Tidal Trust II has slid into the SEC’s DMs with a Bitcoin ETF proposal that’s basically the financial equivalent of a midnight snack. 🌙🍟 Because who needs sleep when you can chase Bitcoin’s overnight returns, right?

This filing drops just as spot BTC ETFs are having a worse month than your Tinder date who “forgot” their wallet. Heavy outflows, price manipulation whispers-it’s a mess. But hey, at least someone’s still trying to make Bitcoin cool after hours. 🕶️

SEC Filing: The Night Owl’s Guide to Bitcoin Profits

The Form N-1A, filed on Tuesday (because even bureaucracy needs a midweek pick-me-up), introduces two ETFs with names that scream “we’re serious but also kind of extra”: Nicholas Bitcoin and Treasuries AfterDark ETF and Nicholas Bitcoin Tail ETF. 🦉💼

Here’s the tea: the AfterDark ETF won’t touch BTC directly. Instead, it’s all about futures, options, and other ETFs-basically, the financial version of “I’m not texting him, I’m just liking his Instagram stories from 2017.” It might even use a Cayman Islands subsidiary, because tax havens are so fetch. 🌴💸

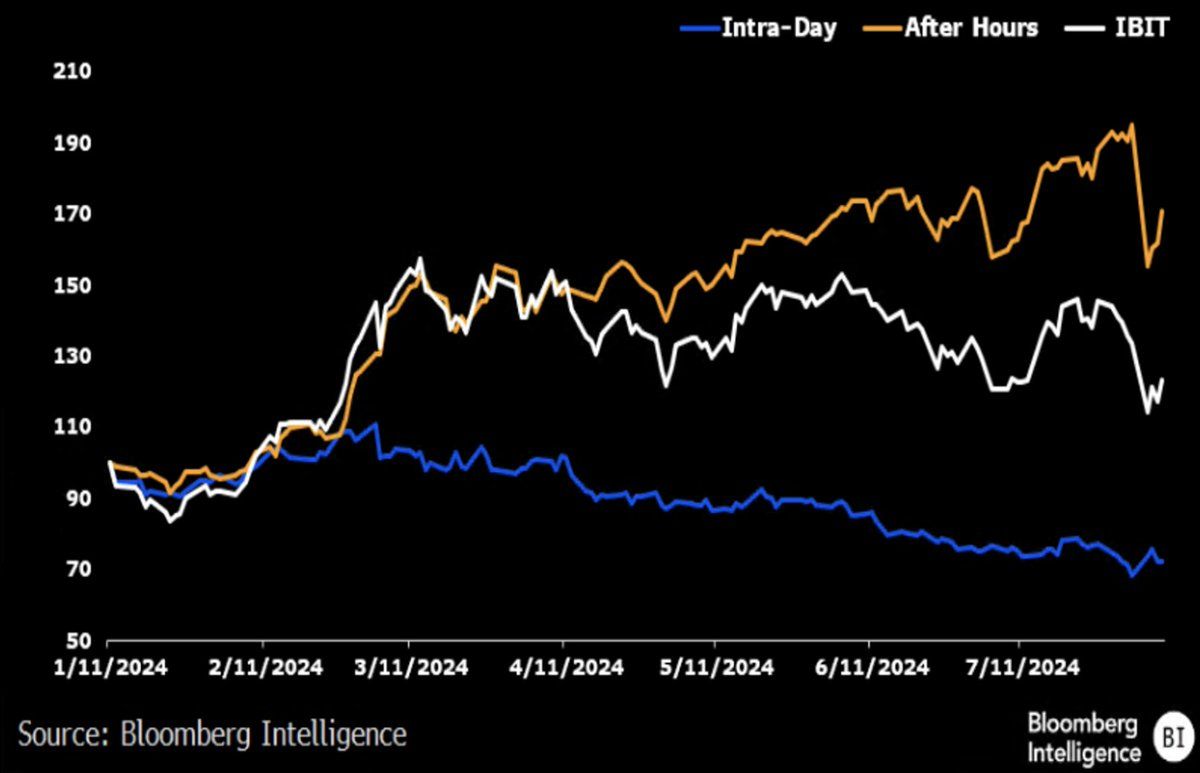

The goal? Long-term capital appreciation by targeting Bitcoin’s overnight return profile. During the day, it chills with US Treasuries and cash equivalents, like a finance bro who only works out after 5 PM. 💪💤

“When utilizing Bitcoin Futures, the Fund trades these instruments during US overnight hours and closes them out shortly after the US market opens each trading day. When utilizing Bitcoin Underlying Funds, the Fund purchases a security at US market close, and then sells the position around US market open….When utilizing Bitcoin Options, the Fund typically enters into options positions that establish a synthetic long bitcoin position near the close of regular US trading hours. These positions are typically closed or unwound near the following market open, however, the Fund may hold these synthetic long positions longer term and offset them during US daytime trading hours by entering into a synthetic short position,,” the document reads. 🧐📜

Bloomberg’s Eric Balchunas (aka the ETF whisperer) spilled the beans on X (formerly Twitter, because rebranding is hard). Apparently, Bitcoin’s gains love the night life. 🌃💰

“Doesn’t mean the ETFs aren’t having impact. Some of this is positioning bc of the ETFs etc or derivatives based on flows etc etc. But yeah, bitcoin After Dark ETF could put up better returns, we’ll see tho,” Balchunas wrote. 🤷♂️

Meanwhile, industry watchers are side-eyeing alleged price manipulation during US daytime trading hours. Bitcoin’s price drops around market open? Sounds like someone’s hitting the snooze button too hard. ⏰📉

Bitcoin ETF Flows: The Drama Never Stops

Spot Bitcoin ETFs have been taking an L lately. November saw outflows hit $3.48 billion-more than your ex spent on their midlife crisis sports car. BlackRock’s iShares Bitcoin ETF led the pack with $2.34 billion in outflows. Ouch. 😬

Bitcoin’s price dropped 17.4% in November, its worst month of the year. Investor confidence? Shattered. Digital asset markets? Cautious AF. But hey, at least December’s looking slightly less bleak-$151.74 million in inflows on the 9th. Baby steps. 👶💸

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- Every Death In The Night Agent Season 3 Explained

2025-12-10 12:57