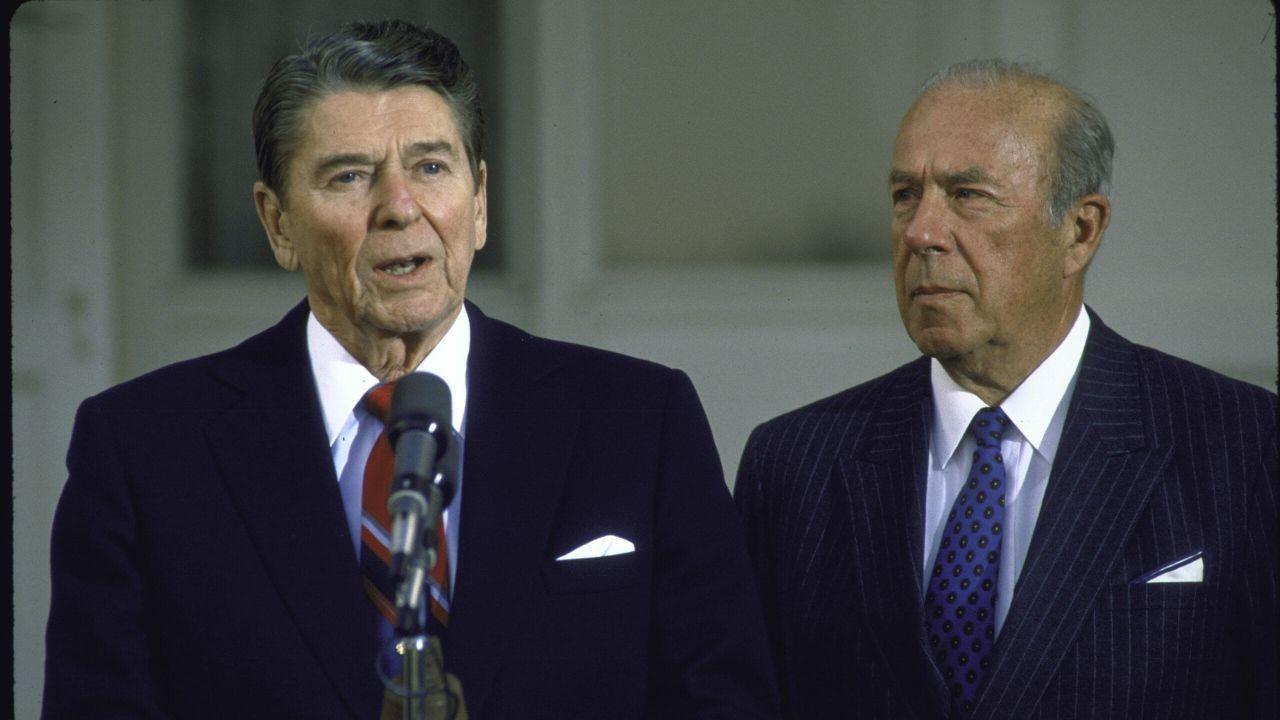

The Fed Chairman delivered a highly personal tribute to Reagan-era economist and statesman George Shultz.

Powell’s Tribute to George Shultz Skips Any Mention of the Economy

Economists were left more confused than a chimp with a calculator on Monday evening after Fed Chairman Jerome Powell delivered his tribute to late Reagan-era diplomat and economist George Shultz at Stanford University’s Hoover Institution. Markets were bracing for any additional hints about the direction of interest rates ahead of the central bank’s Federal Open Market Committee (FOMC) meeting next week. But Powell was mum on the issue and made it abundantly clear from the outset that no hints were coming. Because nothing says “I care about the economy” like a 45-minute eulogy for a man who’s been dead for 10 years. 💀📈

“I am deeply honored to have been asked to speak here today about the remarkable legacy of George Shultz,” Powell said. “Just to be clear, I will not address current economic conditions or monetary policy.”

Most experts agree that the Fed is now leaning so dovish they’re practically doing yoga, as evidenced by the two rate cuts in September and October. The CME Fedwatch Tool currently shows an 87% probability of another 25-basis-point reduction at next week’s meeting. But perhaps Powell’s comments from October 29 are still fresh in the minds of many. “A further reduction at the December meeting is not a foregone conclusion,” Powell said, a statement some believe sent bitcoin plunging 3%-because nothing terrifies crypto bros like a man who says “not a foregone conclusion.” 🚀💥

And so when markets learned that the chairman would be delivering a speech at Stanford University’s Hoover Institution on Monday evening, they were looking for any indication of his position on rates or the economy to move the needle from 87% to near-certainty, but Powell was not forthcoming. He did, however, explain that central banking, and specifically managing inflation is a difficult task.

“The central bank is responsible for price stability, so that issue is settled. It doesn’t mean it’s easy to do,” Powell said when asked about what lessons he had learned from Shultz. “You make it look so easy,” said panel moderator Peter Robinson jokingly. “Yeah. That’s the trick,” Powell responded, drawing laughs from the audience. Classic Fed speak: “difficult” code for “we’re winging it.” 🤷♂️💸

FAQ ⚡

- Why didn’t Powell comment on interest rates? He said upfront that his Stanford speech was strictly a tribute to George Shultz and not about monetary policy. Because why talk about the economy when you can talk about a dead man’s mustache? 🧔♂️📜

- What were markets hoping to hear from Powell? Investors were looking for any hint about rate cuts ahead of next week’s FOMC meeting. Instead, they got a history lesson. The Fed’s version of “air quotes” around transparency. 📜🙄

- Is the Fed still expected to cut rates in December? Markets now price an 87% chance of a 25-basis-point cut despite Powell’s prior warning that it’s “not a foregone conclusion.” Because 87% is basically a yes, right? 🤷♂️📉

- Did Powell offer any economic insights at all? Only indirectly, noting that managing inflation is difficult even when the Fed’s mandate is clear. Translation: “We’re lost, but we’re charging you for the GPS.” 🧭🧭

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- What time is It: Welcome to Derry Episode 8 out?

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- Now you can get Bobcat blueprint in ARC Raiders easily. Here’s what you have to do

- Dogecoin: Still Waiting for Liftoff 🚀

- Donald Glover’s Canceled Deadpool Show: A Missed Opportunity For Marvel & FX

- Jamie Lee Curtis & Emma Mackey Talk ‘Ella McCay’ in New Featurette

2025-12-02 23:39