Quod Juvenile Docere Dixerit:

- The bewitching dance of Bitcoin, down by 18% in mere trimesters, has rekindled old fears of a crypto winter-a term increasingly resembling a phantasmagoria rather than reality.

- Emissaries from Glassnode and Fasanara Digital decipher market runes that reveal gold streams of capital into Bitcoin’s coffers, challenging the usual frosty predictions.

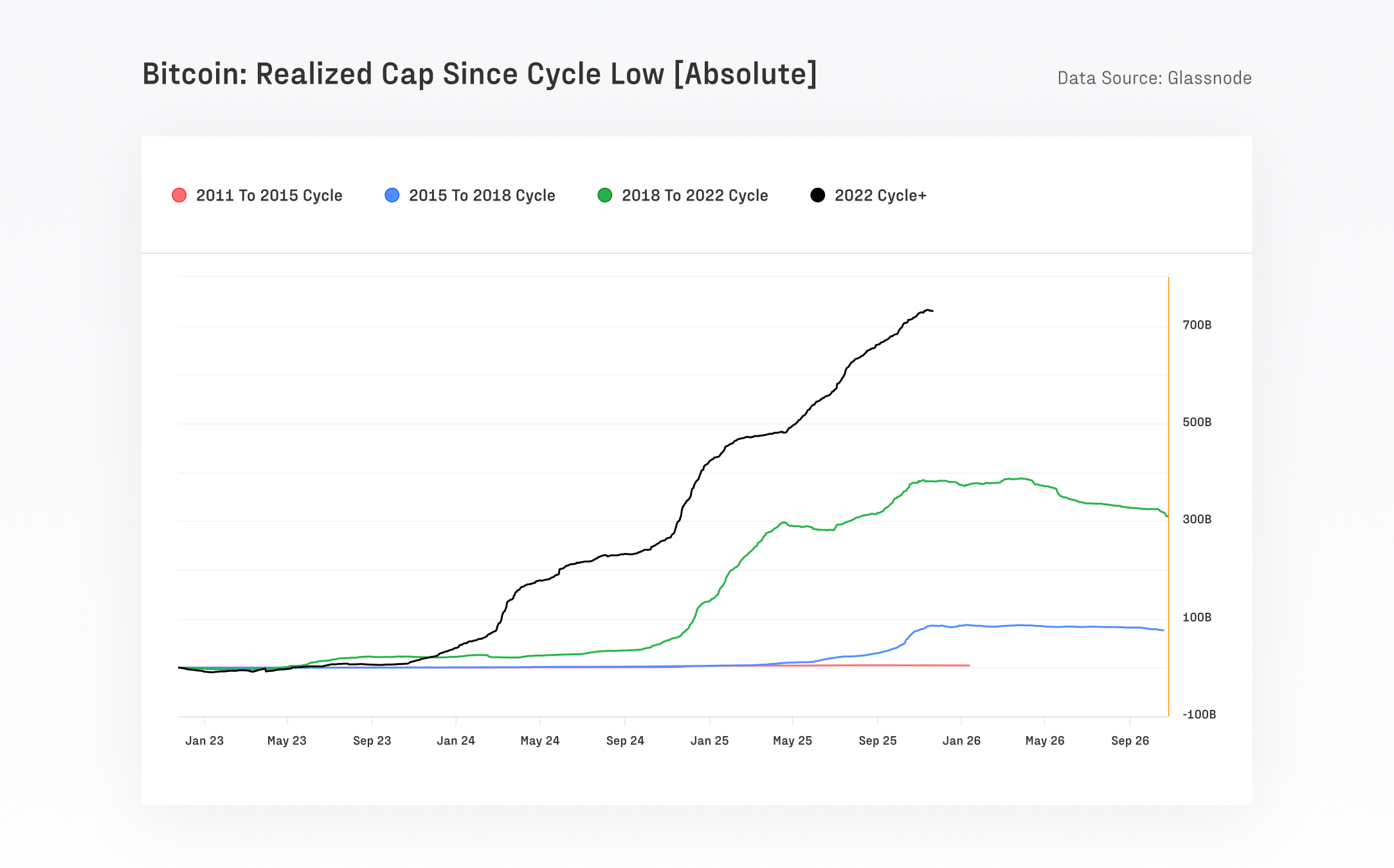

- Notably, the cycle sucked in a staggering $732 billion, an amount larger than its progenitors combined-a belletristic feat! 🎉

With its recent downturn, Bitcoin revived this worn narrative of an impending crypto winter. The sylph has pirouetted down approximately 18% of its value in these months, sparking speculation that we may be waltzing into another icy stretch.

A scene of remarkable peculiarity was observed as the stocks of American Bitcoin Corp.-that affirmative entity-plunged about 40% under a peculiarly voracious volume, followed by a brief tremor in Hut 8, its majority shareholder sibling. Other Trump-inspired digital currencies also plummeted, eloquently whispering a broader rumour of another frosty downturn.

Yet, contrary to the narrative, the structure of the market refutes it with silent dignity.

In a discourse penned by Glassnode in consort with Fasanara Digital, it is noted Bitcoin embraced over $732 billion in couched capital since its nadir in 2022.

This cycle has bagged greater inflows than previous cycles combined, thrusting the realized cap to approximately $1.1 trillion while the spot price, with the fanciful elegance of a debutante at her ball, rose from $16,000 to $126,000 at its zenith. Realized capital is typically a harbinger of looming winters, yet it does not contract presently.

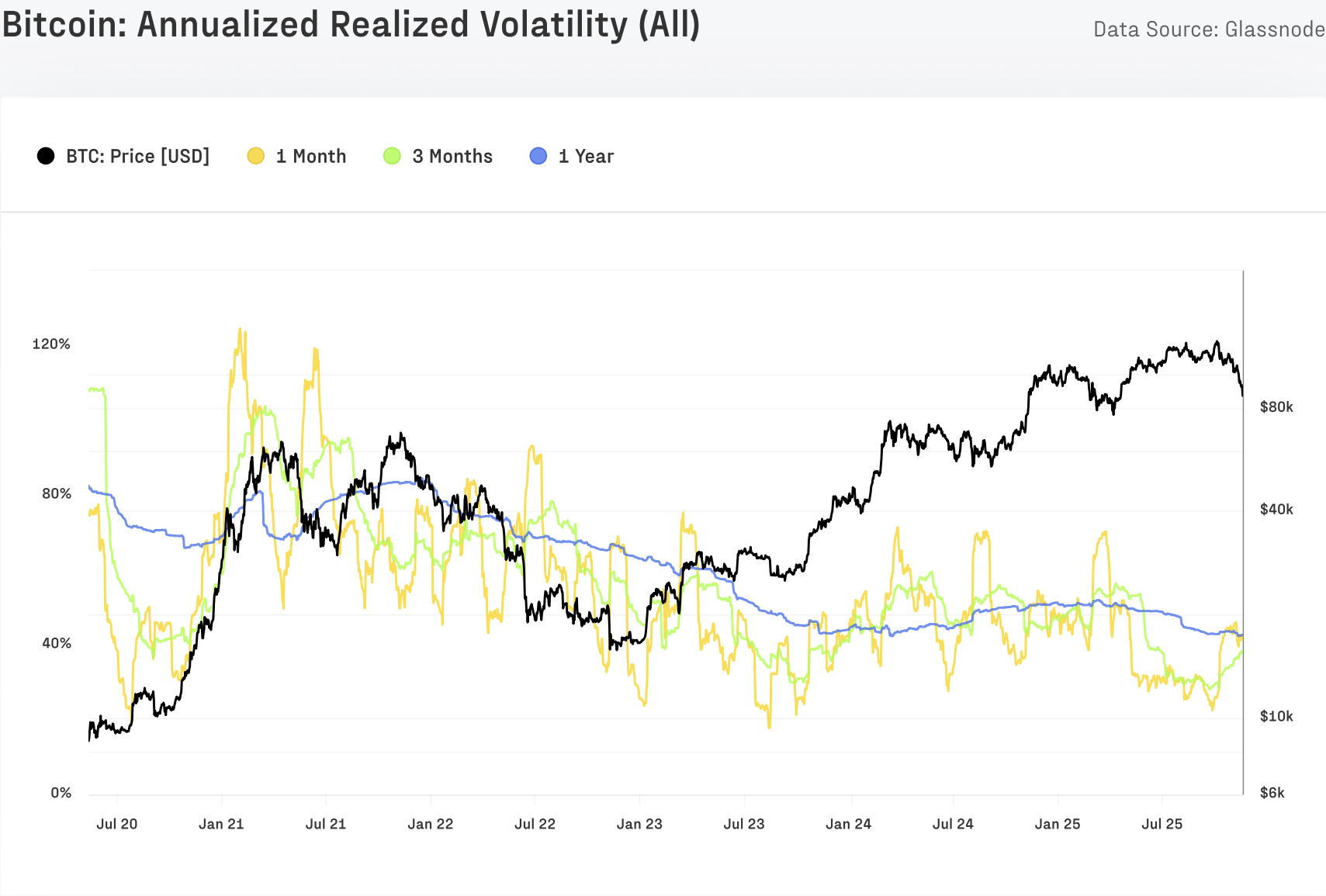

Volatility offers its own tale.

The demure one-year realized volatility of Bitcoin gracefully fell from 84% to a gentle 43%, resonating with deeper liquidity and increased participation by ETF enthusiasts, along with cash-margined derivatives. Winters begin with rising volatility and receding liquidity, not with such an abatement. If history be our collie, this cycle is distinguished by the rising popularity of call overwriting stratagems within BTC and IBIT options, which has softened the volatility in a manner that old spot-vol relationships find quaint.

ETF activity, too, boldly contradicts a winter’s soothsaying. The report notes that spot ETFs are eminently harboring about 1.36 million BTC-nearly 6.9% of the circulating supply-and have contributed around 5.2% of net inflows since their inception. During authentic winters, these flows tend to retreat and languish, especially when those with long-term expectations divest themselves together and synchronously. Such conditions today are nowhere to be found.

Performance across the sector does not mirror the chilly air of winters past. The CoinShares Bitcoin Mining ETF (WGMI) has blossomed by more than 35% over the interval in which BTC saw its decline. In previous winters, miners were the harbingers of collapse as hashprice dwindled. The current schism suggests that miner frailty is neither pervasive nor emblematic of the sector, yet rather harbors idiosyncrasies, such as the American Bitcoin episode, which should not conflate with wider trends.

The recent descent seems more akin to mid-cycle caprice as presented by Glassnode, not a reversal.

With a history of similar declines in 2017, 2020, and 2023 during periods of leverage pruning or macro contraction, Bitcoin historically precedes these with periods of higher altitudes post-adjustment. The October 2022 deligning event cited is reminiscent of this recurring pattern. Open interest plummeted, liquidity absorbed crimson tonics of expeditious sales-a cyclical reset rather than a cessation.

Boldly, Bitcoin dallies nearer its annual zenith of around $124,000 than its nadir near $76,000. Always in winters past, the milieu gravitated ceaselessly towards the range’s base, as seasoned holders transformed their comportment. This milieu bears scant resemblance to that historical environment.

Short-term tempests in equities can craft vivid headlines, yet the structural filigrees defining the cycles recount a subtler narrative.

As Glassnode suggests, with an illustrious cap tenacious in its majesty, relentless ETF demand, and softly declining volatility, we witness consolidation following an epochal inflow cycle-far from the wintry debut we might anticipate. 🌞

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- What time is It: Welcome to Derry Episode 8 out?

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- Elizabeth Olsen’s Love & Death: A True-Crime Hit On Netflix

- Southern Charm Recap: The Wrong Stuff

- 8 Tim Burton Movies That Still Hold Up as Gothic Masterpieces

- EA announces paid 2026 expansion for F1 25 ahead of full game overhaul in 2027

2025-12-03 09:39