O, ye fickle mistress of finance, Bitcoin’s volatility hath once more ensnared the gaze of MicroStrategy, that most audacious of corporate titans, whose strategies are now the subject of hushed whispers in the halls of Wall Street. With billions of BTC amassed and a penchant for aggressive buying during the darkest of hours, this company hath become the compass by which many navigate the tempestuous seas of the crypto market. 🐮💸

The Perilous Dance of MicroStrategy and the Cryptocurrency’s Fate

Behold, the Bitcoin price, that capricious jester, hath once again placed MicroStrategy (MSTR), the largest corporate holder of BTC, in the spotlight. Walter Bloomberg, that sage of X, doth declare that analysts, ever the curious hounds, await to see if the company might sway the cryptocurrency’s price should it choose to sell its hoard. 🕵️♂️📉

According to the venerable JPMorgan, Strategy may evade forced sales as long as its enterprise value-to-BTC holdings ratio remains above 1.0, which currently stands at 1.13 BTC. Yet, the analysts, those ever-skeptical jesters, scoff at such claims, accusing the bank of spreading tales as false as a fox’s promise. 🐺💼

Walter, that wise old owl, doth opine that if the ratio remains above this level, BTC markets may stabilize and ease recent chaos. Yet, due to the market’s turmoil, the firm hath slowed its BTC purchases, adding 9,062 BTC last month compared to 134,480 BTC a year ago-a more cautious approach, akin to a man tiptoeing through a minefield. Its stock hath plummeted 42% over three months, a testament to the perils of gambling with digital gold. 📉💸

Moreover, challenges loom, such as the potential exclusion from MSCI indices, which could trigger $8.8 billion in passive fund outflows if index funds are forced to divest. Yet, MicroStrategy holds a $1.4 billion reserve for dividends and interest, a shield against further woes. In the meantime, there is no proof that the firm is in danger of liquidation-though one might say the devil is in the details. 🧙♂️🔮

How Institutional Behavior Builds A Higher Floor For Bitcoin

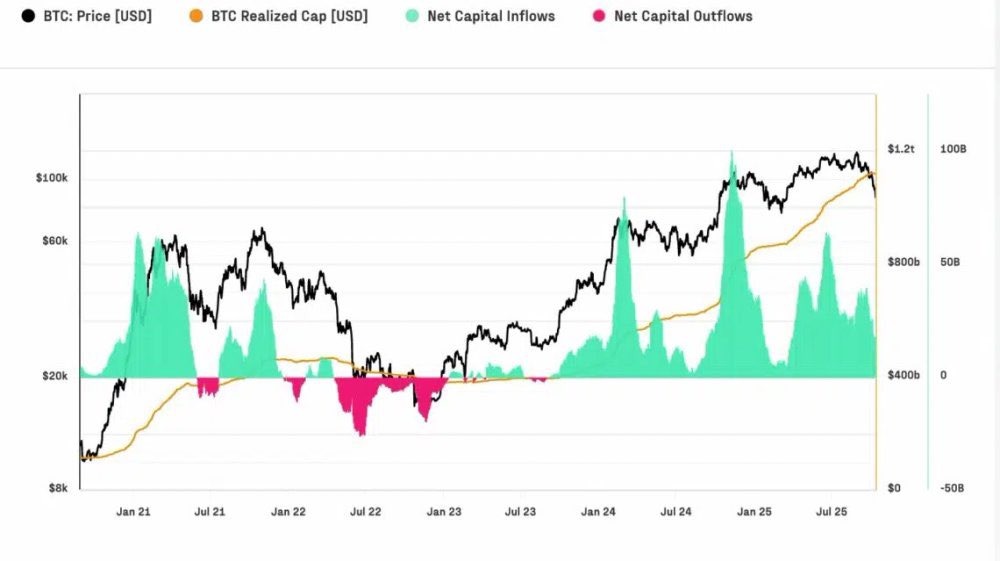

In this age of speculation, Bitcoin is experiencing one of the most significant capital migrations in its history, fueled by the antics of institutional giants. Analyst Matthew, that erudite sage, doth note that the current BTC market cycle from 2022 to 2025 hath absorbed an unprecedented amount of new capital, surpassing all prior cycles. This growth is a reflection of the market’s maturity and the ecosystem’s innovative approach to liquidity through regulated instruments. 📈🧠

Furthermore, the network hath incorporated more than $732 billion in fresh capital in the current cycle, surpassing the $388 billion of yore. At that time, the surge helped push BTC market capitalization to an all-time high of $1.1 trillion-a metric that indicates a much higher aggregate cost base for new institutional investors. 📊💰

Meanwhile, the total settlement volume in the decentralized BTC protocol was approximately $6.9 trillion in just 90 days. Despite this, the number of active on-chain entities hath dropped from 240,000 to 170,000 per day, a reflection of liquidity migration of capital flows into spot ETFs. 🏦🌀

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- YouTuber streams himself 24/7 in total isolation for an entire year

- Gold Rate Forecast

- What does Avatar: Fire and Ash mean? James Cameron explains deeper meaning behind title

- Landman Recap: The Dream That Keeps Coming True

- James Cameron Gets Honest About Avatar’s Uncertain Future

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

- Jane Austen Would Say: Bitcoin’s Turmoil-A Tale of HODL and Hysteria

2025-12-05 23:27