictIt, LedgerX Over Data Rules

7 hours ago

Bitcoin Rebounds to $93K From Post-Fed Lows, but Altcoins Remain Under Pressure

8 hours ago

U.S. Financial-Risk Watchdog, FSOC, Erased Digital Assets as a Potential Hazard

8 hours ago

Binance Overhauls Stablecoin Trading with Trump-Linked USD1

11 hours ago

Read More

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- My Favorite Coen Brothers Movie Is Probably Their Most Overlooked, And It’s The Only One That Has Won The Palme d’Or!

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- Games of December 2025. We end the year with two Japanese gems and an old-school platformer

- Thieves steal $100,000 worth of Pokemon & sports cards from California store

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Ne Zha 2: 2025’s Biggest Box Office Hit Comes To HBO Max For Holidays

- Travis And Jason Kelce Revealed Where The Life Of A Showgirl Ended Up In Their Spotify Wrapped (And They Kept It 100)

2025-12-12 08:59